Please solve this prompt. Thank you

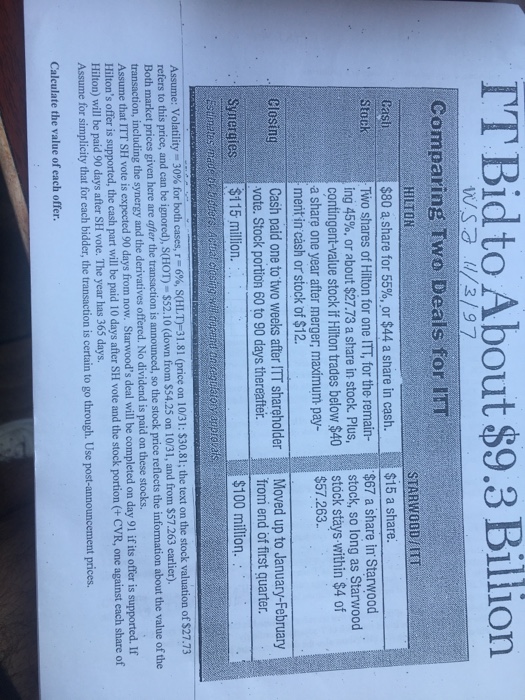

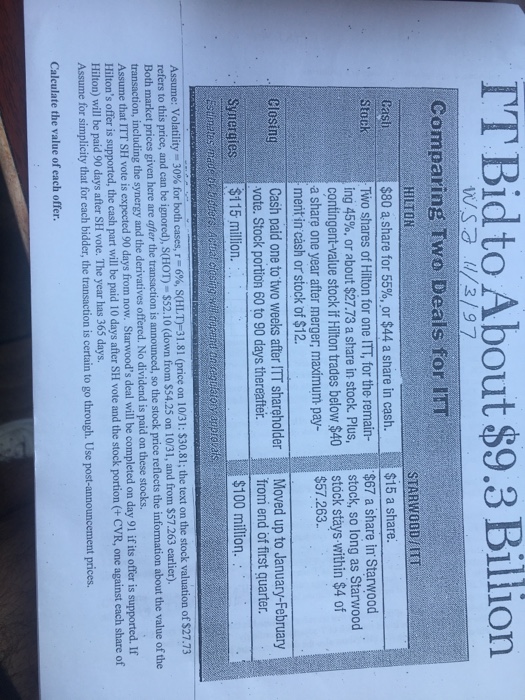

TT Bid to About $9.3 Billion 1 Comparing Two Deals for ITT HILTON Cash Stoc STARWOOD/ $15 a share. $80 a share for 55%, or $44 a share in cash. Two shares of Hilton for one IT, for the remairn-$67 a share in Starwood ing 45%, or about $27.73 a share in stock. Plus, stock, so long as Starwood contingent-value stock if Hilton trades below $40 stock stays within $4 of a share one year after merger; maximum- pay- mernt in cash or stock of $12 $57.263 Moved up to January-February from end of first quarter. $100 milion. Closing Cash paid one to two weeks after ITT shareholder vote. Stock portion 60 to 90 days thereafter. Synergies$115 million. Assume: Volatility-30% for both cases, r-6%, sall T-31.81 (price on i 0/31: $30.81 ; the text on the stock refers to this price, and can be ignored), S(HOT) $52.10 (down from $54.25 on 10/31, and from $57.263 Both market prices given here are afer the transaction is announced, so the stock price reflects the information about the value of the Assume tha TET SHT ote i expected 9o days from now. Starwoods deal will be completed on day 91 ifits offeris supported.Ir Hilton's offer is su Hilton) will be paid 90 days after SH vote. The year has 365 days. Assume for simplicity that for each bidder, the transaction is certain to go through. Use post-announcement prices. Calculate the value of each offer. each share of TT Bid to About $9.3 Billion 1 Comparing Two Deals for ITT HILTON Cash Stoc STARWOOD/ $15 a share. $80 a share for 55%, or $44 a share in cash. Two shares of Hilton for one IT, for the remairn-$67 a share in Starwood ing 45%, or about $27.73 a share in stock. Plus, stock, so long as Starwood contingent-value stock if Hilton trades below $40 stock stays within $4 of a share one year after merger; maximum- pay- mernt in cash or stock of $12 $57.263 Moved up to January-February from end of first quarter. $100 milion. Closing Cash paid one to two weeks after ITT shareholder vote. Stock portion 60 to 90 days thereafter. Synergies$115 million. Assume: Volatility-30% for both cases, r-6%, sall T-31.81 (price on i 0/31: $30.81 ; the text on the stock refers to this price, and can be ignored), S(HOT) $52.10 (down from $54.25 on 10/31, and from $57.263 Both market prices given here are afer the transaction is announced, so the stock price reflects the information about the value of the Assume tha TET SHT ote i expected 9o days from now. Starwoods deal will be completed on day 91 ifits offeris supported.Ir Hilton's offer is su Hilton) will be paid 90 days after SH vote. The year has 365 days. Assume for simplicity that for each bidder, the transaction is certain to go through. Use post-announcement prices. Calculate the value of each offer. each share of

Please solve this prompt. Thank you

Please solve this prompt. Thank you