Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this question :) Case Study Pequirerment equivalent to 06% what they are currester erperiencing - These calculations wif be umbertaken en an CXCCL

please solve this question :)

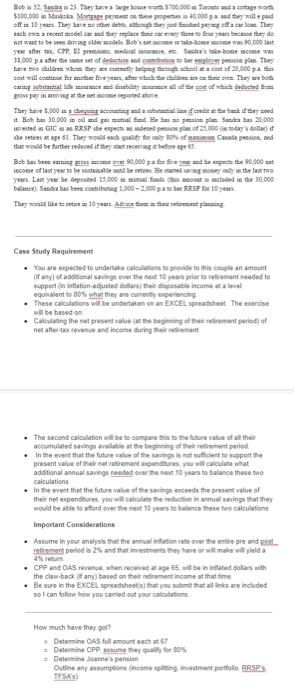

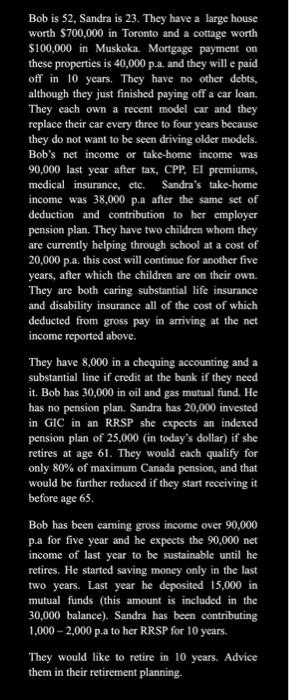

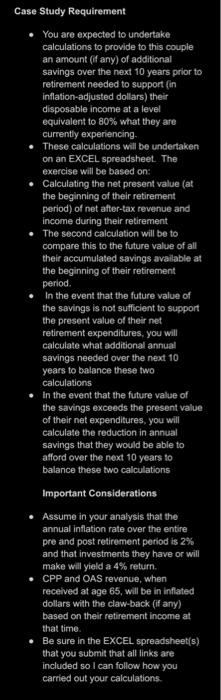

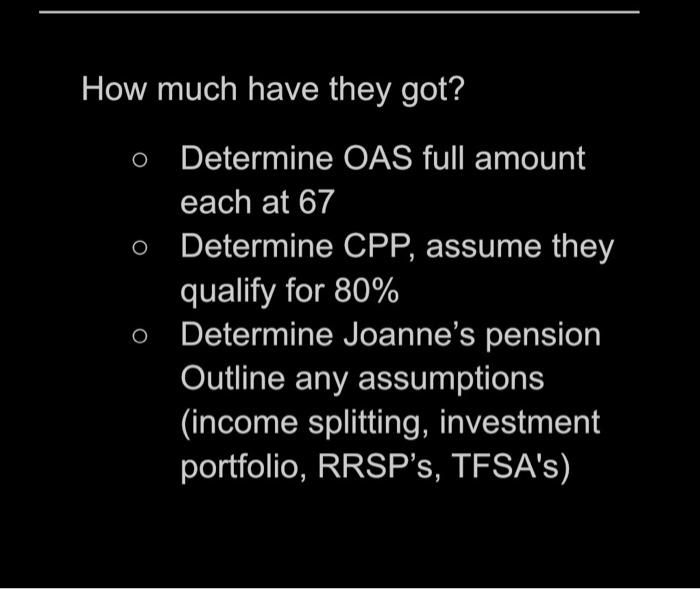

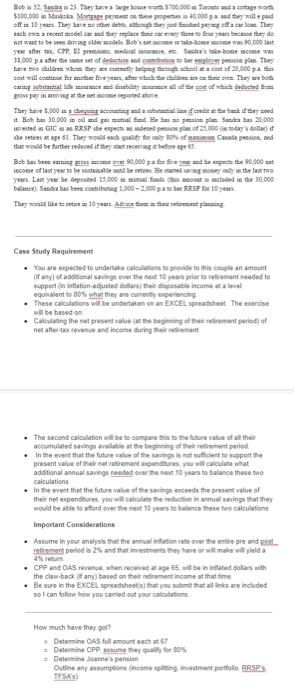

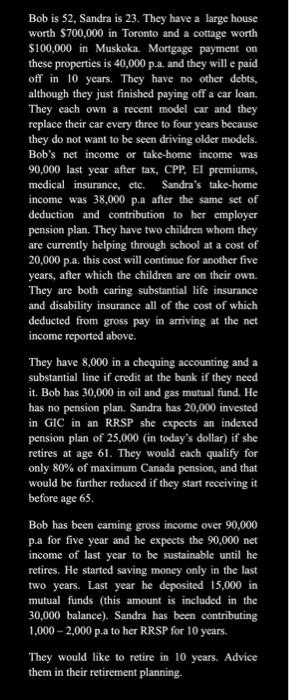

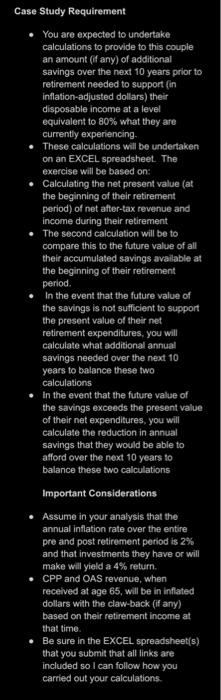

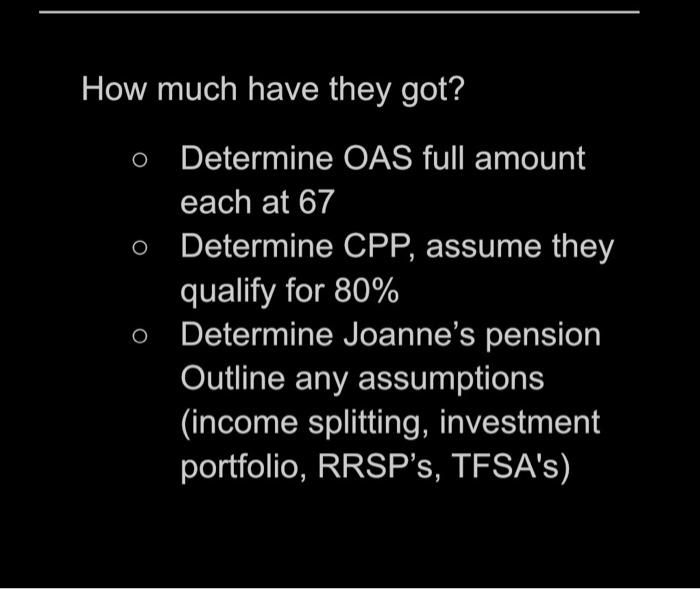

Case Study Pequirerment equivalent to 06\% what they are currester erperiencing - These calculations wif be umbertaken en an CXCCL spreaditeet. The exercise will be based on - The second calculation well be to compons this na the firture vake of all their - In the event thue the futare valse of the serings in act suffoient to suspert the present value of seir mat retrement expendines, you will culculane what additional annual savingen needed ever the ment it yoars to balance these too celculatisns - In the tevent that the futare vaiue ef the saings exiseds the prasent value of would be able to attord ever the hext 15 ywars to balance these heo calculatons important Consideratiens - Anseame in your annhysis that the ancuatinfukson ratir veer the sntire pre and posa. 4. iefurn the clae-back (id any) bosed an their netireventincome at that time. so 1 can folow how you caried out your caicalietsona How much have they got? - Detemine OMS tull amount each at th? - Deteration CPP asturn they quath far best - Belermine Jaarne is jtheish frisaid) Bob is 52 , Sandra is 23. They have a large house worth $700,000 in Toronto and a cottage worth $100,000 in Muskoka. Mortgage payment on these properties is 40,000 p.a. and they will e paid off in 10 years. They have no other debts, although they just finished paying off a car loan. They each own a recent model car and they replace their car every three to four years because they do not want to be seen driving older models. Bob's net income or take-home income was 90,000 last year after tax, CPP. El premiums, medical insurance, etc. Sandra's take-home income was 38,000 p.a after the same set of deduction and contribution to her employer pension plan. They have two children whom they are currently helping through school at a