please solve these questions for the course (fanacial management)

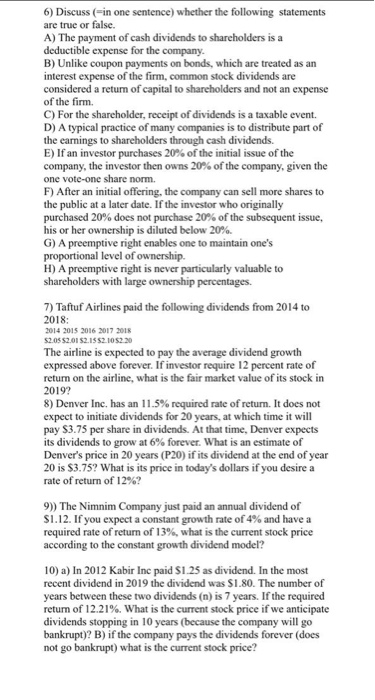

6) Discuss (=in one sentence) whether the following statements are true or false. A) The payment of cash dividends to shareholders is a deductible expense for the company. B) Unlike coupon payments on bonds, which are treated as an interest expense of the firm, common stock dividends are considered a return of capital to shareholders and not an expense of the firm. C) For the shareholder, receipt of dividends is a taxable event. D) A typical practice of many companies is to distribute part of the earnings to shareholders through cash dividends. E) If an investor purchases 20% of the initial issue of the company, the investor then owns 20% of the company, given the one vote-one share norm. F) After an initial offering, the company can sell more shares to the public at a later date. If the investor who originally purchased 20% does not purchase 20% of the subsequent issue, his or her ownership is diluted below 20% G) A preemptive right enables one to maintain one's proportional level of ownership H) A preemptive right is never particularly valuable to shareholders with large ownership percentages. 7) Taftuf Airlines paid the following dividends from 2014 to 2018: 2014 2015 2016 2017 2018 52.0 52.01 $2.1552.105220 The airline is expected to pay the average dividend growth expressed above forever. If investor require 12 percent rate of return on the airline, what is the fair market value of its stock in 2019? 8) Denver Inc. has an 11.5% required rate of return. It does not expect to initiate dividends for 20 years, at which time it will pay $3.75 per share in dividends. At that time, Denver expects its dividends to grow at 6% forever. What is an estimate of Denver's price in 20 years (P20) if its dividend at the end of year 20 is $3.75? What is its price in today's dollars if you desire a rate of return of 12%? 9)) The Nimnim Company just paid an annual dividend of $1.12. If you expect a constant growth rate of 4% and have a required rate of return of 13%, what is the current stock price according to the constant growth dividend model? 10) a) In 2012 Kabir Inc paid $1.25 as dividend. In the most recent dividend in 2019 the dividend was $1.80. The number of years between these two dividends (n) is 7 years. If the required return of 12.21%. What is the current stock price if we anticipate dividends stopping in 10 years because the company will go bankrupt)? B) if the company pays the dividends forever (does not go bankrupt) what is the current stock price