please solve this question as early as possible

Assume that after completion of your MBA you have started working as a financial planner at JS Capital Limited. In a second week of Job you have got assignment to invest Rupees 100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Moreover, your manager has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data; you will fill in the blanks later.)

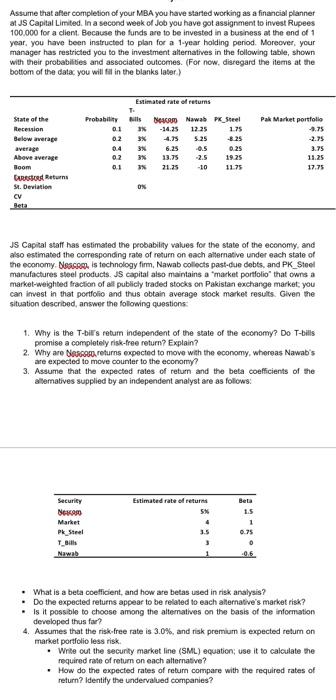

Estimated rate of returns

State of the Probability T-Bills Nescom Nawab PK_Steel Pak Market portfolio

Recession 0.1 3% -14.25 12.25 1.75 -9.75

Below average 0.2 3% -4.75 5.25 -8.25 -2.75

average 0.4 3% 6.25 -0.5 0.25 3.75

Above average 0.2 3% 13.75 -2.5 19.25 11.25

Boom 0.1 3% 21.25 -10 11.75 17.75

Expectred Returns

St. Deviation 0%

CV

Beta

JS Capital staff has estimated the probability values for the state of the economy, and also estimated the corresponding rate of return on each alternative under each state of the economy. Nescom. is technology firm, Nawab collects past-due debts, and PK_Steel manufactures steel products. JS capital also maintains a market portfolio that owns a market-weighted fraction of all publicly traded stocks on Pakistan exchange market; you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions:

1. Why is the T-bills return independent of the state of the economy? Do T-bills promise a completely risk-free return? Explain?

2. Why are Nescom returns expected to move with the economy, whereas Nawabs are expected to move counter to the economy?

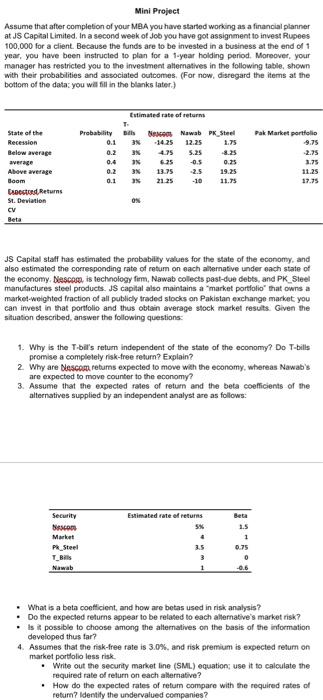

3. Assume that the expected rates of return and the beta coefficients of the alternatives supplied by an independent analyst are as follows:

Security Estimated rate of return Beta

Nescom 5% 1.5

Market 4 1

Pk_Steel 3.5 0.75

T_Bills 3 0

Nawab 1 -0.6

What is a beta coefficient, and how are betas used in risk analysis?

Do the expected returns appear to be related to each alternatives market risk?

Is it possible to choose among the alternatives on the basis of the information developed thus far?

4. Assumes that the risk-free rate is 3.0%, and risk premium is expected return on market portfolio less risk.

Write out the security market line (SML) equation; use it to calculate the required rate of return on each alternative?

How do the expected rates of return compare with the required rates of return? Identify the undervalued companies?

