Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this problem urgently I will upvote thanks Do default process D Question 1 1.5 pts If Brown Ltd uses the cost model to

Please solve this problem urgently I will upvote thanks

Do default process

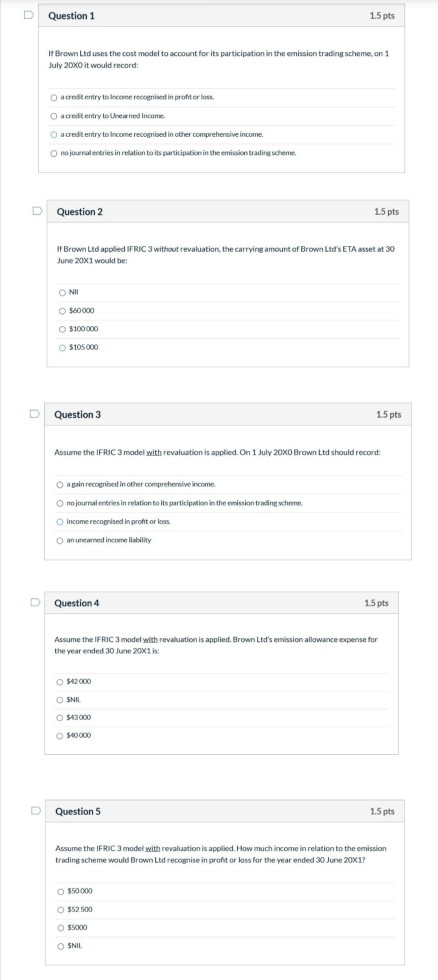

D Question 1 1.5 pts If Brown Ltd uses the cost model to account for its participation in the emission trading scheme, on 1 July 20X0 it would record: acreditentry to income recognised in profit or loss. O acreditentry to Unearned Income O acreditentry to Income recognised in other comprehensive income Ono journal entries in relation to its participation in the emission trading scheme Question 2 15 pts If Brown Ltd applied IFRIC 3 without revaluation, the carrying amount of Brown Ltd's ETA asset at 30 June 20x1 would be: NII O 0000 $100000 $105000 Question 3 15 pts Assume the IFRIC3 model with revaluation is applied. On 1 July 20X0 Brown Ltd should record: again recognised in other comprehensive income no journal entries in relation to its participation in the emission trading scheme Income recognised in proht or loss anunca ed income ability D Question 4 15 pts Assume the IFRIC3 model with revaluation is applied. Brown Ltd's emission allowance expense for the year ended 30 June 20X1 is: $12000 OSNIL $43000 500000 Question 5 1.5 pts Assume the IFRIC3 model with revaluation is applied. How much income in relation to the emission trading scheme would Brown Ltd recognise in profit or loss for the year ended 30 June 20x1? 550000 $52500 $5000 SNILStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started