Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve them all. Only answers are needed. Thanks a lot for that! Alpaca Corporation had revenues of $270,000 in its first year of operations.

Please solve them all. Only answers are needed. Thanks a lot for that!

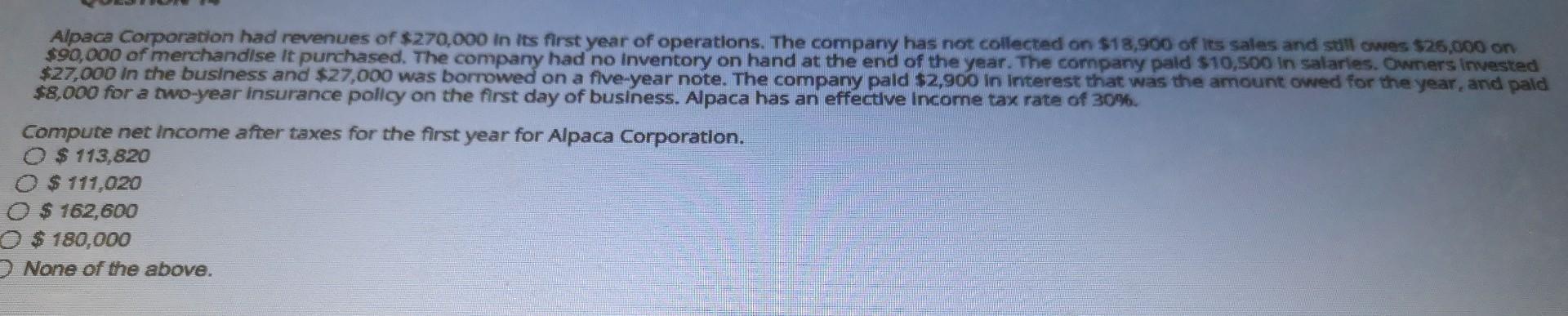

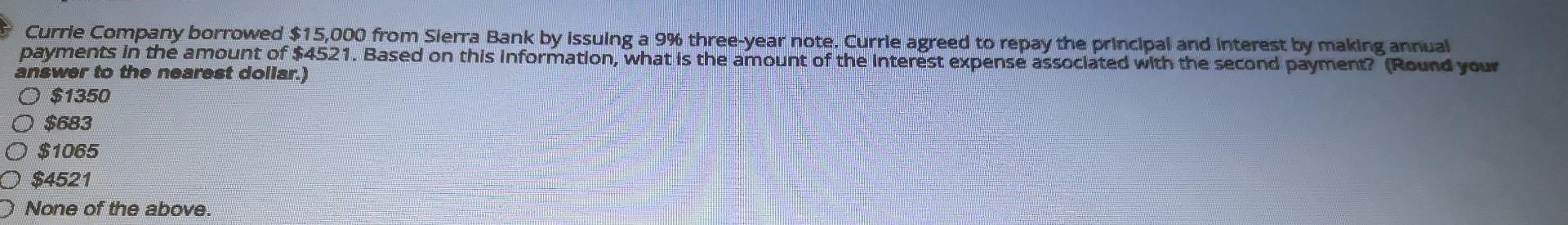

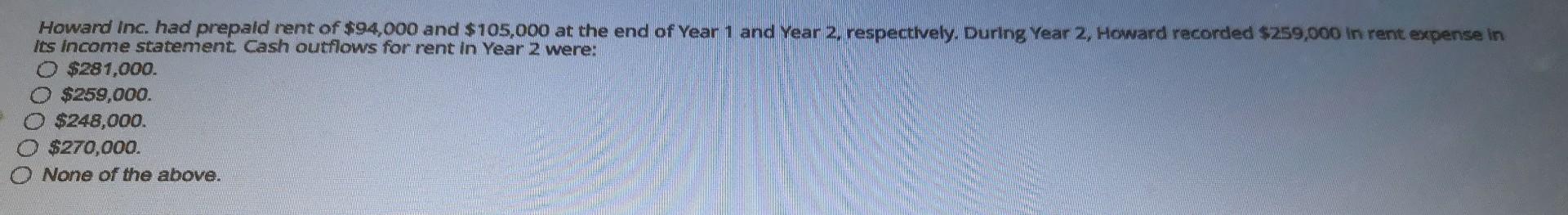

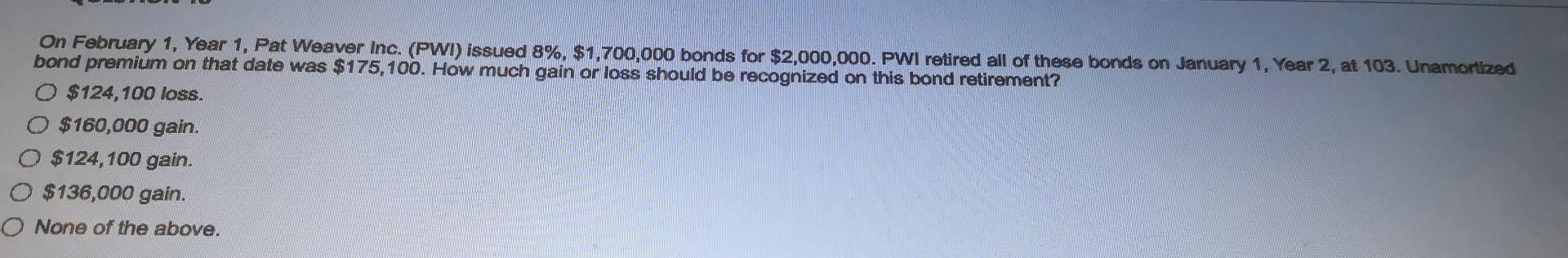

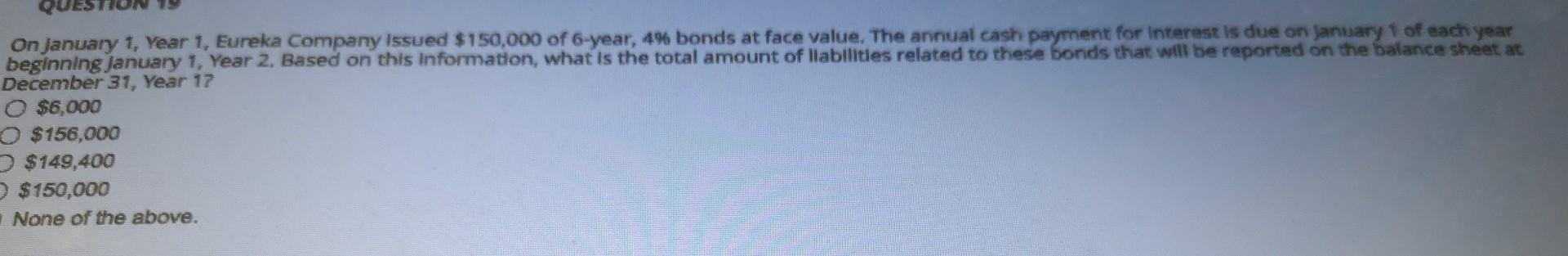

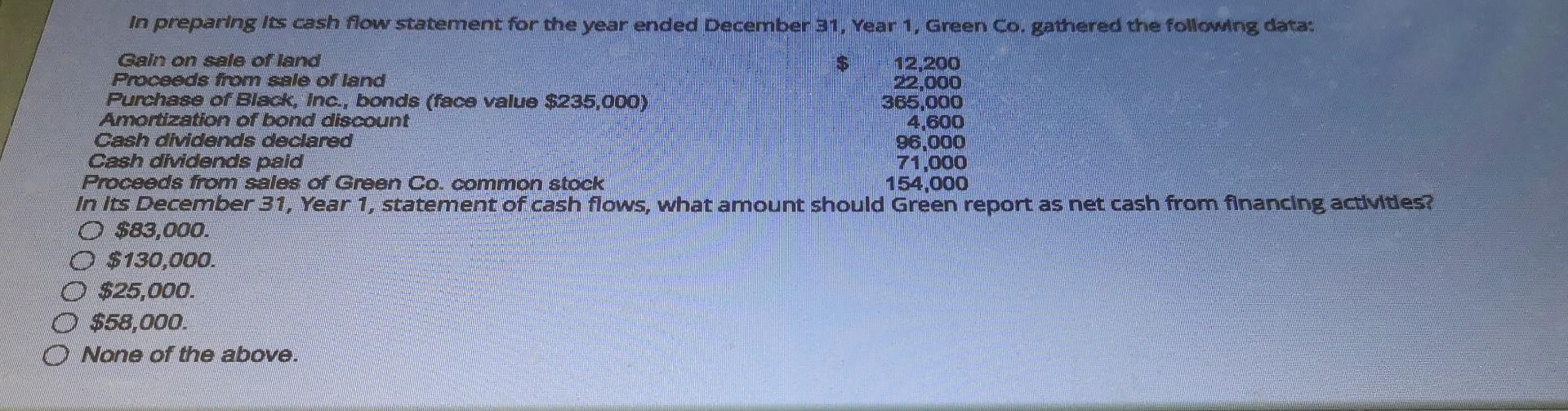

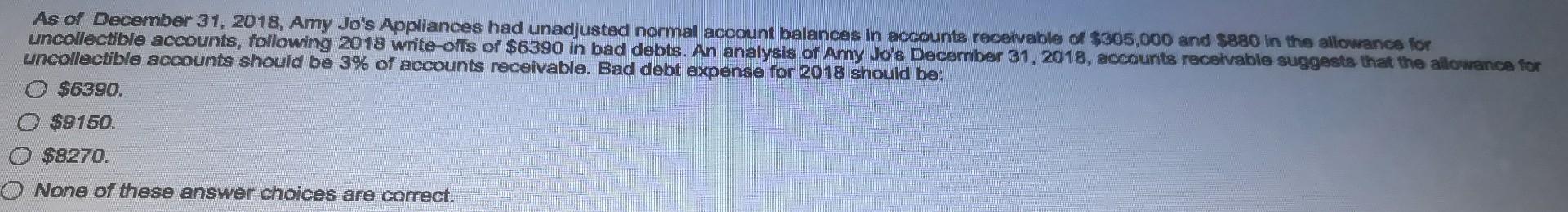

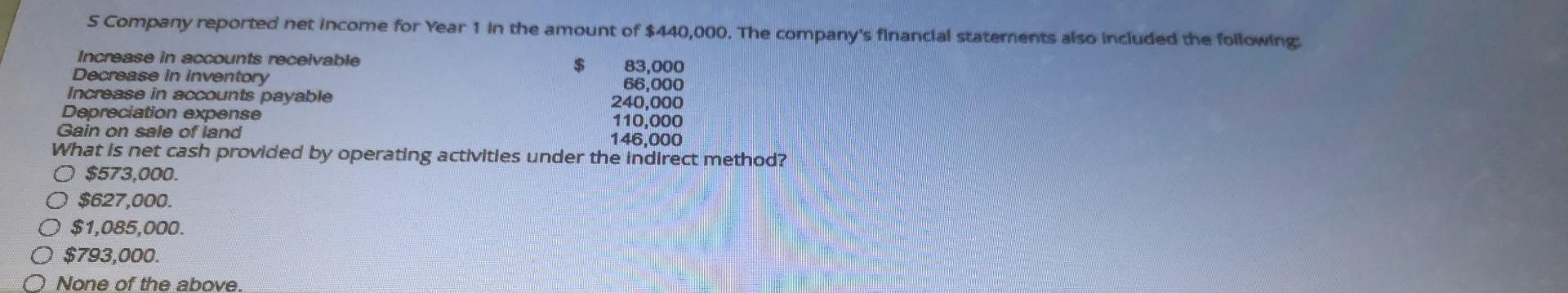

Alpaca Corporation had revenues of $270,000 in its first year of operations. The company has not collected on $18,900 of les sales and still awes $25,000 on $90,000 of merchandise it purchased. The company had no inventory on hand at the end of the year. The company paid $10,500 in salaries. Owners invested $27,000 in the business and $27,000 was borrowed on a five-year note. The company paid $2,900 in interest that was the amount owed for the year, and paid $8,000 for a two-year insurance policy on the first day of business. Alpaca has an effective income tax rate of 30%. Compute net income after taxes for the first year for Alpaca Corporation. $ 113,820 $ 111,020 O $ 162,600 O $ 180,000 None of the above. Currle Company borrowed $15,000 from Sierra Bank by Issuing a 9% three-year note. Currle agreed to