Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this problem urgently I will upvote thanks 1) SLE Ventures is making an $8M Series A investment in MemChu TechCo. The founders and

Please solve this problem urgently I will upvote thanks

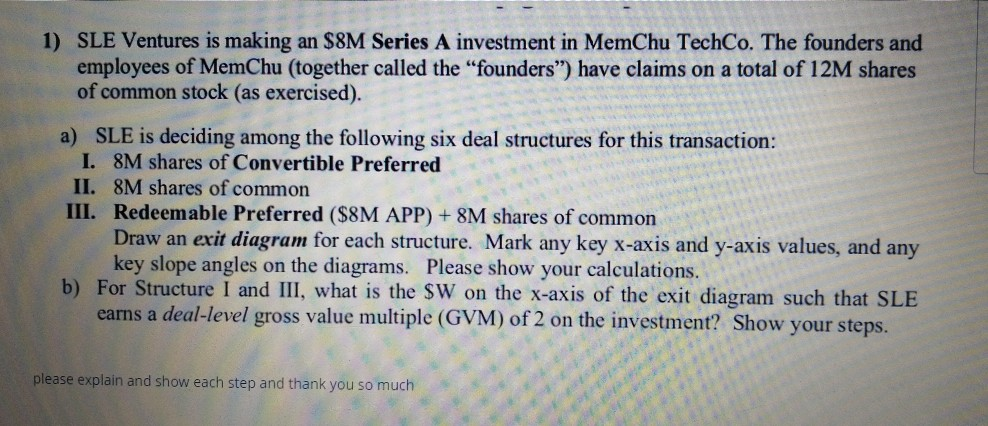

1) SLE Ventures is making an $8M Series A investment in MemChu TechCo. The founders and employees of MemChu (together called the "founders) have claims on a total of 12M shares of common stock (as exercised). a) SLE is deciding among the following six deal structures for this transaction: I. 8M shares of Convertible Preferred II. 8M shares of common III. Redeemable Preferred ($8M APP) + 8M shares of common Draw an exit diagram for each structure. Mark any key x-axis and y-axis values, and any key slope angles on the diagrams. Please show your calculations. b) For Structure I and III, what is the $W on the x-axis of the exit diagram such that SLE earns a deal-level gross value multiple (GVM) of 2 on the investment? Show your steps. please explain and show each step and thank you so much 1) SLE Ventures is making an $8M Series A investment in MemChu TechCo. The founders and employees of MemChu (together called the "founders) have claims on a total of 12M shares of common stock (as exercised). a) SLE is deciding among the following six deal structures for this transaction: I. 8M shares of Convertible Preferred II. 8M shares of common III. Redeemable Preferred ($8M APP) + 8M shares of common Draw an exit diagram for each structure. Mark any key x-axis and y-axis values, and any key slope angles on the diagrams. Please show your calculations. b) For Structure I and III, what is the $W on the x-axis of the exit diagram such that SLE earns a deal-level gross value multiple (GVM) of 2 on the investment? Show your steps. please explain and show each step and thank you so muchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started