Answered step by step

Verified Expert Solution

Question

1 Approved Answer

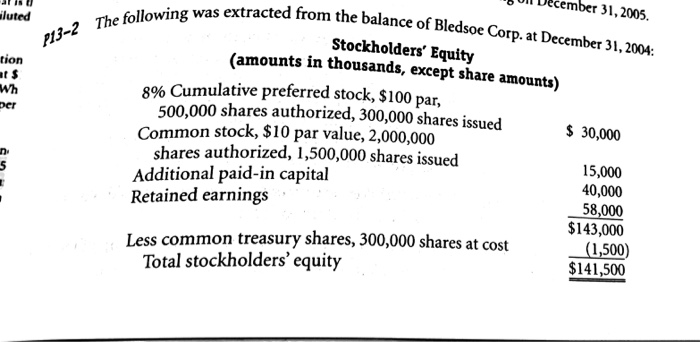

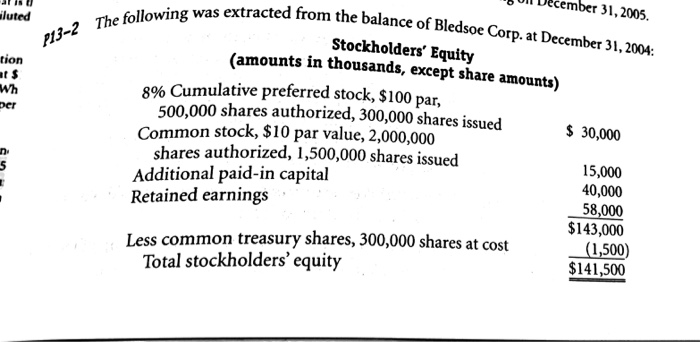

please solve this problem P13-2 The following was extracted from the balance of Bledsoe Corp. at December 31, 2004: iluted ber 31, 2005. Stockholders' Equity

please solve this problem

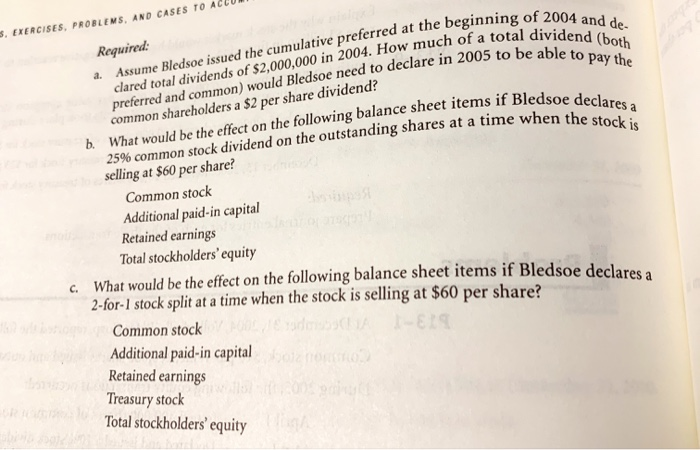

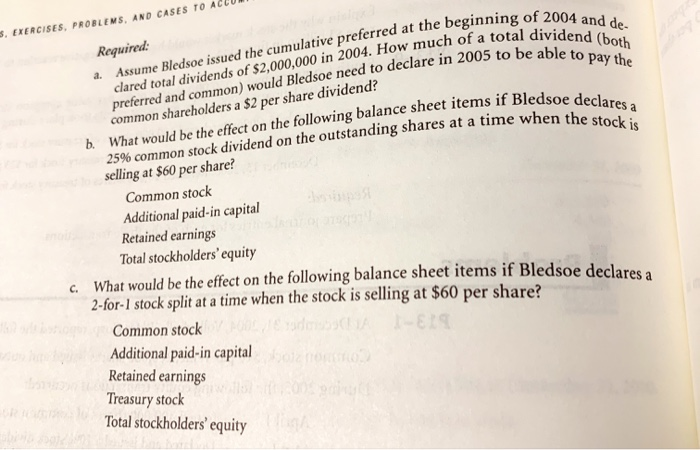

P13-2 The following was extracted from the balance of Bledsoe Corp. at December 31, 2004: iluted ber 31, 2005. Stockholders' Equity (amounts in thousands, except share amounts) tion at $ Wh per $ 30,000 ni 8% Cumulative preferred stock, $100 par, 500,000 shares authorized, 300,000 shares issued Common stock, $10 par value, 2,000,000 shares authorized, 1,500,000 shares issued Additional paid-in capital Retained earnings Less common treasury shares, 300,000 shares at cost Total stockholders' equity 15,000 40,000 58,000 $143,000 (1,500) $141,500 2. Assume Bledsoe issued the cumulative preferred at the beginning of 2004 and de preferred and common) would Bledsoe need to declare in 2005 to be able to pay the b. What would be the effect on the following balance sheet items if Bledsoe declares a 25% common stock dividend on the outstanding shares at a time when the stock is clared total dividends of $2,000,000 in 2004. How much of a total dividend (both S. EXERCISES, PROBLEMS, AND CASES TO Required: common shareholders a $2 per share dividend? selling at $60 per share? Common stock Additional paid-in capital Retained earnings Total stockholders'equity c. What would be the effect on the following balance sheet items if Bledsoe declares a 2-for-1 stock split at a time when the stock is selling at $60 per share? Common stock Additional paid-in capital of Retained earnings Treasury stock Total stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started