Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this for me is a strategic financial management Question 3 [15 Marks) Company Y currently pays an annual dividend of Gh200. The company's

please solve this for me is a strategic financial management

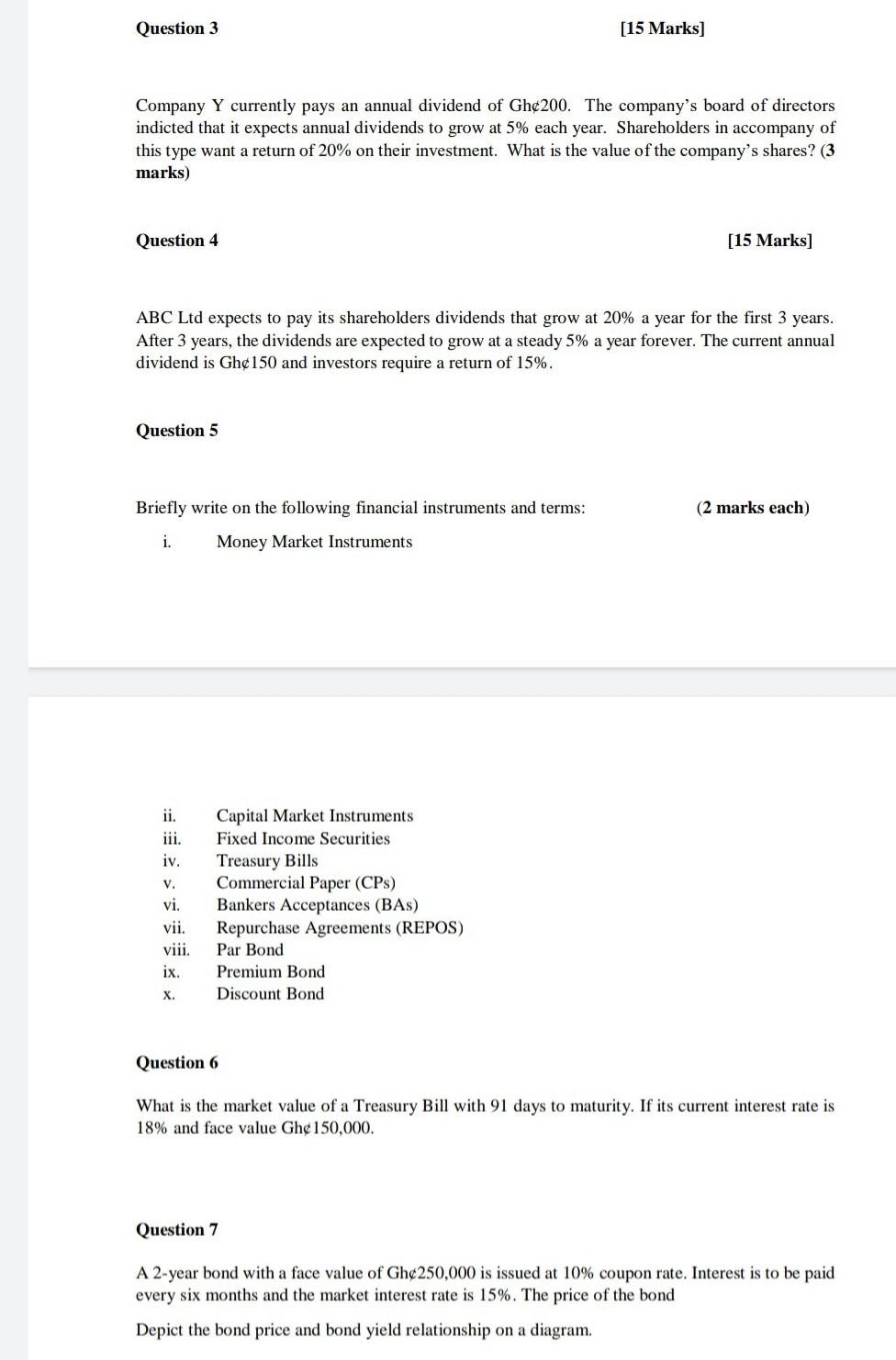

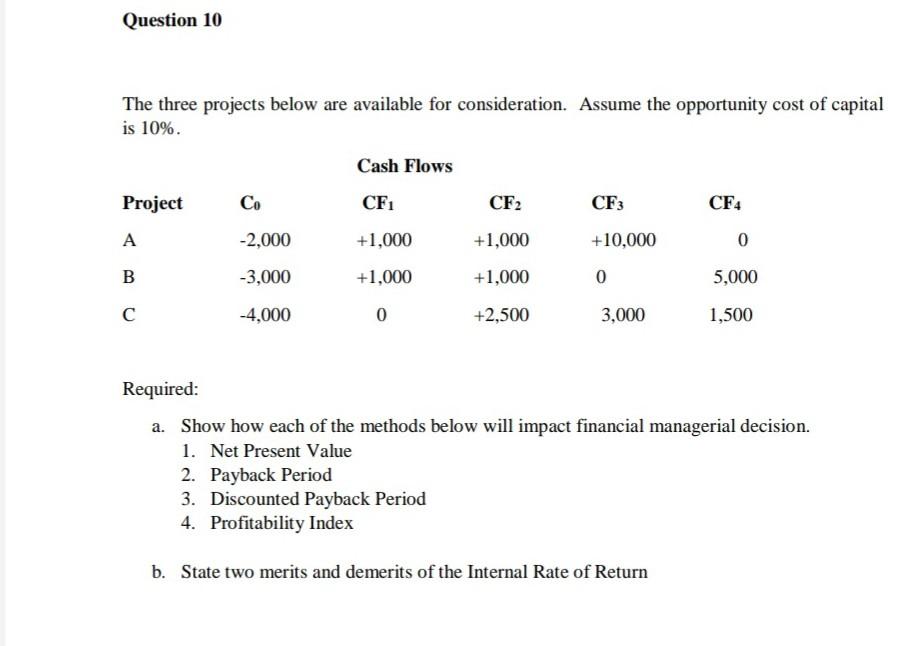

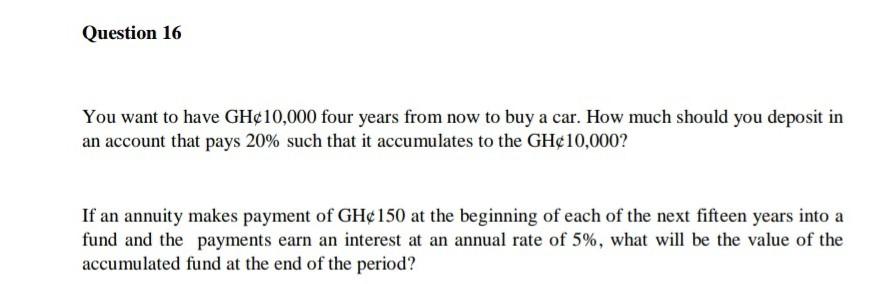

Question 3 [15 Marks) Company Y currently pays an annual dividend of Gh200. The company's board of directors indicted that it expects annual dividends to grow at 5% each year. Shareholders in accompany of this type want a return of 20% on their investment. What is the value of the company's shares? (3 marks) Question 4 [15 Marks] ABC Ltd expects to pay its shareholders dividends that grow at 20% a year for the first 3 years. After 3 years, the dividends are expected to grow at a steady 5% a year forever. The current annual dividend is Gh150 and investors require a return of 15%. Question 5 Briefly write on the following financial instruments and terms: (2 marks each) i. Money Market Instruments ii. iii. iv. V. vi. vii. viii. ix. Capital Market Instruments Fixed Income Securities Treasury Bills Commercial Paper (CPs) Bankers Acceptances (BAS) Repurchase Agreements (REPOS) Par Bond Premium Bond Discount Bond X. Question 6 What is the market value of a Treasury Bill with 91 days to maturity. If its current interest rate is 18% and face value Gh150,000. Question 7 A 2-year bond with a face value of Gh250,000 is issued at 10% coupon rate. Interest is to be paid every six months and the market interest rate is 15%. The price of the bond Depict the bond price and bond yield relationship on a diagram. Question 10 The three projects below are available for consideration. Assume the opportunity cost of capital is 10%. Cash Flows Project Co CF1 CF2 CF3 CF4 A -2,000 +1,000 +1,000 +10,000 0 B -3,000 +1,000 +1,000 0 5,000 -4,000 0 +2,500 3,000 1,500 Required: a. Show how each of the methods below will impact financial managerial decision. 1. Net Present Value 2. Payback Period 3. Discounted Payback Period 4. Profitability Index b. State two merits and demerits of the Internal Rate of Return Question 16 You want to have GH10,000 four years from now to buy a car. How much should you deposit in an account that pays 20% such that it accumulates to the GH10,000? If an annuity makes payment of GH150 at the beginning of each of the next fifteen years into a fund and the payments earn an interest at an annual rate of 5%, what will be the value of the accumulated fund at the end of the periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started