Answered step by step

Verified Expert Solution

Question

1 Approved Answer

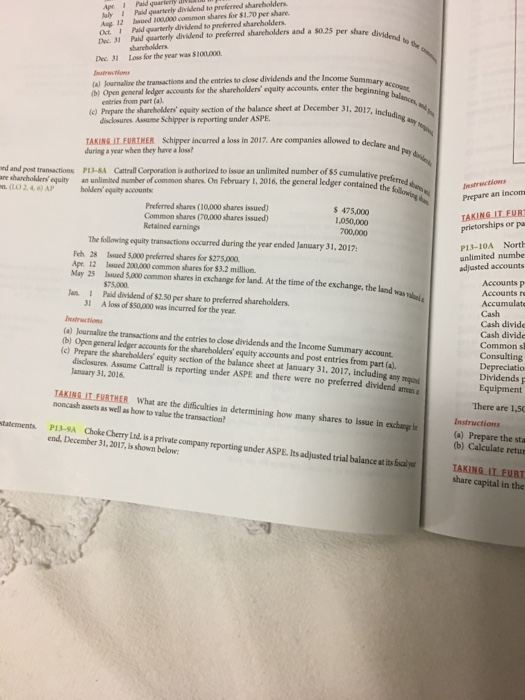

please solve this p13-A p13-9A Aug. 12 ued 20.000 common shares for $1.70 per share. Ot. 1 Paid quarterly dividend to preferred shareholders Dac I