repay the principal and Interest by making annual payments in the amount of $4521. Based on this information, what is the amount of the Interest expense associated with the second payment? (Round your answer to the nearest dollar.) $1350 $683 $1065 O $4521 None of the above. Howard Inc. had prepaid rent of $94,000 and $105,000 at the end of Year 1 and Year 2, respectively. During Year 2, Howard recorded $259,000 in rent expense in Its Income statement Cash outflows for rent in Year 2 were: $281,000. $259,000. $248,000. $270,000. None of the above. On February 1, Year 1, Pat Weaver Inc. (PWI) issued 8%, $1,700,000 bonds for $2,000,000. PWI retired all of these bonds on January 1, Year 2, at 103. Unamortized bond premium on that date was $175, 100. How much gain or loss should be recognized on this bond retirement? $124,100 loss. $160,000 gain. $124,100 gain. 0 $136,000 gain. O None of the above. On January 1, Year 1. Eureka Company issued $150,000 of 6 year, 4% bonds at face value. The annual cash payment for Interest is due on January 1 of each year beginning January 1, Year 2. Based on this information, what is the total amount of liabilities related to these bonds that will be reported on the balance sheet at December 31, Year 17 $6,000 O $156,000 $149,400 $ 150,000 None of the above. In preparing its cash flow statement for the year ended December 31, Year 1, Green Co. gathered the following