please solve the questions on a table like the given in the question

continued:

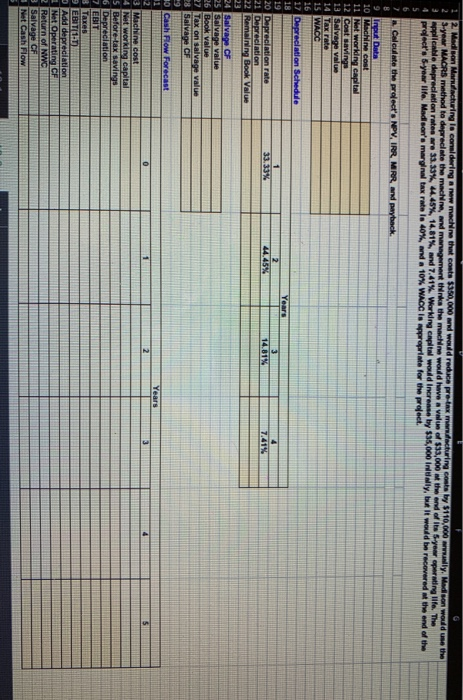

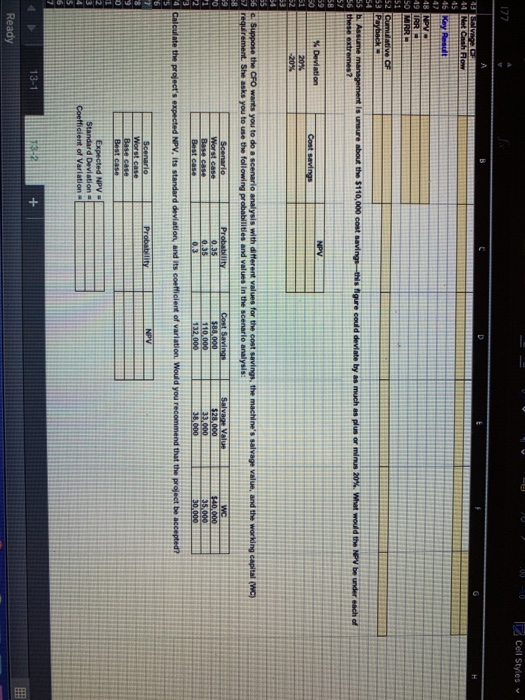

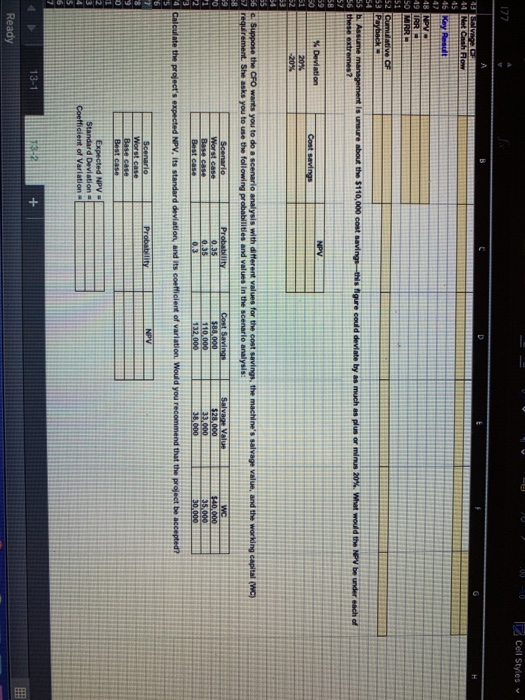

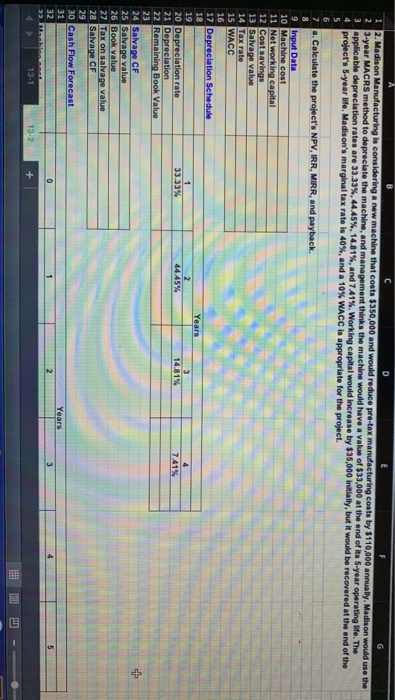

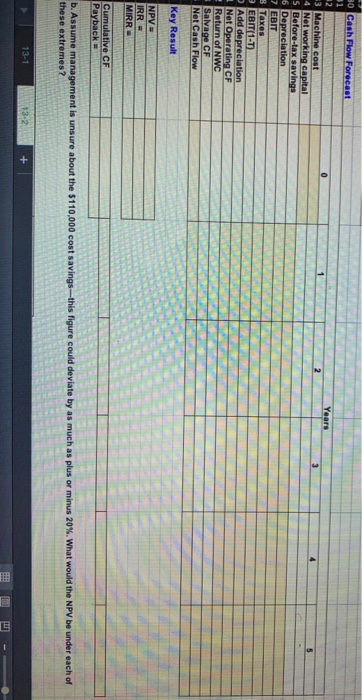

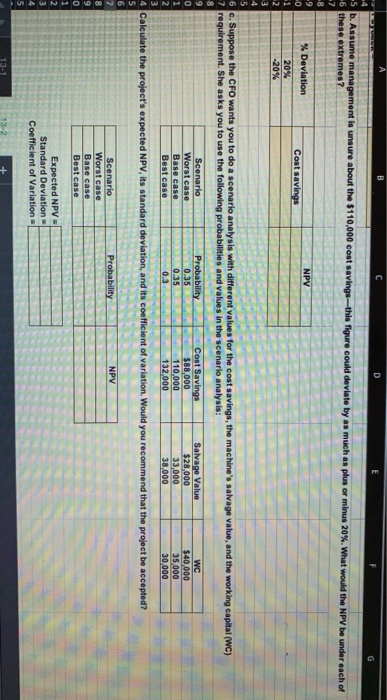

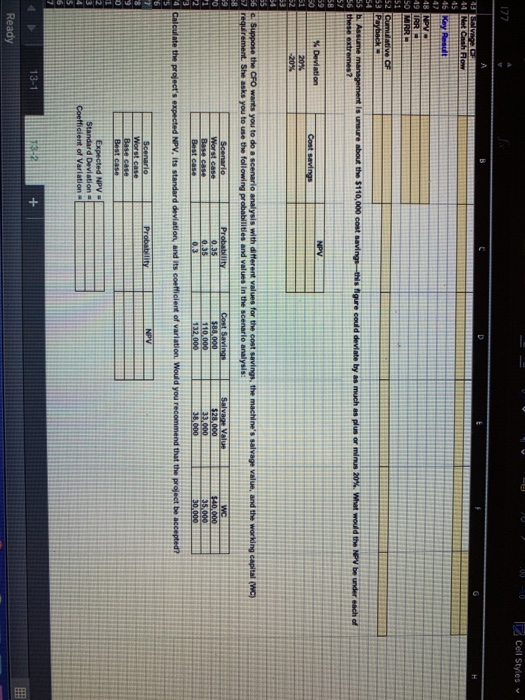

2 Madison Maracturing la condering a new machine that conta $350,000 w orld reduce pe tax m acturing costs by $110,000 w ally Madison would use the Syew MACRS method to depreciate the macm, ww margement In the machine would have 533,000 M the end of its Sewering life. The applicable depreciation rates are 33,33% 44.45% 14.81% and 7.41%. Working capital would increase by $35,000 Inowly, but it would be recovered at the end of the prolect's year life. Madison's marginal tax rate la 40%, and a 10% WACC is propriate for the project. Calculate the project's NPV, IRR MRR d payback. Input Data Machine cost Not working capital 12 cost saving 13 Salvage valu Tax rate 17 Depreciation Schedule Depreciation rate 21 Depreciation Remaining Book Value 24 Salvage CF Salvage value BOOK Value WNHOUSUN Salvage CF Cash Flow Forecast Depreciation EBITH 3 Laxes EBITDA Add depreciation Net Operating CF 2 Return of MWC Salvage C Net Cash Flow U 0 .000 Cell Styles 177 Uwaga 44 Net Cashow 45 Key Result 48 NPVD 19 IRRI agement is unsure about the $110,000 cost saving this figure could deviate by as much as plus or minus 20%. What would the NPV be under each of % Deviation c. Suppose the CFO wants you to do a scenario analysis with different values for the cost savings, the machine's salvage value, and the working capital (WC) requirement. She asks you to use the following probabilities and values in the scenario analysis: Cost Savings Salvage Value Worst case ect's expected NPV, Its standard deviation, and its coefficient of variation. Would you recommend that the project be accepted? OWNEOUSWNHOUSU 13- 1 313 Ready 1 2. Madison Manufacturing is considering a new machine that costs $350,000 and would reduce pre-tax manufacturing