cost of 20,000 p.a. this cost will continue for another five years, after which the children are on their own. They are both caring substantial life insurance and disability insurance all of the cost of which deducted from gross pay in arriving at the net income reported above. They have 8,000 in a chequing accounting and a substantial line if credit at the bank if they need it. Bob has 30,000 in oil and gas mutual fund. He has no pension plan. Sandra has 20,000 invested in GIC in an RRSP she expects an indexed pension plan of 25,000 (in today's dollar) if she retires at age 61 . They would each qualify for only 80% of maximum Canada pension, and that would be further reduced if they start receiving it before age 65. Bob has been eaming gross income over 90,000 p.a for five year and he expects the 90,000 net income of last year to be sustainable until he retires. He started saving money only in the last two years. Last year he deposited 15,000 in mutual funds (this amount is included in the 30,000 balance). Sandra has been contributing 1,0002,000 p.a to her RRSP for 10 years. They would like to retire in 10 years. Advice them in their retirement planning. How much have they got? - Determine OAS full amount each at 67 - Determine CPP, assume they qualify for 80% - Determine Joanne's pension Outline any assumptions (income splitting, investment portfolio, RRSP's, TFSA's) Case Study Pequirerment equivalent to 06\% what they are currester erperiencing - These calculations wif be umbertaken en an CXCCL spreaditeet. The exercise will be based on - The second calculation well be to compons this na the firture vake of all their - In the event thue the futare valse of the serings in act suffoient to suspert the present value of seir mat retrement expendines, you will culculane what additional annual savingen needed ever the ment it yoars to balance these too celculatisns - In the tevent that the futare vaiue ef the saings exiseds the prasent value of would be able to attord ever the hext 15 ywars to balance these heo calculatons important Consideratiens - Anseame in your annhysis that the ancuatinfukson ratir veer the sntire pre and posa. 4. iefurn the clae-back (id any) bosed an their netireventincome at that time. so 1 can folow how you caried out your caicalietsona How much have they got? - Detemine OMS tull amount each at