Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SOLVE THIS MCQS I DONT HAVE ANOTHER QUESTION LIMIT PLEASE HELP ME ITS MY QUIZ Question 15 0.5 points Save Answer Macnamara Corporation has

PLEASE SOLVE THIS MCQS I DONT HAVE ANOTHER QUESTION LIMIT PLEASE HELP ME ITS MY QUIZ

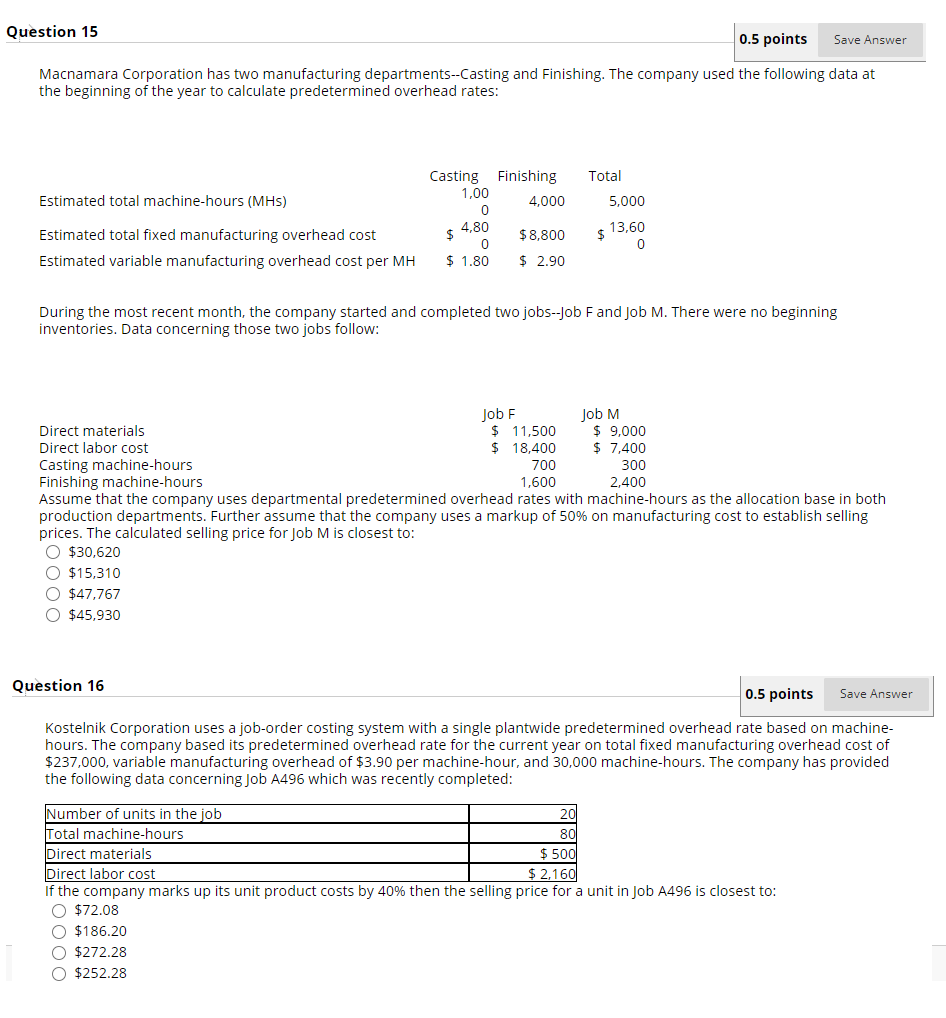

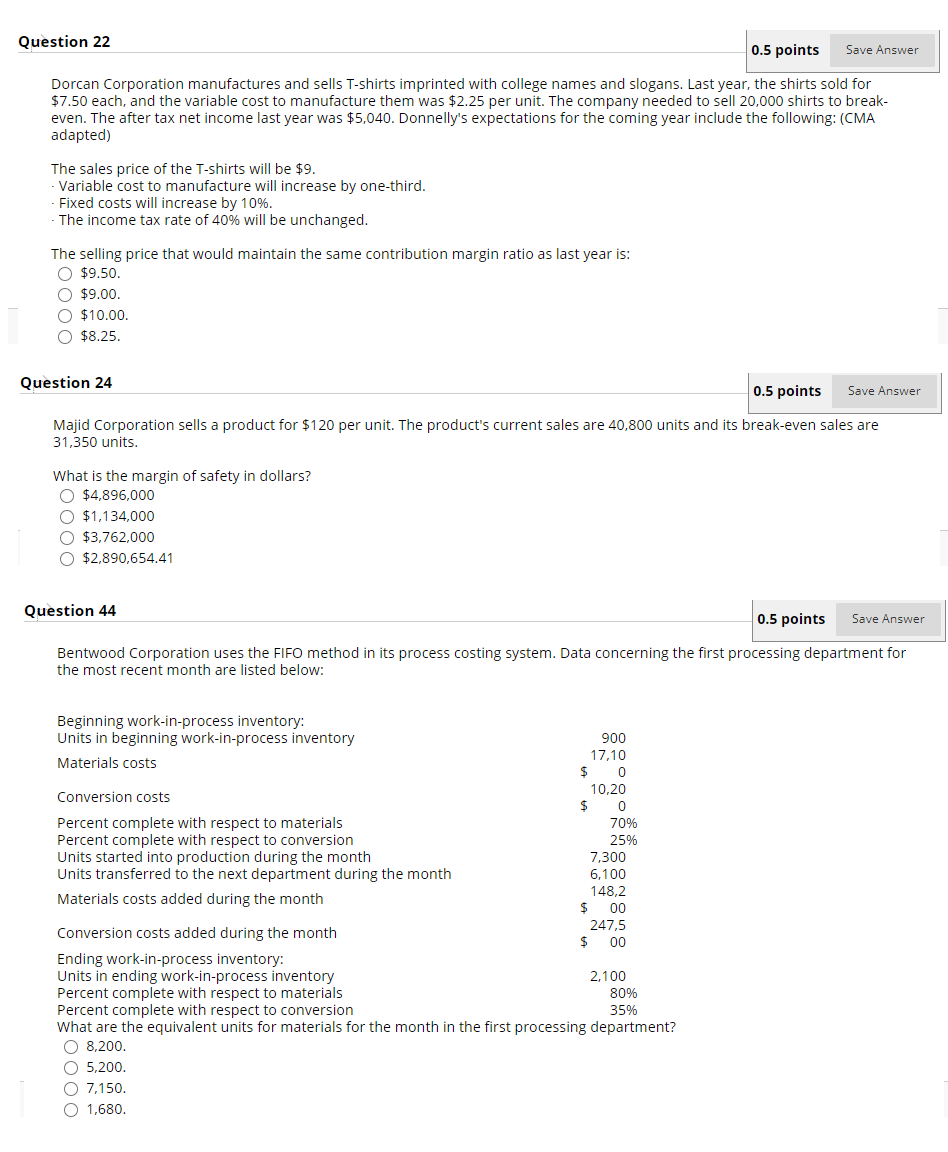

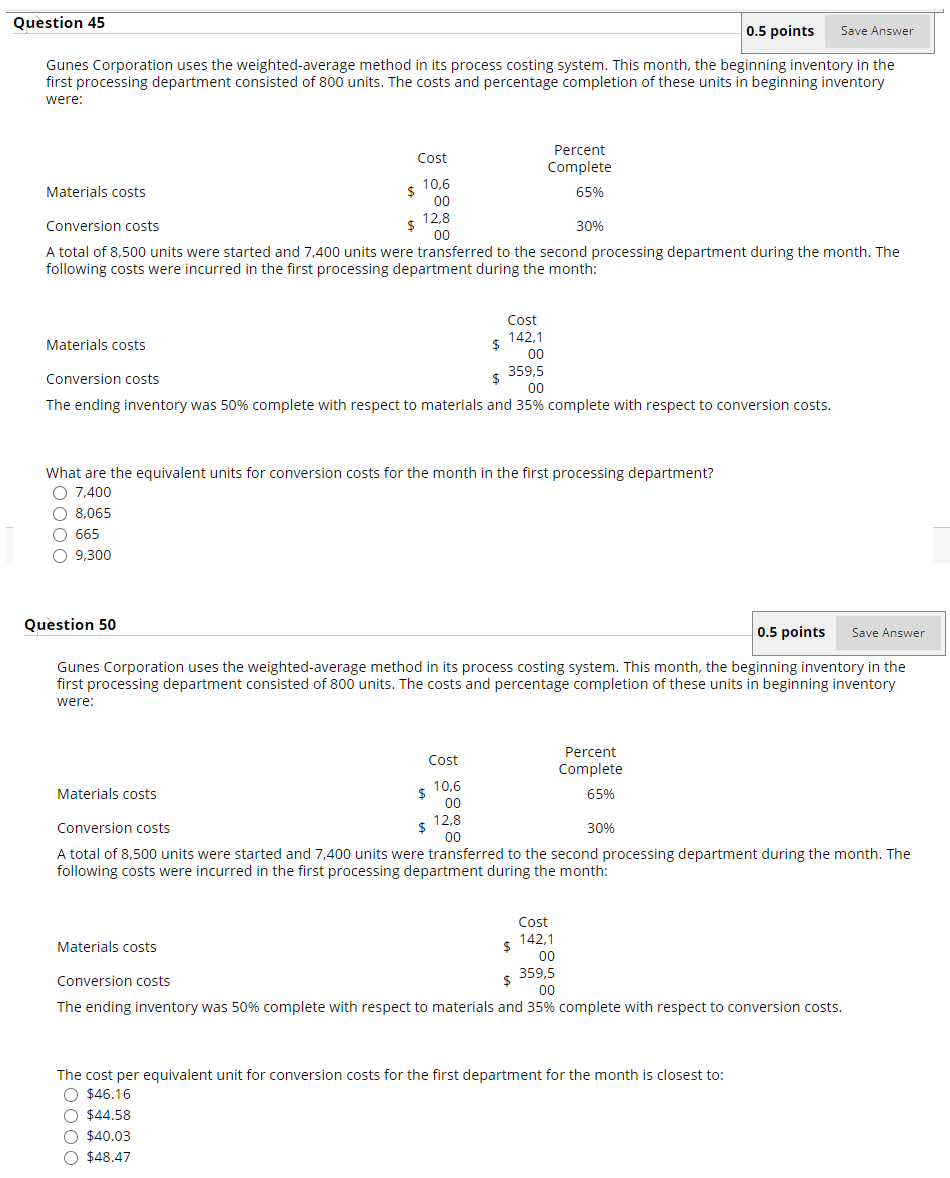

Question 15 0.5 points Save Answer Macnamara Corporation has two manufacturing departments--Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates: Total Estimated total machine-hours (MHS) 5,000 Casting Finishing 1,00 0 4,000 4,80 $ $ 8,800 0 $ 2.90 Estimated total fixed manufacturing overhead cost Estimated variable manufacturing overhead cost per MH 13,60 $ 0 $ 1.80 During the most recent month, the company started and completed two jobs--Job Fand Job M. There were no beginning inventories. Data concerning those two jobs follow: Job F JobM Direct materials $ 11,500 $ 9,000 Direct labor cost $ 18,400 $ 7,400 Casting machine-hours 700 300 Finishing machine-hours 1,600 2,400 Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job M is closest to: O $30,620 O $15,310 O $47,767 O $45,930 Question 16 0.5 points Save Answer Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine- hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed: Number of units in the job 20 Total machine-hours 80 Direct materials $ 500 Direct labor cost $ 2,160 If the company marks up its unit product costs by 40% then the selling price for a unit in Job A496 is closest to: O $72.08 