((Please SOLVE THESE Qs))

with an uneven stream of future cash flows, the present value is determined by discounting all of the cash flows back to the present and then adding the present value. is there ever a time when you can treat some of the cash flows as annuities and apply the annuity techniques you learned in this chapter?

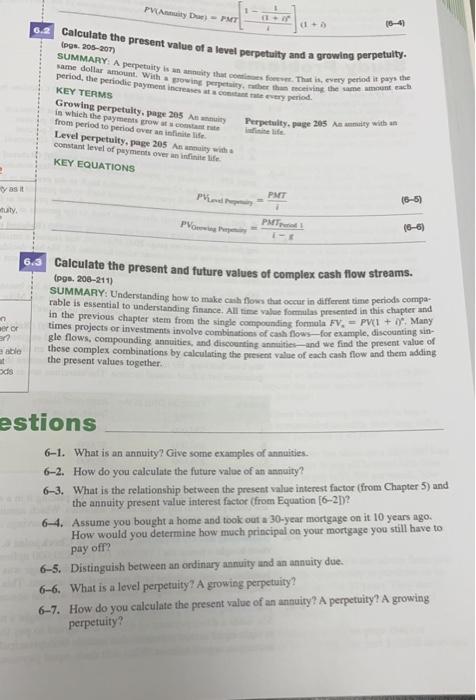

6-1. What is an annuity? Give some examples of annuities. 6-2. How do you calculate the future value of an annuity? 6-3. What is the relationship between the present value interest factor (from Chapter 5) and the annuity present value interest factor (from Equation [6-2])? 6-4. Assume you bought a home and took out a 30-year mortgage on it 10 years ago. How would you determine how much principal on your mortgage you still have to pay off? 6-5. Distinguish between an ordinary annuity and an annuity due. 6-6. What is a level perpetuity? A growing perpetuity? 6-7. How do you calculate the present value of an annuity? A perpetuity? A growing perpetuity? PV( Antuility Due )=PMr[11n+1](1+i) 0.2 Calculate the present value of a level perpetuity and a growing perpetuity. (pos. 205-207) SUMMARY: A perpetuity is an ahneity that ceemlites foever. That is, every period it pays the period, the periodic payment increases at w cenetame nater every period. KEY TERMS. KEY TERMS Growing perpetulty, page 205 An mainity from period to period over an inflinile life. Level perpetuity, page 205 An ammaity with a. Perpetuity, page 205 An ammiley with an constant level of payments over an infinite life. KEY EQUATIONS 6.3 Calculate the present and future values of complex cash flow streams. (ogs, 200-211) SUMMARY: Understanding how to make ciik flows that occur in different time periods comparable is essential to understanding firance, All tire valee formulas presented in this chapter and in the previous chapter stem from the single cocnpounding formola FVa=PV(1+0n, Many times projects or investments involvo combinations of cash fows-for example, discounting single flows, compounding annuities, and discounting annaities-and we find the present value of these complex combinations by calculating the persent value of each casth flow and them adding the present values together. tions 6-1. What is an annuity? Give some examples of annuities. 6-2. How do you calculate the future valoe of an annuity? 6-3. What is the relationship between the present value interest factor (from Chapter 5) and the annuity present value interest factor (from Equation [6-2])? 6-4. Assume you bought a home and took out a 30-year mortgage on it 10 years ago. How would you determine how much principal on your mortgage you still have to pay off? 6-5. Distinguish between an ordinary annuity and an annuiry due. 6-6. What is a level perpetuity? A growing perpetuity? 6-7. How do you calculate the present value of an annuity? A perpetuity? A growing perpetuity