Answered step by step

Verified Expert Solution

Question

1 Approved Answer

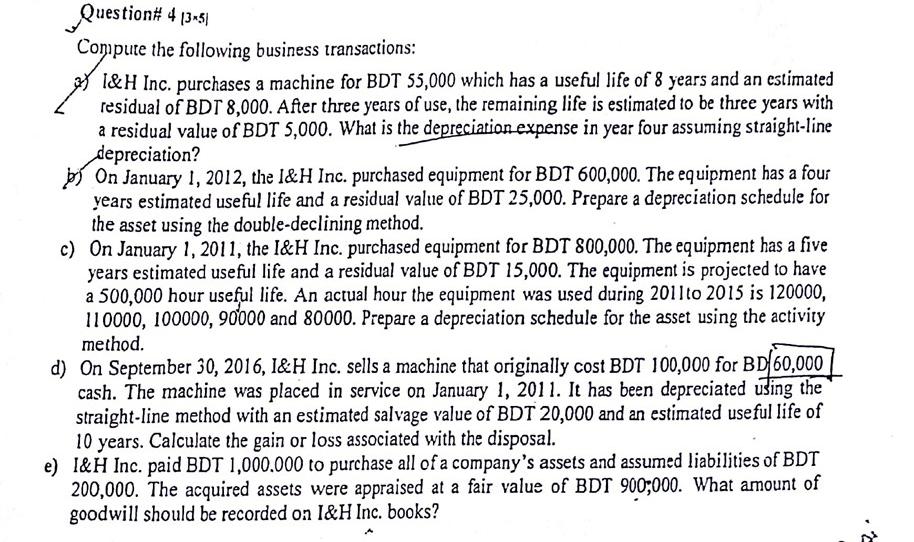

Please Solve this!! Question# 4 13-51 Compute the following business transactions: By I&H Inc. purchases a machine for BDT 55,000 which has a useful life

Please Solve this!!

Question# 4 13-51 Compute the following business transactions: By I&H Inc. purchases a machine for BDT 55,000 which has a useful life of 8 years and an estimated residual of BDT 8,000. After three years of use, the remaining life is estimated 10 be three years with a residual value of BDT 5,000. What is the depreciation expense in year four assuming straight-line depreciation? by On January 1, 2012, the l&H Inc. purchased equipment for BDT 600,000. The equipment has a four years estimated useful life and a residual value of BDT 25,000. Prepare a depreciation schedule for the asset using the double-declining method. c) On January 1, 2011, the I&H Inc. purchased equipment for BDT 800,000. The equipment has a five years estimated useful life and a residual value of BDT 15,000. The equipment is projected to have a 500,000 hour useful life. An actual hour the equipment was used during 2011to 2015 is 120000, 110000, 100000, 90000 and 80000. Prepare a depreciation schedule for the asset using the activity method. d) On September 30, 2016, 1&H Inc. sells a machine that originally cost BDT 100,000 for BD 60,000 cash. The machine was placed in service on January 1, 2011. It has been depreciated using the straight-line method with an estimated salvage value of BDT 20,000 and an estimated useful life of 10 years. Calculate the gain or loss associated with the disposal. e) I&H Inc. paid BDT 1,000,000 to purchase all of a company's assets and assumed liabilities of BDT 200,000. The acquired assets were appraised at a fair value of BDT 900,000. What amount of goodwill should be recorded on 1&H Inc. booksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started