please solve this problem

please solve this problem

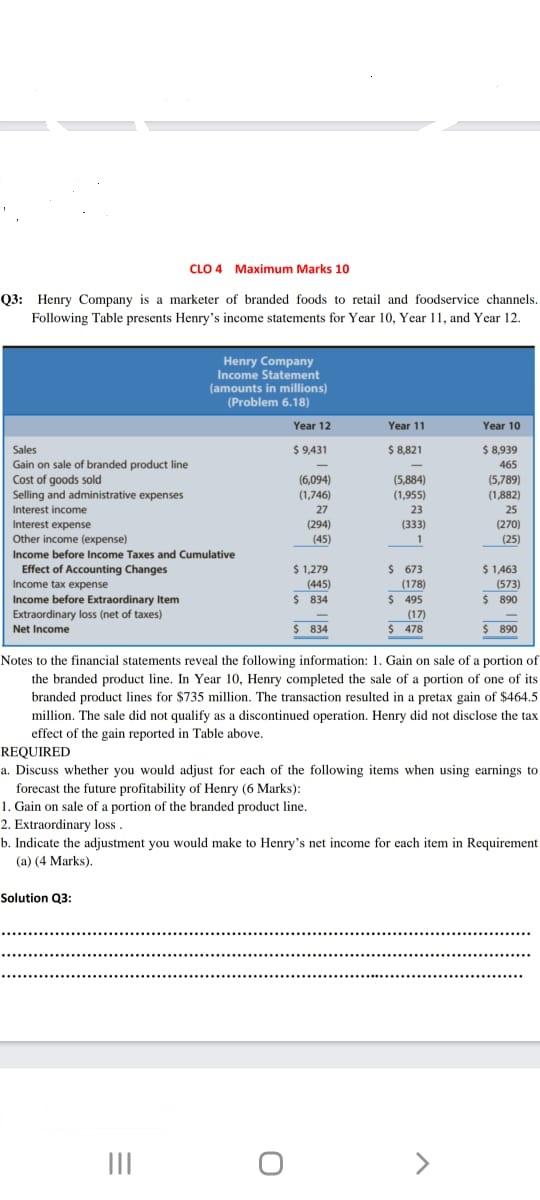

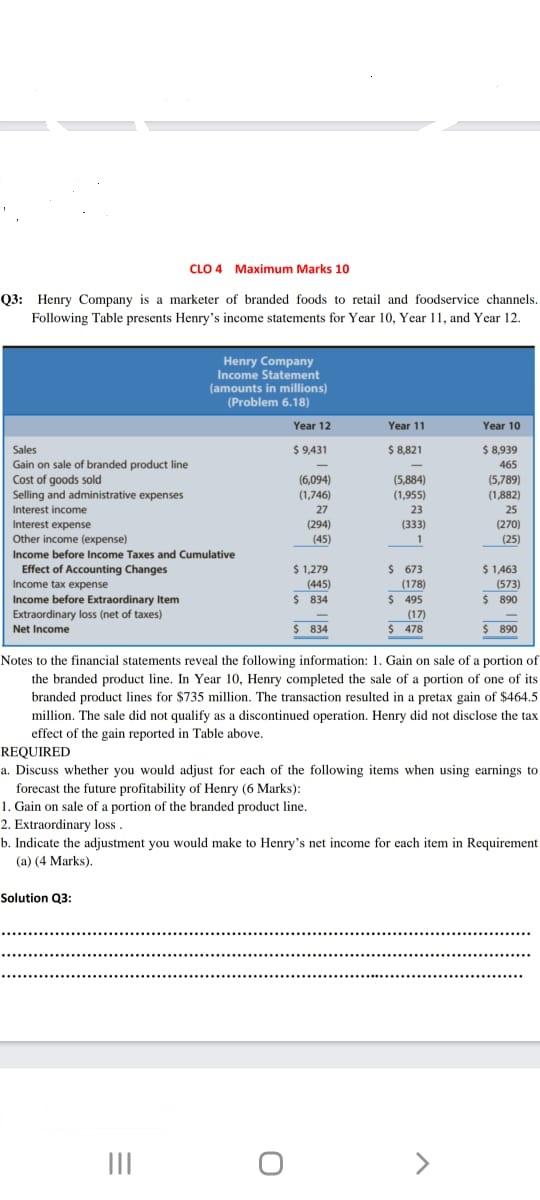

CLO4 Maximum Marks 10 Q3: Henry Company is a marketer of branded foods to retail and foodservice channels. Following Table presents Henry's income statements for Year 10 Year 11, and Year 12. Henry Company Income Statement (amounts in millions) (Problem 6.18) Year 12 Year 11 Year 10 $ 9,431 $ 8,821 (6,094) (1,746) 27 (294) (45) (5,884) (1.955) 23 Sales Gain on sale of branded product line Cost of goods sold Selling and administrative expenses Interest income Interest expense Other income (expense) Income before Income Taxes and Cumulative Effect of Accounting Changes Income tax expense Income before Extraordinary Item Extraordinary loss (net of taxes) Net Income $ 8,939 465 15,789) (1,882) 25 (270) (25) (333) 1 $ 1.279 (445) $ 673 (178) $ 495 (17) $ 478 $ 1,463 (573) $ 890 $ 834 $ 834 $ 890 Notes to the financial statements reveal the following information: 1. Gain on sale of a portion of the branded product line. In Year 10. Henry completed the sale of a portion of one of its branded product lines for $735 million. The transaction resulted in a pretax gain of $464.5 million. The sale did not qualify as a discontinued operation. Henry did not disclose the tax effect of the gain reported in Table above. REQUIRED a. Discuss whether you would adjust for each of the following items when using earnings to forecast the future profitability of Henry (6 Marks): 1. Gain on sale of a portion of the branded product line. 2. Extraordinary loss. b. Indicate the adjustment you would make to Henry's net income for each item in Requirement (a) (4 Marks). Solution Q3: > CLO4 Maximum Marks 10 Q3: Henry Company is a marketer of branded foods to retail and foodservice channels. Following Table presents Henry's income statements for Year 10 Year 11, and Year 12. Henry Company Income Statement (amounts in millions) (Problem 6.18) Year 12 Year 11 Year 10 $ 9,431 $ 8,821 (6,094) (1,746) 27 (294) (45) (5,884) (1.955) 23 Sales Gain on sale of branded product line Cost of goods sold Selling and administrative expenses Interest income Interest expense Other income (expense) Income before Income Taxes and Cumulative Effect of Accounting Changes Income tax expense Income before Extraordinary Item Extraordinary loss (net of taxes) Net Income $ 8,939 465 15,789) (1,882) 25 (270) (25) (333) 1 $ 1.279 (445) $ 673 (178) $ 495 (17) $ 478 $ 1,463 (573) $ 890 $ 834 $ 834 $ 890 Notes to the financial statements reveal the following information: 1. Gain on sale of a portion of the branded product line. In Year 10. Henry completed the sale of a portion of one of its branded product lines for $735 million. The transaction resulted in a pretax gain of $464.5 million. The sale did not qualify as a discontinued operation. Henry did not disclose the tax effect of the gain reported in Table above. REQUIRED a. Discuss whether you would adjust for each of the following items when using earnings to forecast the future profitability of Henry (6 Marks): 1. Gain on sale of a portion of the branded product line. 2. Extraordinary loss. b. Indicate the adjustment you would make to Henry's net income for each item in Requirement (a) (4 Marks). Solution Q3: >

please solve this problem

please solve this problem