Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this case!!! O'Ryan Auto Centers, a national auto parts chain, was seeking a way to expand into the Middle Atlantic gion. Their investment

Please solve this case!!!

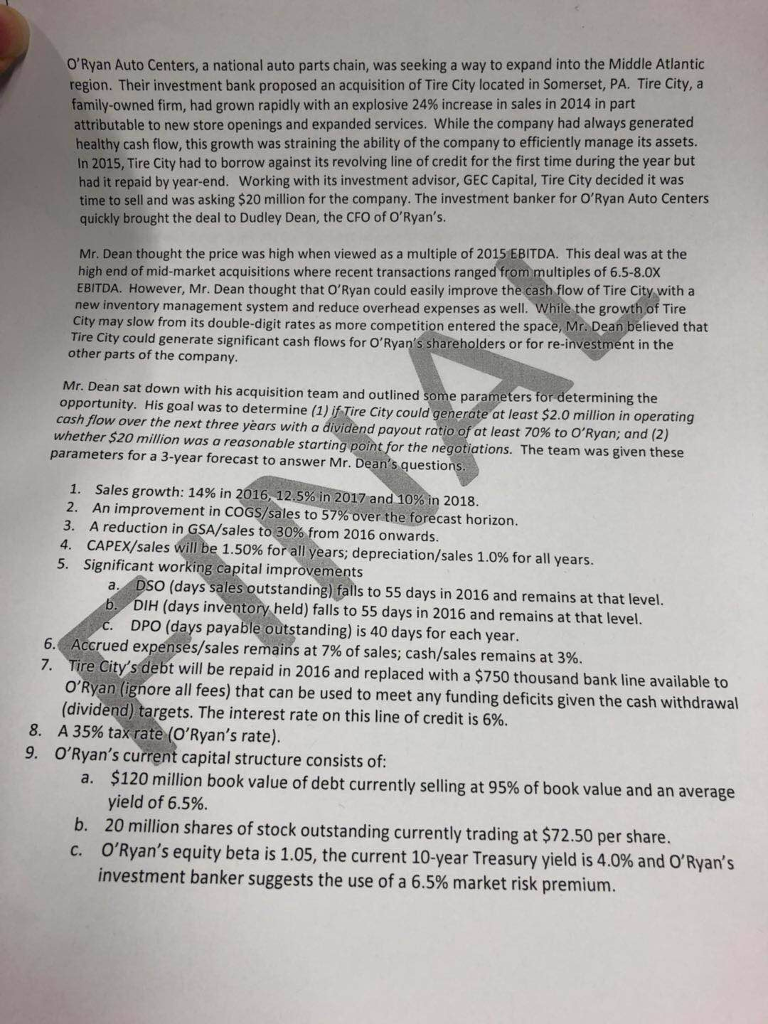

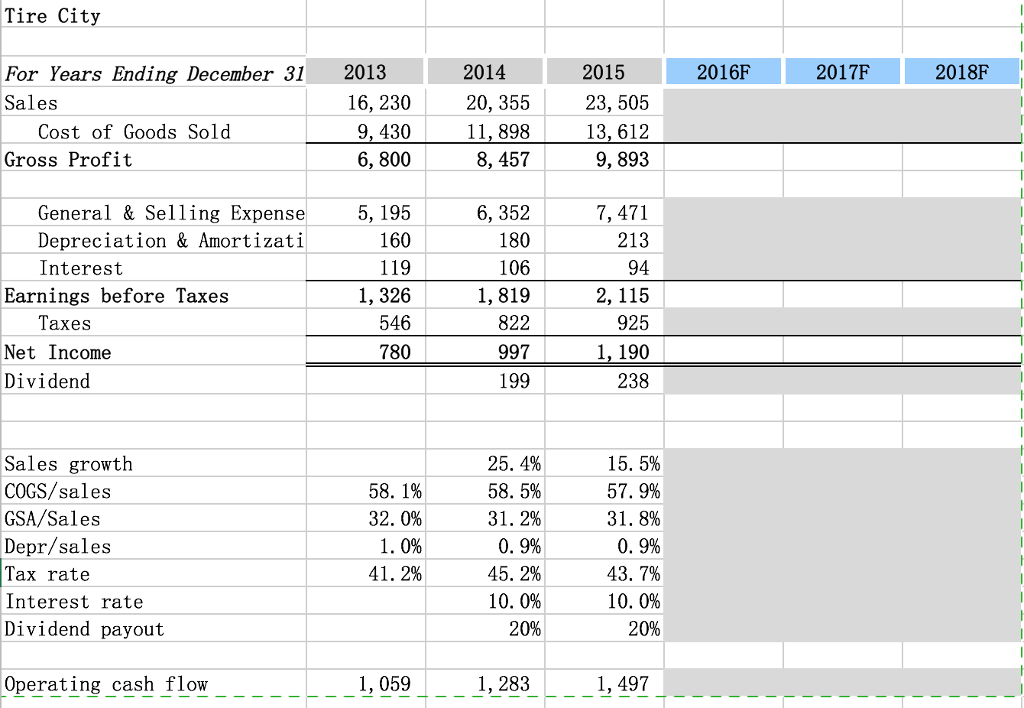

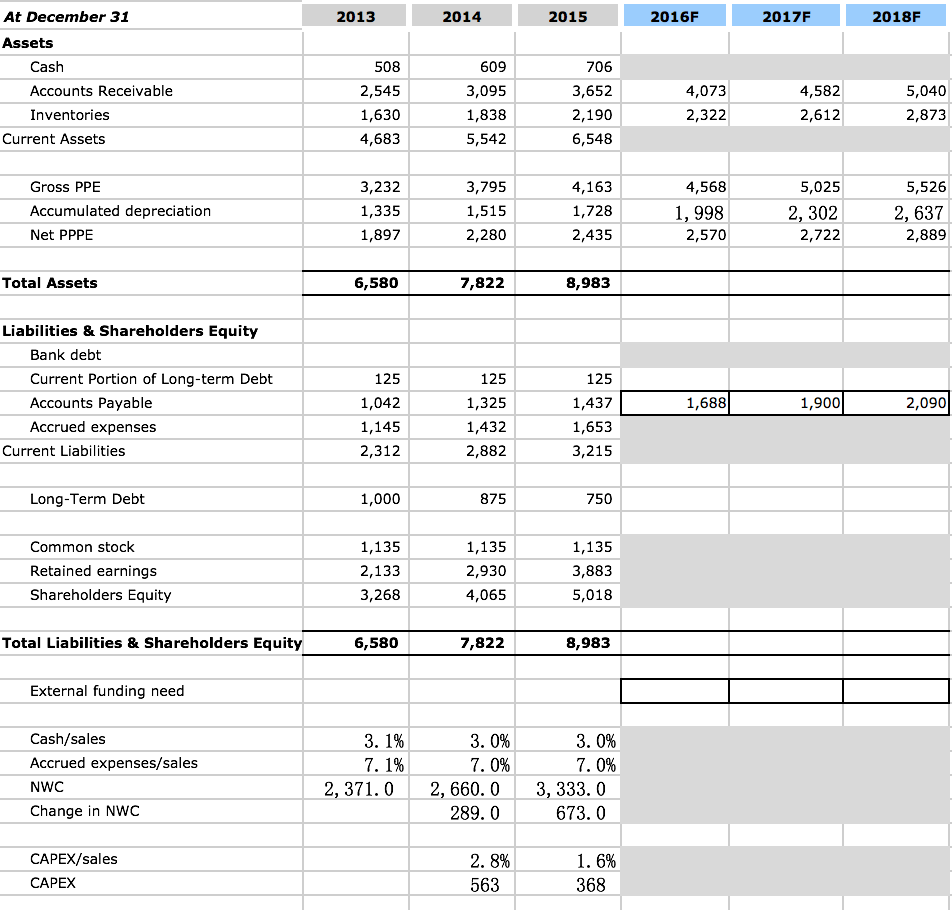

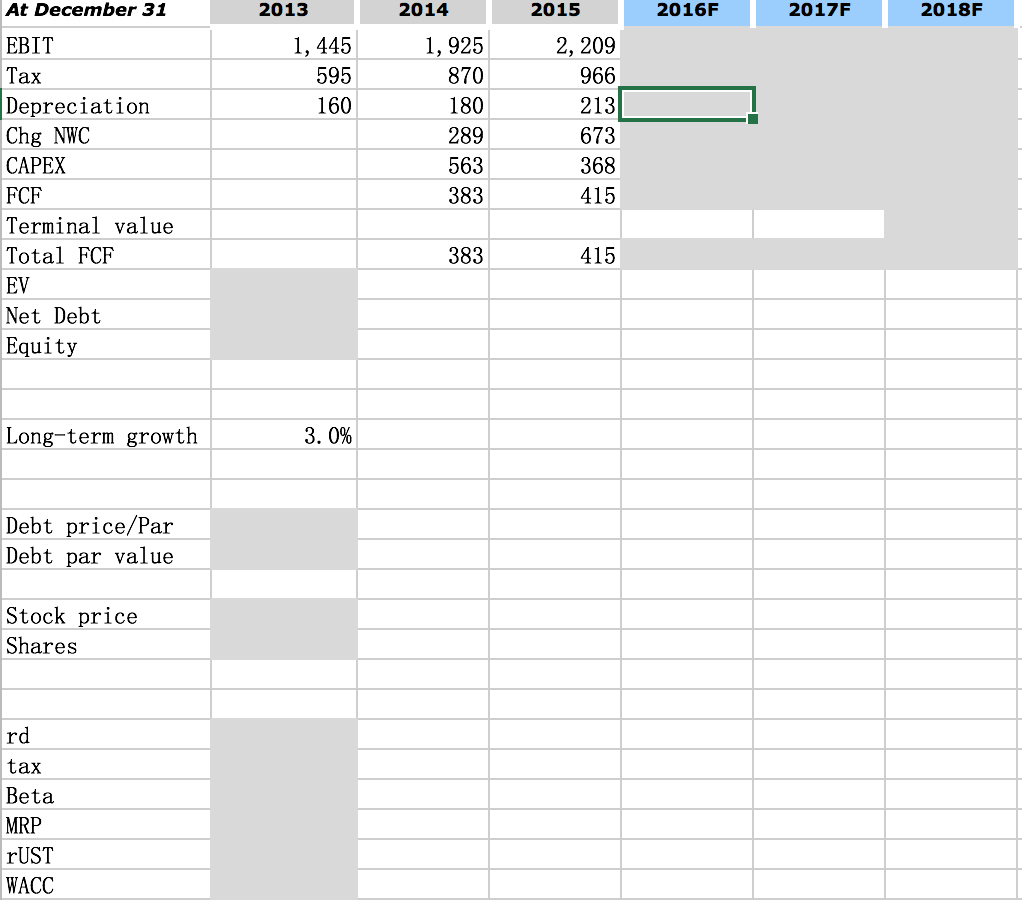

O'Ryan Auto Centers, a national auto parts chain, was seeking a way to expand into the Middle Atlantic gion. Their investment bank proposed an acquisition of Tire City located in Somerset, PA. Tire City, a family-owned firm, had grown rapidly with an explosive 24% increase in sales in 2014 in part ibutable to new store openings and expanded services. While the company had always generated cash flow, this growth was straining the ability of the company to efficiently manage its assets In 2015, Tire City had to borrow against its revolving line of credit for the first time during the year but had it repaid by year-end. Working with its investment advisor, GEC Capital, Tire City decided it was time to sell and was asking $20 million for the company. The investment banker for O'Ryan Auto Centers quickly brought the deal to Dudley Dean, the CFO of O'Ryan's Mr. Dean thought the price was high when viewed as a multiple of 2015 EBITDA. This deal was at the high end of