costs by $110,000 annually. Madison would use the 2 3-year MACRS method to depreciate the machine, and management thinks the machine would have a value of $33,000 at the end of its 5-year operating life. The 3 applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 741%. Working capital would increase by $35,000 initially, but it would be recovered at the end of the 4 project's 5-year life, Madison's marginal tax rate is 40%, and a 10% WACC is appropriate for the project. 7 a. Calculate the project's NPV, IRR, MIRR, and payback. 9 Input Data 10 Machine cost 11 Networking capital 12 Cost savings 13 Salvage value 14 Tax rate 15 WACC 17 Depreciation Schedule 20 Depreciation rate 21 Depreciation 22 Remaining Book Value 24 Salvage CF 25 Salvage value 26 Book value 27 Tax on salvage value 28 Salvage CF 30 Cash Flow Forecast 13-2 Cash Flow Forecast Machine cost Networking capital Before-tax savings Depreciation EBIT EBIT (1. D Add depreciation Net Operating CF Return of NWC Salvage CF Net Cash Flow Key Result INPV RR - Cumulative CF Payback uchas plus or minus 20%. What would the NPV be under each of b. Assume management is unsure about the $110,000 cost savings--this figure could de these extremes? 13-1 13- 20 b. Assume management is unsure about the $110,000 cost savings-this figure could deviate by -6 these extremes? plus or minus 20%. What would the NPV be under each of % Deviation DONNT 20% 6 c. Suppose the CFO wants you to do a scenario analysis with different values for the cost savings, the machine's salvage value, and the working capital (WC) 7 requirement. She asks you to use the following probabilities and values in the scenario analysis: Scenario Worst case Base case Best case Probability 0. 35 0. 35 0.3 Cost Savings S B8,000 1 10,000 132.000 Salvage Value $28.000 33,000 38,000 540,000 35,000 30.000 Calculate the project's expected NPV, its standard deviation, and its coefficient of variation. Would you recommend that the project be accepted? bility NPV Scenario Worst case Base case Best case Expected NPV = Standard Deviation - Coefficient of Variation 11- 13-2