Answered step by step

Verified Expert Solution

Question

1 Approved Answer

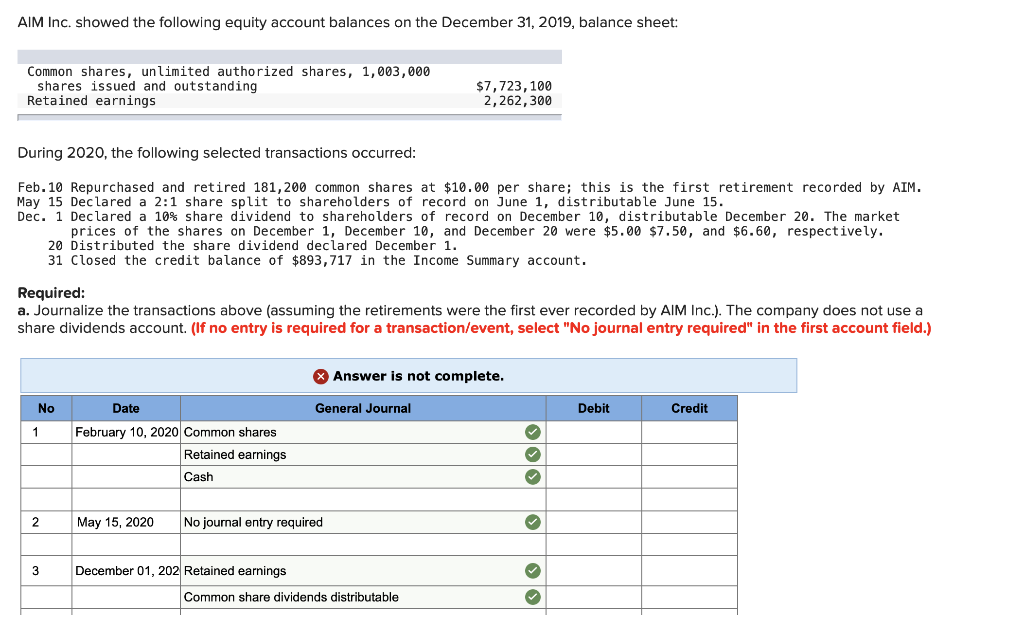

Please solve this question. AIM Inc. showed the following equity account balances on the December 31,2019 , balance sheet: During 2020, the following selected transactions

Please solve this question.

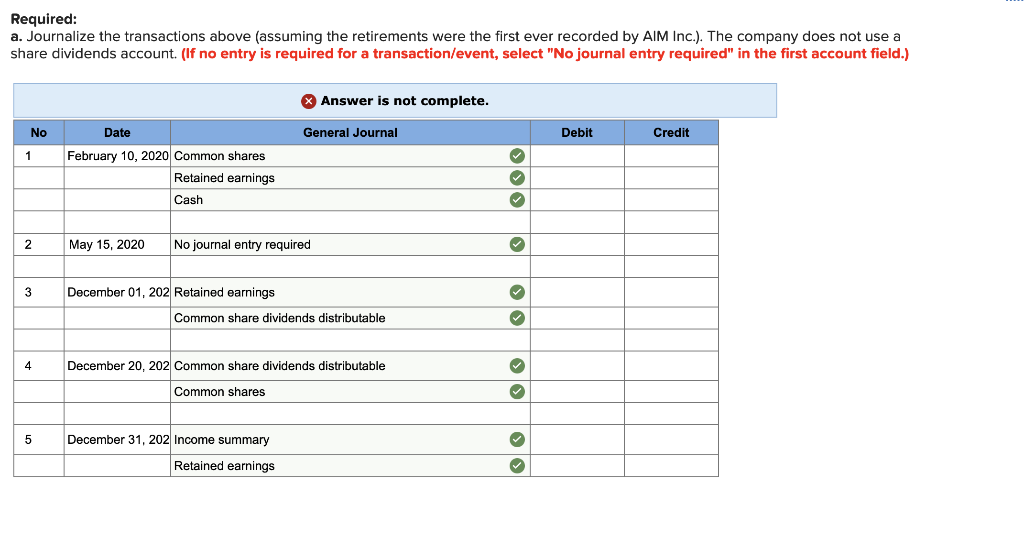

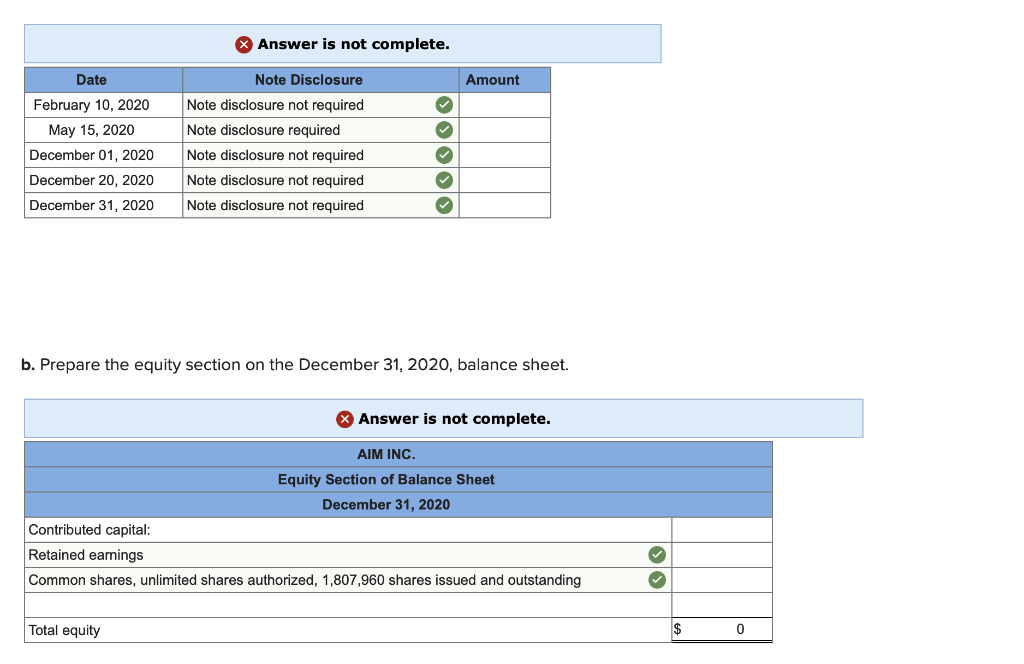

AIM Inc. showed the following equity account balances on the December 31,2019 , balance sheet: During 2020, the following selected transactions occurred: Feb.10 Repurchased and retired 181,200 common shares at $10.00 per share; this is the first retirement recorded by AIM. May 15 Declared a 2:1 share split to shareholders of record on June 1 , distributable June 15 . Dec. 1 Declared a 10% share dividend to shareholders of record on December 10, distributable December 20. The market prices of the shares on December 1 , December 10 , and December 20 were $5.00$7.50, and $6.60, respectively. 20 Distributed the share dividend declared December 1. 31 closed the credit balance of $893,717 in the Income Summary account. Required: a. Journalize the transactions above (assuming the retirements were the first ever recorded by AIM Inc.). The company does not use a share dividends account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required: a. Journalize the transactions above (assuming the retirements were the first ever recorded by AIM Inc.). The company does not use a share dividends account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. b. Prepare the equity section on the December 31,2020 , balance sheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started