please solve this p13-A

p13-9A

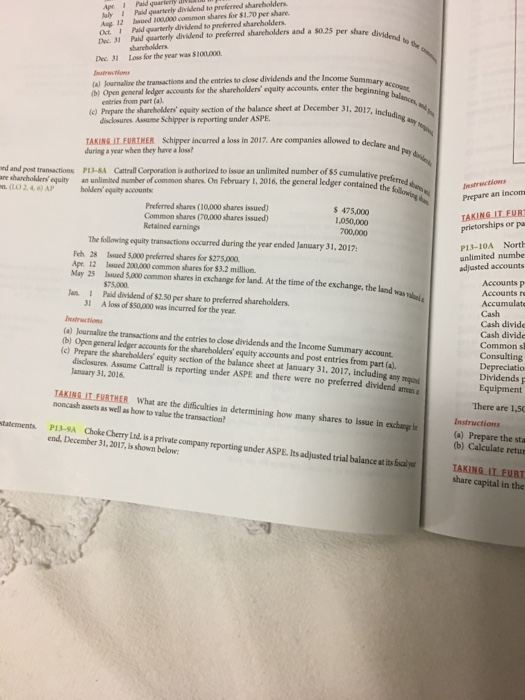

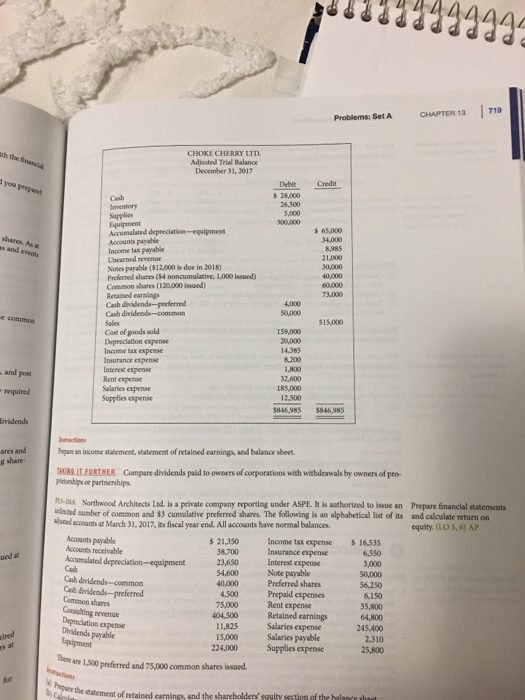

Aug. 12 ued 20.000 common shares for $1.70 per share. Ot. 1 Paid quarterly dividend to preferred shareholders Dac I Paid quarterly dividend to preferred shareholders and a s0.25 per share Dec. 31 Loss for the year was $100000 (a) Journaline the transactions and the entries to close dividends and the Income b) Open gewral ledger accosunts for the sharcholden' equity accounts, enter the beginn Summary accoune entries from part (a). (c) Prepare the shareholders' equity section of the balance sheet at December 31, 2017 disclosures Assume Schipper is reporting under ASPE TAKING IT FURTMER Schipper incurred a loss in 2017. Are companies allowed to during a year when they have a loss declare and pay $5 cumalative preferred suPrepare nd and post transactions P13-84 Cattral Cerporation is authorized to issse an unlimited number of sS re sharcholen' equity an unlimited number of common shares On February 1, 2016, the g general ledger contained the follo an incom holders' equity accounts Preferred shares (10,000 shares issued) Common shares (70,000 shares issued) Retained earnings 475,000 1,050,000 700,000 TAKING .IT FUR prietorships or pa The following equity transactions occurred during the year ended January 31, 2017 Feb. 28 Isued 5,000 preferred shares for $275,000 Apr. 12 Issued 200,000 common shares for $3.2 million May 25 Issued 5,000 common shares in exchange for land. At the time of the exchange, the land P13-10A North unlimited numbe adjusted accounts Accounts p Accounts re Accumulate land was raluel a 75,000 an 1 Paild dividend of $2.50 per share to preferred shareholders 31 A loss of $50,000 was incurred for the year Cash Cash divide Cash divide Common sl (a) Journalize the transactions and the entries to close dividends and the Income Summary account b) Open general ledger accounts for the shareholders' equity accounts and post entries from part (a). (e) Prepare the shareholders' equity section of the balance sheet at January 31, 2017, including any requndl Consulting Depreciatio Dividendsp Equipment disclosures. Assume Cattrall is reporting under ASPE and there were no preferred dividend amen Janary 31.2016 There are 1,50 TAKNULIRTMER What are the dif culties in determining how many shares to issue in eday noncash assets as well as how to valoe the transaction (a) Prepare the sta (b) Calculate retur atcments P13-9A Choke Chery Ltd. is aprivate compuny ncporting under ASPE.Its adjusted trial balance at t osal Choke Cherry Ltd. is end, December 31, 2017, is shown below TAKING IL FURT share capital in the Problems: Set A CHAPTER 13 71 CHOKE CHERRY LTD Adjusted Trial Balance December 31, 2017 Deblt Credit 5 28,000 s 65,000 34,000 8,985 21,000 30,000 40,000 shares As e s and Accounts payable Income tax payable Unearned revenve Notes payable (512,000 is due in 2018) Preferred shares (54 noncumulative, 1,000 Issued) Common shares 120000 issued) Retained earnings Cash dividends Cost of goods sold Depreciation expense Income tax expense Insurance expense Interest expense Rent expense 159,000 14,385 8200 1,800 32,600 185,000 12.500 and post Salaries expense Supplies expense 846985 $846,985 ares and g share- hpuse an income statement, statement of retained carnings, and balance sheet IT FURTHER Compare dividends paid to owners of corporations with withdrawals by owners of peo- toips or partmerships -A Northwood Architects Ltd. is a private company reporting under ASPE It is authorized to issue an Prepare fnancial statements elimited mumber of common and $3 cumulative preferred shares. The following is an alphabetical list of its and calculate return on d accounts at March 31, 2017, its fiscal year end. All accounts have normal balances equity. (LO 5, 6) AP Accounts payable Accounts receivable 21,30 Income tax expense 38,700 23,650 54,600 16535 6,550 Insurance expense nterest expense Note payable Preferred shares Prepaid expenses Rent expense Retained earnings Salaries expense Salaries payable Supplies expense ued at 4.500 75,000 404,500 11,825 15,000 56,250 6,150 35,800 64,800 245,400 2310 25,800 Common shares Cotsulting revenue epense are 1,500 preferred and 75,000 common shares issued. ethtatement of retained carnings and the shareholdens sguity otgn af th lanh Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started