Please solve the steps using excel and show the functions to get the results. The answers are given I just need excel functions

2016 11% 12% 9% 2017 12% 11% 10% 2018 13% 10% 11% 2019 14% 9% 12%

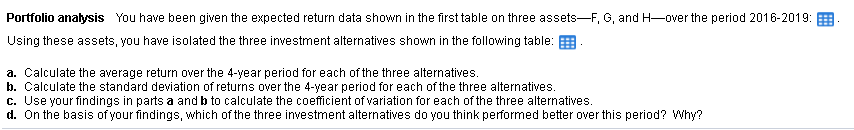

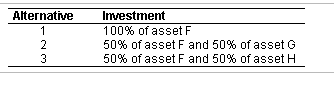

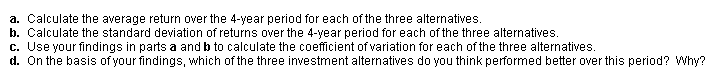

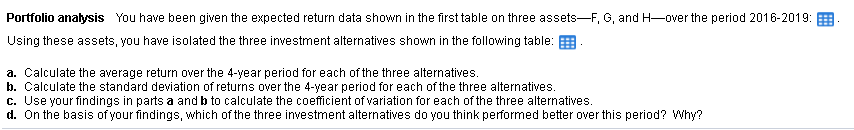

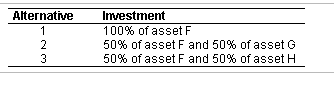

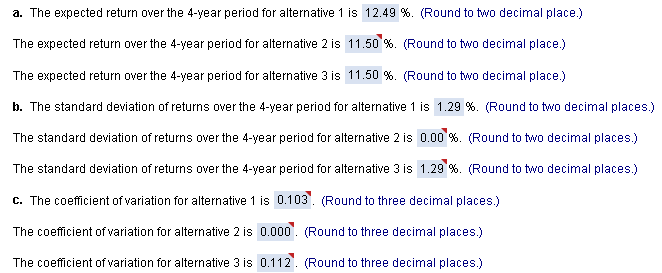

Portfolio analysis You have been given the expected return data shown in the first table on three assetsF, G, and H-over the period 2016-2019: B Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the average return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why? Alternative 1 2 3 Investment 100% of asset F 50% of asset F and 50% of asset G 50% of asset F and 50% of asset H a. Calculate the average return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you think performed better over this period? Why? a. The expected return over the 4-year period for alternative 1 is 12.49 %. (Round to two decimal place.) The expected return over the 4-year period for alternative 2 is 11.50 %. (Round to two decimal place.) The expected return over the 4-year period for alternative 3 is 11.50 %. (Round to two decimal place.) b. The standard deviation of returns over the 4-year period for alternative 1 is 1.29 %. (Round to two decimal places.) The standard deviation of returns over the 4-year period for alternative 2 is 0.00 %. (Round to two decimal places.) The standard deviation of returns over the 4-year period for alternative 3 is 1.29 %. (Round to two decimal places.) C. The coefficient of variation for alternative 1 is 0.103". (Round to three decimal places.) The coefficient of variation for alternative 2 is 0.000. (Round to three decimal places.) The coefficient of variation for alternative 3 is 0.112. (Round to three decimal places.) d. On the basis of your findings, which of the three investment alternatives do you recommend? Why? Alternative 2 is the best choice because the assets are perfectly negatively correlated. (Select the best answers from the drop-down menus.)