data: Gain on sale of land 6 12,200 Proceeds from sale of land 22.000 Purchase of Black, Inc., bonds (face value $285,000) 365.000 Amortization of bond discount 4.600 Cash dividends declared 96,000 Cash dhidends paid 71,000 Proceeds from sales of Green Co. common stock 154,000 In Its December 31, Year 1, statement of cash flows, what amount should Green report as net cash from financing activities? O $83,000. $130,000. O $25,000. $58,000. O None of the above. As of December 31, 2018, Amy Jo's Appliances had unadjusted normal account balances in accounts receivable of $305,000 and $880 in the allowance for uncollectible accounts, following 2018 write-offs of $6390 in bad debts. An analysis of Amy Jo's December 31, 2018, accounts receivable suggests that the allowance for uncollectible accounts should be 3% of accounts receivable. Bad debt expense for 2018 should be: $6390. $9150. $8270. 0 None of these answer choices are correct. s Company reported net income for Year 1 In the amount of $440,000. The company's financial staternents also included the following: Increase in acxounts receivable $ 83,000 Decrease in inventory 66,000 Increase in accounts payable 240,000 Depreciation expense 110,000 Gain on sale of land 146,000 What is net cash provided by operating activities under the indirect method? O $573,000. $627,000. $1,085,000. $793,000. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started