Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this on paper. Thankyou ! You must answer BOTH questions from this section. QUESTION 1 After his last full year of business, is

Please solve this on paper. Thankyou !

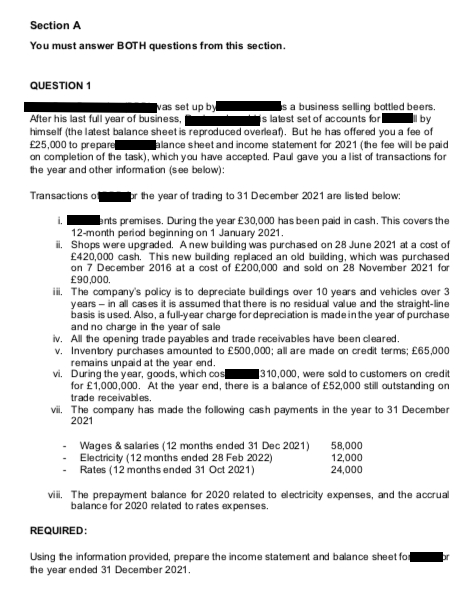

You must answer BOTH questions from this section. QUESTION 1 After his last full year of business, is business selling bottled beers. himself (the latest balance sheet is reproduced overleaff. But he has offered you a fee of 25,000 to prepare _alance sheet and income statement for 2021 (the fee will be paid on completion of the task), which you have accepted. Paul gave you a list of transactions for the year and other information (see below): Transactions of the year of trading to 31 December 2021 are listed below: i. Ints premises. During the year 30,000 has been paid in cash. This covers the 12-month period beginning on 1 January 2021. ii. Shops were upgraded. A new building was purchas ed on 28 June 2021 at a cost of 420,000 cash. This new building replaced an old building, which was purchased on 7 December 2016 at a cost of 200,000 and sold on 28 November 2021 for 90,000. iii. The company's policy is to depreciate buildings over 10 years and vehicles over 3 years - in all cases it is assumed that there is no residual value and the straight-line basis is used. Also, a full-year charge for depreciation is made in the year of purchase and no charge in the year of sale iv. All the opening trade payables and trade receivables have been cleared. v. Inventory purchases amounted to 500,000; all are made on credit terms; 65,000 remains unpaid at the year end. vi. During the year, goods, which cos 310,000 , were sold to customers on credit for 1,000,000. At the year end, there is a balance of 52,000 still outstanding on trade receivables. vii. The company has made the following cash payments in the year to 31 December 2021 - Wages \& salaries (12 months ended 31 Dec 2021) 58,000 - Electricity (12 months ended 28 Feb 2022) 12,000 -Rates(12monthsended31Oct2021)24,000 viii. The prepayment balance for 2020 related to electricity expenses, and the accrual balance for 2020 related to rates expenses. REQUIRED: Using the information provided, prepare the income statement and balance sheet for the year ended 31 December 2021. You must answer BOTH questions from this section. QUESTION 1 After his last full year of business, is business selling bottled beers. himself (the latest balance sheet is reproduced overleaff. But he has offered you a fee of 25,000 to prepare _alance sheet and income statement for 2021 (the fee will be paid on completion of the task), which you have accepted. Paul gave you a list of transactions for the year and other information (see below): Transactions of the year of trading to 31 December 2021 are listed below: i. Ints premises. During the year 30,000 has been paid in cash. This covers the 12-month period beginning on 1 January 2021. ii. Shops were upgraded. A new building was purchas ed on 28 June 2021 at a cost of 420,000 cash. This new building replaced an old building, which was purchased on 7 December 2016 at a cost of 200,000 and sold on 28 November 2021 for 90,000. iii. The company's policy is to depreciate buildings over 10 years and vehicles over 3 years - in all cases it is assumed that there is no residual value and the straight-line basis is used. Also, a full-year charge for depreciation is made in the year of purchase and no charge in the year of sale iv. All the opening trade payables and trade receivables have been cleared. v. Inventory purchases amounted to 500,000; all are made on credit terms; 65,000 remains unpaid at the year end. vi. During the year, goods, which cos 310,000 , were sold to customers on credit for 1,000,000. At the year end, there is a balance of 52,000 still outstanding on trade receivables. vii. The company has made the following cash payments in the year to 31 December 2021 - Wages \& salaries (12 months ended 31 Dec 2021) 58,000 - Electricity (12 months ended 28 Feb 2022) 12,000 -Rates(12monthsended31Oct2021)24,000 viii. The prepayment balance for 2020 related to electricity expenses, and the accrual balance for 2020 related to rates expenses. REQUIRED: Using the information provided, prepare the income statement and balance sheet for the year ended 31 December 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started