Answered step by step

Verified Expert Solution

Question

1 Approved Answer

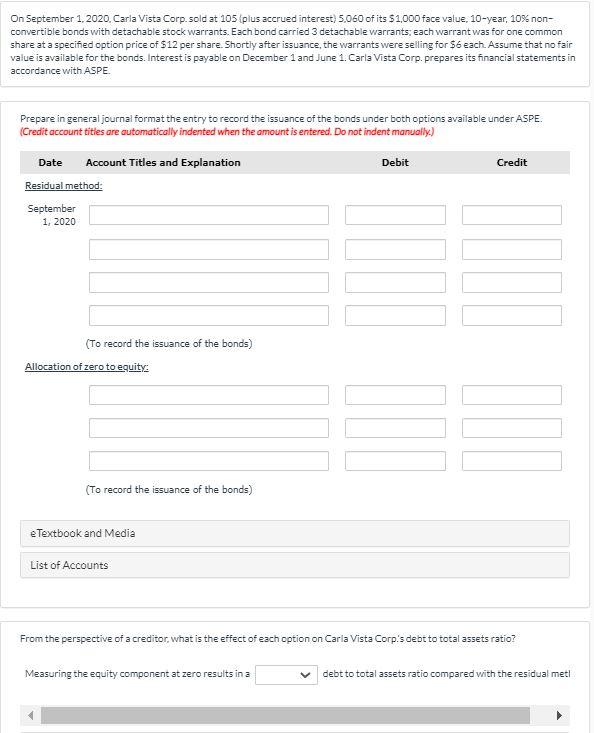

please solve this correctly ASAP. On September 1, 2020. Carla Vista Corp.sold at 105 (plus accrued interest) 5.060 of its $1,000 face value, 10-year, 10%

please solve this correctly ASAP.

On September 1, 2020. Carla Vista Corp.sold at 105 (plus accrued interest) 5.060 of its $1,000 face value, 10-year, 10% non- convertible bonds with detachable stock warrants. Each bond carried 3 detachable warrants, each warrant was for one common share at a specified option price of $12 per share. Shortly after issuance, the warrants were selling for $6 each. Assume that no fair value is available for the bonds. Interest is payable on December 1 and June 1. Carla Vista Corp. prepares its financial statements in accordance with ASPE Prepare in general journal format the entry to record the issuance of the bonds under both options available under ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Residual method: September 1, 2020 (To record the issuance of the bonds) Allocation of zero to equity (To record the issuance of the bonds) e Textbook and Media List of Accounts From the perspective of a creditor, what is the effect of each option on Carla Vista Corp's debt to total assets ratio? Measuring the equity component at zero results in a debt to total assets ratio compared with the residual metStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started