mid-market acquisitions where recent transactions ranged from multiples of 6.5-8.0x EBITDA. However, Mr. Dean thought that O'Ryan could easily improve the cash flow of Tire City with a new inventory management system and reduce overhead expenses as well. While the growth of Tire City may slow from its double-digit rates as more competition entered the space, Mr. Dean believed that Tire City could generate significant cash flows for O'Ryan's shareholders or for re-investment in the other parts of the company Mr. Dean sat down with his acquisition team and outlined some parameters fo opportunity. His goal was to determine (1) jif Tire City could generate at least $ cash flow over the next three years with a dividend payout ratio of at least 70% to O'Ryan; a whether $20 million was a reasonable starting point for the negotiations. The team was given these r determining the nd (2) parameters for a 3-year forecast to answer Mr. Dean's questio 1. Sales growth: 14% in 2016, 12.5% in 2017 and 10% in 2018 2. An improvement in coGs/sales to 57% over the forecast horizon 3. A reduction in GSA/sales to:30%from 2016 onwards 4, CAPEX/sales willbe 1.50% for all years, depreciation/sales 1.0% for all years 5. Significant working capital improvements a. DSO (days sales outstanding) falls to 55 days in 2016 and remains at that level DIH (days inventory held) falls to 55 days in 2016 and remains at that level DPO (days payable outstanding) is 40 days for each year 6. Accrued expenses/sales remains at 7% of sales, cash/sales remains at 3%. 