O $186.20 O $272.28 O $252.28 Question 22 0.5 points Save Answer Dorcan Corporation manufactures and sells T-shirts imprinted with college names and slogans. Last year, the shirts sold for $7.50 each, and the variable cost to manufacture them was $2.25 per unit. The company needed to sell 20,000 shirts to break- even. The after tax net income last year was $5,040. Donnelly's expectations for the coming year include the following: (CMA adapted) The sales price of the T-shirts will be $9. - Variable cost to manufacture will increase by one-third. Fixed costs will increase by 10%. The income tax rate of 40% will be unchanged. The selling price that would maintain the same contribution margin ratio as last year is: O $9.50 O$9.00. O $10.00 $8.25. Question 24 0.5 points Save Answer Majid Corporation sells a product for $120 per unit. The product's current sales are 40,800 units and its break-even sales are 31,350 units. What is the margin of safety in dollars? 0 $4,896,000 O $1,134,000 O $3,762,000 O $2,890,654.41 Question 44 0.5 points Save Answer Bentwood Corporation uses the FIFO method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work-in-process inventory: Units in beginning work-in-process inventory 900 17,10 Materials costs $ 0 Conversion costs 10,20 $ 0 Percent complete with respect to materials 70% Percent complete with respect to conversion 25% Units started into production during the month 7,300 Units transferred to the next department during the month 6,100 148,2 Materials costs added during the month $ 00 247,5 Conversion costs added during the month $ 00 Ending work-in-process inventory: Units in ending work-in-process inventory 2.100 Percent complete with respect to materials 80% Percent complete with respect to conversion 35% What are the equivalent units for materials for the month in the first processing department? O 8,200. O 5,200. O 7,150. O 1,680. Question 45 0.5 points Save Answer Gunes Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were: $ 10,6 Percent Cost Complete Materials costs 65% 00 Conversion costs 12,8 $ 30% 00 A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Cost Materials costs $ 142,1 00 Conversion costs 359,5 $ 00 The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs. What are the equivalent units for conversion costs for the month in the first processing department? O 7,400 O 8,065 O 665 0 9,300 Question 50 0.5 points Save Answer Gunes Corporation uses the weighted average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 800 units. The costs and percentage completion of these units in beginning inventory were: Cost Percent Complete 65% Materials costs $ 10,6 00 12,8 Conversion costs $ 00 30% A total of 8,500 units were started and 7,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Cost 142,1 Materials costs $ 00 359,5 Conversion costs $ 00 The ending inventory was 50% complete with respect to materials and 35% complete with respect to conversion costs. The cost per equivalent unit for conversion costs for the first department for the month is closest to: O $46.16 O $44.58 O $40.03 O $48.47Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started