Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this problem in step by step procedure. Tyrene Products manufactures recreational equipment. The operating results for the most recent year for one of

please solve this problem in step by step procedure.

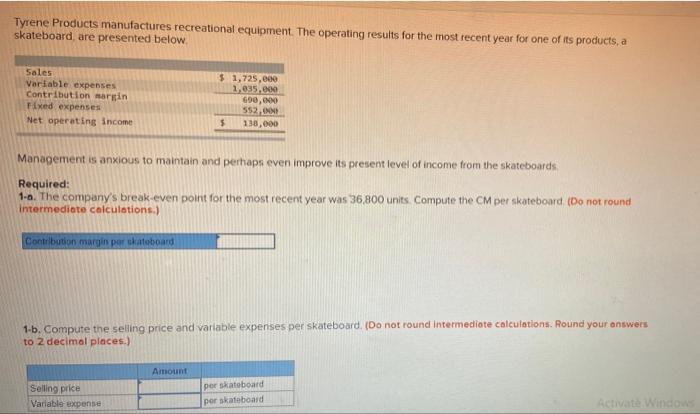

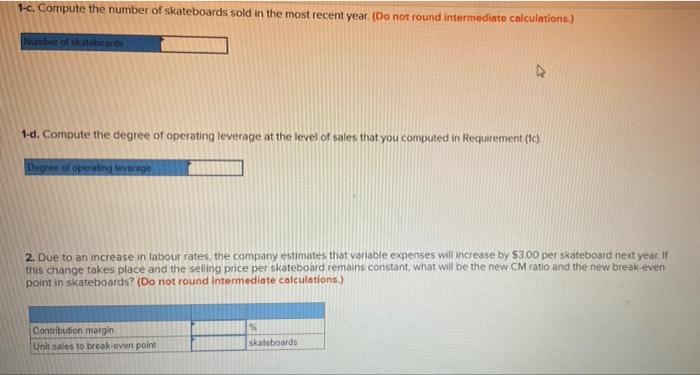

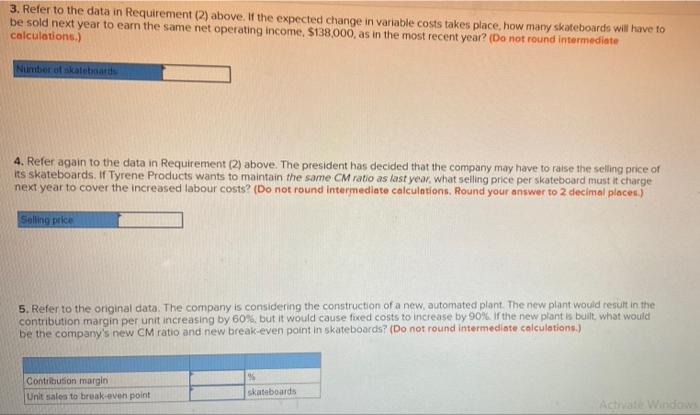

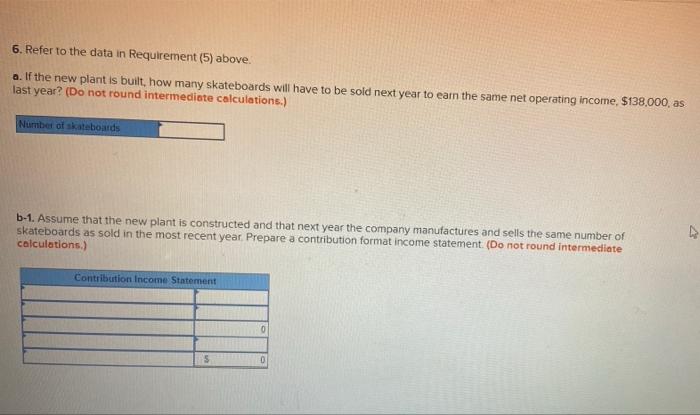

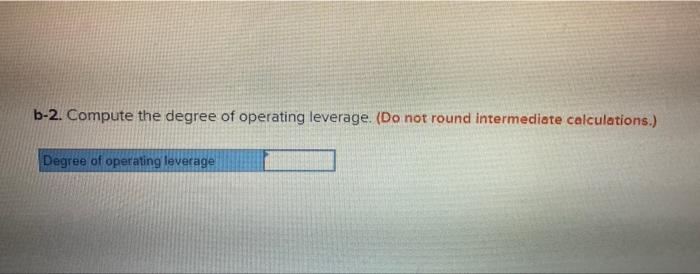

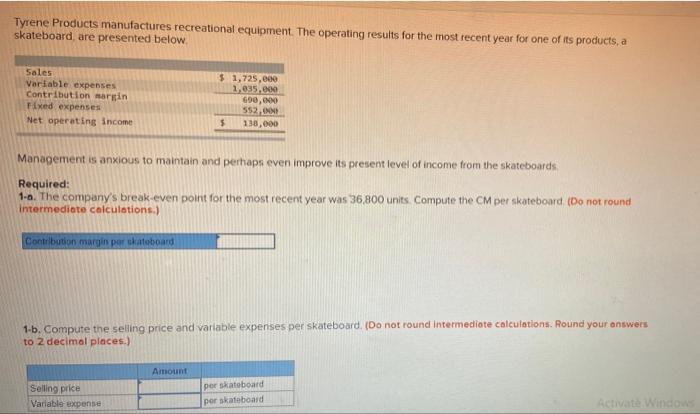

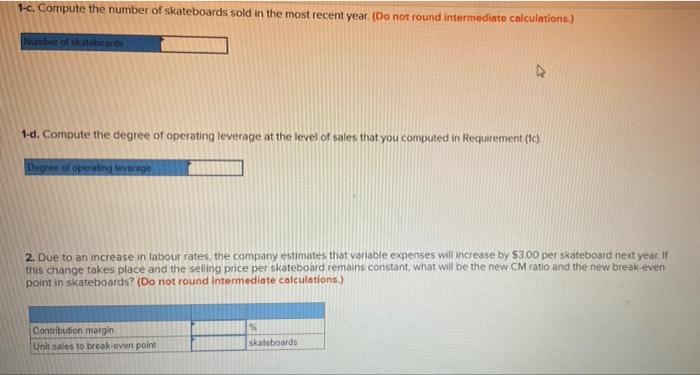

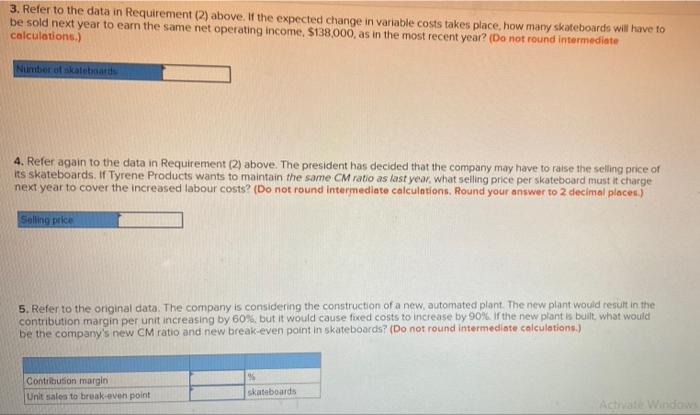

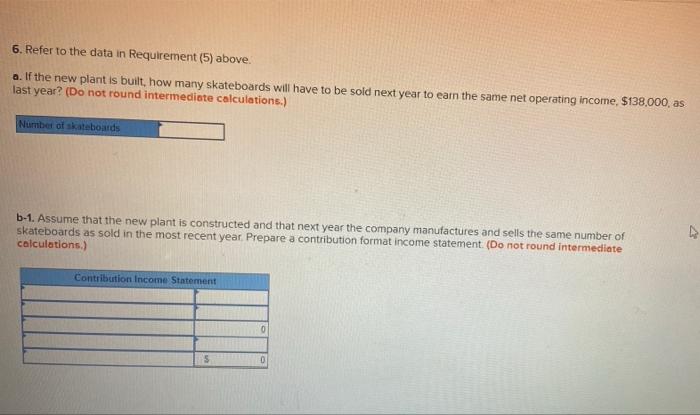

Tyrene Products manufactures recreational equipment. The operating results for the most recent year for one of its products, a skateboard, are presented below. Sales Variable expenses Contribution margin Fixed expenses Net operating income Contribution margin par skateboard Management is anxious to maintain and perhaps even improve its present level of income from the skateboards Required: 1-a. The company's break-even point for the most recent year was 36,800 units. Compute the CM per skateboard. (Do not round intermediate calculations.) $ 1,725,000 1,035,000 690,000 552,000 138,000 Selling price Variable expense $ 1-b. Compute the selling price and variable expenses per skateboard. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Amount per skateboard per skateboard Activate Windows 1-c. Compute the number of skateboards sold in the most recent year. (Do not round intermediate calculations.) Number of skateboards 1-d. Compute the degree of operating leverage at the level of sales that you computed in Requirement (1c). Degree of operating leverage 2. Due to an increase in labour rates, the company estimates that variable expenses will increase by $3.00 per skateboard next year. If this change takes place and the selling price per skateboard remains constant, what will be the new CM ratio and the new break-even point in