Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this question 16. Company A acquires 80% of outstanding shares of Company B. On 1/1/2016, parent Company sold to subsidiary company machines at

please solve this question

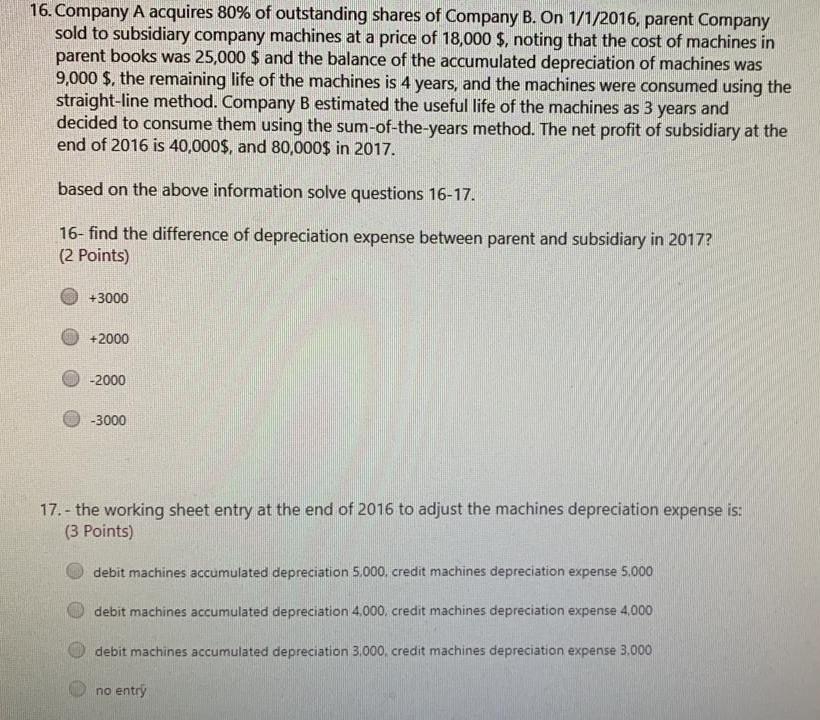

16. Company A acquires 80% of outstanding shares of Company B. On 1/1/2016, parent Company sold to subsidiary company machines at a price of 18,000 $, noting that the cost of machines in parent books was 25,000 $ and the balance of the accumulated depreciation of machines was 9,000 $, the remaining life of the machines is 4 years, and the machines were consumed using the straight-line method. Company B estimated the useful life of the machines as 3 years and decided to consume them using the sum-of-the-years method. The net profit of subsidiary at the end of 2016 is 40,000$, and 80,000$ in 2017. based on the above information solve questions 16-17. 16- find the difference of depreciation expense between parent and subsidiary in 2017? (2 points) +3000 +2000 -2000 -3000 17.- the working sheet entry at the end of 2016 to adjust the machines depreciation expense is: (3 Points) debit machines accumulated depreciation 5,000. credit machines depreciation expense 5.000 debit machines accumulated depreciation 4.000 credit machines depreciation expense 4,000 debit machines accumulated depreciation 3.000, credit machines depreciation expense 3.000 no entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started