7. Tire City'sdebt will be repaid in 2016 and replaced with a $750 thousand bank line available to o'Ryan (ignore all fees) that can be used to meet any funding deficits given the cash withdrawal (dividend)targets. The interest rate on this line of credit is 6% 8. A 35% tax rate,O'Ryan's rate) 9. O'Ryan's current capital structure consists of: $120 million book value of debt currently selling at 95% of book value and an average yield of 6.5% 20 million shares of stock outstanding currently trading at $72.50 per share O'Ryan's equity beta is 1.05, the current 10-year Treasury yield is 40% and O'Ryan's investment banker suggests the use of a 6.5% market risk premium. a. b. c. Tire City For Years Ending December 312013 Sales 2014 2015 2016F 2017F 2018F 16,230 9, 430 6, 800 20, 355 11,898 8, 457 23, 505 13,612 9,893 Cost of Goods Sold Gross Profit 6, 352 180 106 1,819 822 997 199 General & Selling Expense Depreciation & Amortizati Interest 5,195 160 119 1,326 546 780 7, 471 213 94 2,115 925 1, 190 238 Earnings before Taxes Taxes Net Income Dividend Sales growth COGS/sales GSA/Sales Depr/sales lax rate Interest rate Dividend payout 58. 1% 32. 0% 1. 0% 41. 2% 25.4% 58. 