Assume that after completion of your MBA you have started working as a financial planner at JS Capital Limited. In a second week of Job you have got assignment to invest Rupees 100.000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Moreover, your manager has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data you will fill in the blanks later) State of the Recension Below wverage average Above average Boom CARS Returns St. Deviation Peta Estimated rate of returns Probability is DACA Nawab Pl_Steel 0.1 -34.25 1225 1.75 0.23% -4.75 5.25 -8.25 0.43 6.25 -0.5 0.25 0.2 13.75 19.25 0.13 21.25 -10 1175 Pak Market portfolio -1.75 -2.75 3.75 11.25 17.75 ON JS Capital staff has estimated the probability values for the state of the economy, and also estimated the corresponding rate of return on each alternative under each state of the economy Nesc, is technology fim, Nawab collects past-due debts, and PK_Steel manufactures steel products. JS capital also maintains a market portfolio that owns a market-weighted fraction of all publicly traded stocks on Pakistan exchange market, you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: 1. Why is the T-bill's return independent of the state of the economy? Do T-bills promise a completely risk-free return? Explain? 2. Why are Narrer returns expected to move with the economy, whereas Nawab's are expected to move counter to the economy 3. Assume that the expected rates of return and the beta coefficients of the alternatives supplied by an independent analyst are as follows: Estimated rate of return SN Security BAO Market Pk Steel Title Nawab 4 3.5 3 1.5 1 0.75 0 06 What is a beta coefficient, and how are betas used in risk analysis? . Do the expected returns appear to be related to each alternative's market risk? Is it possible to choose among the alternatives on the basis of the information developed thus far? 4. Assumes that the risk-free rate is 3.0%, and risk premium is expected return on market portfolio less risk Write out the security market line (SML) equation; use it to calculate the required rate of return on each alternative? How do the expected rates of return compare with the required rates of return? Identify the undervalued companies? Mini Project Assume that after completion of your MBA you have started working as a financial planner at JS Capital Limited. In a second week of Job you have got assignment to invest Rupees 100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Moreover, your manager has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data you will fill in the blanks later) Pak Market portfolio -9.75 State of the Recension Below average average Above average Boom pested Returns St. Deviation CV Beta Estimated rate of returns Probability Bits Bescom Nawab PK_Steel 0.1 -1425 12.25 0.2 3 4.75 0.4 5 -0.5 0.25 0.23% 13.75 2.5 19.25 -10 11. $25 1.75 11.25 17.75 ON JS Capital staff has estimated the probability values for the state of the economy, and also estimated the corresponding rate of return on each alternative under each state of the economy. Descose, is technology form, Nawab collects past-due debts, and PK_Steel manufactures steel products. JS capital also maintains a market portfolio that owns a market-weighted fraction of all publicly traded stocks on Pakistan exchange market you can invest in that portfolio and thus obtain average stock market results. Given the situation described answer the following questions: 1. Why is the T-bil's return independent of the state of the economy? Do T-bills promise a completely risk-free return? Explain? 2 Why are Descomretums expected to move with the economy, whereas Nawab's are expected to move counter to the economy? 3. Assume that the expected rates of return and the beta coefficients of the alternatives supplied by an independent analyst are as follows: Beta Security Descope Market PR Steel T_Bils Nawab Estimated rate of returns 5% 4 3.5 3 1.5 1 0.75 0 -0.6 What is a beta coefficient, and how are botas used in risk analysis? Do the expected returns appear to be related to each alternative's market risk? . Is it possible to choose among the alternatives on the basis of the information developed thus far? 4. Assumes that the risk-free rate is 3.0% and risk premium is expected return on market portfolio less risk. . Write out the security market line (SML) equation use it to calculate the required rate of return on each alternative? How do the expected rates of retum compare with the required rates of return? Identify the undervalued companies? Assume that after completion of your MBA you have started working as a financial planner at JS Capital Limited. In a second week of Job you have got assignment to invest Rupees 100.000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Moreover, your manager has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data you will fill in the blanks later) State of the Recension Below wverage average Above average Boom CARS Returns St. Deviation Peta Estimated rate of returns Probability is DACA Nawab Pl_Steel 0.1 -34.25 1225 1.75 0.23% -4.75 5.25 -8.25 0.43 6.25 -0.5 0.25 0.2 13.75 19.25 0.13 21.25 -10 1175 Pak Market portfolio -1.75 -2.75 3.75 11.25 17.75 ON JS Capital staff has estimated the probability values for the state of the economy, and also estimated the corresponding rate of return on each alternative under each state of the economy Nesc, is technology fim, Nawab collects past-due debts, and PK_Steel manufactures steel products. JS capital also maintains a market portfolio that owns a market-weighted fraction of all publicly traded stocks on Pakistan exchange market, you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: 1. Why is the T-bill's return independent of the state of the economy? Do T-bills promise a completely risk-free return? Explain? 2. Why are Narrer returns expected to move with the economy, whereas Nawab's are expected to move counter to the economy 3. Assume that the expected rates of return and the beta coefficients of the alternatives supplied by an independent analyst are as follows: Estimated rate of return SN Security BAO Market Pk Steel Title Nawab 4 3.5 3 1.5 1 0.75 0 06 What is a beta coefficient, and how are betas used in risk analysis? . Do the expected returns appear to be related to each alternative's market risk? Is it possible to choose among the alternatives on the basis of the information developed thus far? 4. Assumes that the risk-free rate is 3.0%, and risk premium is expected return on market portfolio less risk Write out the security market line (SML) equation; use it to calculate the required rate of return on each alternative? How do the expected rates of return compare with the required rates of return? Identify the undervalued companies? Mini Project Assume that after completion of your MBA you have started working as a financial planner at JS Capital Limited. In a second week of Job you have got assignment to invest Rupees 100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Moreover, your manager has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data you will fill in the blanks later) Pak Market portfolio -9.75 State of the Recension Below average average Above average Boom pested Returns St. Deviation CV Beta Estimated rate of returns Probability Bits Bescom Nawab PK_Steel 0.1 -1425 12.25 0.2 3 4.75 0.4 5 -0.5 0.25 0.23% 13.75 2.5 19.25 -10 11. $25 1.75 11.25 17.75 ON JS Capital staff has estimated the probability values for the state of the economy, and also estimated the corresponding rate of return on each alternative under each state of the economy. Descose, is technology form, Nawab collects past-due debts, and PK_Steel manufactures steel products. JS capital also maintains a market portfolio that owns a market-weighted fraction of all publicly traded stocks on Pakistan exchange market you can invest in that portfolio and thus obtain average stock market results. Given the situation described answer the following questions: 1. Why is the T-bil's return independent of the state of the economy? Do T-bills promise a completely risk-free return? Explain? 2 Why are Descomretums expected to move with the economy, whereas Nawab's are expected to move counter to the economy? 3. Assume that the expected rates of return and the beta coefficients of the alternatives supplied by an independent analyst are as follows: Beta Security Descope Market PR Steel T_Bils Nawab Estimated rate of returns 5% 4 3.5 3 1.5 1 0.75 0 -0.6 What is a beta coefficient, and how are botas used in risk analysis? Do the expected returns appear to be related to each alternative's market risk? . Is it possible to choose among the alternatives on the basis of the information developed thus far? 4. Assumes that the risk-free rate is 3.0% and risk premium is expected return on market portfolio less risk. . Write out the security market line (SML) equation use it to calculate the required rate of return on each alternative? How do the expected rates of retum compare with the required rates of return? Identify the undervalued companies