skateboards? (Do not round intermediate calculations.) Contribution margin Unit sales to break-even point % skateboards 3. Refer to the data in Requirement (2) above. If the expected change in variable costs takes place, how many skateboards will have to be sold next year to earn the same net operating income, $138,000, as in the most recent year? (Do not round intermediate calculations.) Number of skateboards 4. Refer again to the data in Requirement (2) above. The president has decided that the company may have to raise the selling price of its skateboards. If Tyrene Products wants to maintain the same CM ratio as last year, what selling price per skateboard must it charge next year to cover the increased labour costs? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Selling price 5. Refer to the original data. The company is considering the construction of a new, automated plant. The new plant would result in the contribution margin per unit increasing by 60%, but it would cause fixed costs to increase by 90%. If the new plant is built, what would be the company's new CM ratio and new break-even point in skateboards? (Do not round intermediate calculations.) Contribution margin Unit sales to break-even point % skateboards Activate Windows 6. Refer to the data in Requirement (5) above. a. If the new plant is built, how many skateboards will have to be sold next year to earn the same net operating income, $138,000, as last year? (Do not round intermediate calculations.) Number of skateboards b-1. Assume that the new plant is constructed and that next year the company manufactures and sells the same number of skateboards as sold in the most recent year. Prepare a contribution format income statement. (Do not round intermediate calculations.) Contribution Income Statement S 0 0 4 b-2. Compute the degree of operating leverage. (Do not round intermediate calculations.) Degree of operating leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started