596 31, 2% 0.9% 45, 2% 10, 096 20% 15.5% 57. 9% 31, 8% 0.9% 43. 7% 10. 0% 20% Operating cash flow 1, 059 1, 283 1, 497 At December 31 2013 2014 2015 2016F 2017F 2018F Assets 609 3,095 1,838 5,542 706 3,652 2,190 6,548 508 4,582 2,612 5,040 2,873 Accounts Receivable 4,073 2,322 1,630 4,683 Inventories Current Assets Gross PPE Accumulated depreciation Net PPPE 3,232 1,335 1,897 3,795 1,515 2,280 4,163 1,728 2,435 4,568 5,025 5,526 2,570 2,722 2,889 Total Assets 6,580 7,822 8,983 Liabilities & Shareholders Equity Bank debt Current Portion of Long-term Debt Accounts Payable Accrued expenses 125 1,042 1,325 1,432 2,882 125 1,437 1,653 3,215 1,688 1,900 2,090 Current Liabilities 2,312 Long-Term Debt 1,000 875 750 Common stock Retained earnings Shareholders Equity 1,135 2,133 3,268 1,135 2,930 4,065 1,135 3,883 5,018 Total Liabilities & Shareholders Equity 6,580 7,822 8,983 External funding need Cash/sales Accrued expenses/sales NWC Change in NWC 2,371.0 2,660.03, 333. 0 673. 0 289.0 CAPEX/sales CAPEX 368 2015 2016F 2017F 2018F 2013 2014 At December 31 EBIT Tax Depreciation Chg NWC CAPEX FCF Terminal value Total FCF EV Net Debt Equity 1, 925 870 180 289 563 383 2, 209 966 213 673 368 415 1, 445 595 160 383 415 Long-term growth 3. 0% Debt price/Par Debt par value Stock price Shares tax Beta MRP rUST WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started