th? - Deteration CPP asturn they quath far best - Belermine Jaarne is jtheish frisaid) Bob is 52 , Sandra is 23. They have a large house worth $700,000 in Toronto and a cottage worth $100,000 in Muskoka. Mortgage payment on these properties is 40,000 p.a. and they will e paid off in 10 years. They have no other debts, although they just finished paying off a car loan. They each own a recent model car and they replace their car every three to four years because they do not want to be seen driving older models. Bob's net income or take-home income was 90,000 last year after tax, CPP. El premiums, medical insurance, etc. Sandra's take-home income was 38,000 p.a after the same set of deduction and contribution to her employer pension plan. They have two children whom they are currently helping through school at a cost of 20,000 p.a. this cost will continue for another five years, after which the children are on their own. They are both caring substantial life insurance and disability insurance all of the cost of which deducted from gross pay in arriving at the net income reported above. They have 8,000 in a chequing accounting and a substantial line if credit at the bank if they need it. Bob has 30,000 in oil and gas mutual fund. He has no pension plan. Sandra has 20,000 invested in GIC in an RRSP she expects an indexed pension plan of 25,000 (in today's dollar) if she retires at age 61 . They would each qualify for only 80% of maximum Canada pension, and that would be further reduced if they start receiving it before age 65. Bob has been eaming gross income over 90,000 p.a for five year and he expects the 90,000 net income of last year to be sustainable until he retires. He started saving money only in the last two years. Last year he deposited 15,000 in mutual funds (this amount is included in the 30,000 balance). Sandra has been contributing 1,0002,000 p.a to her RRSP for 10 years. They would like to retire in 10 years. Advice them in their retirement planning. How much have they got? - Determine OAS full amount each at 67 - Determine CPP, assume they qualify for 80% - Determine Joanne's pension Outline any assumptions (income splitting, investment portfolio, RRSP's, TFSA's)

Case Study Pequirerment equivalent to 06\% what they are currester erperiencing - These calculations wif be umbertaken en an CXCCL spreaditeet. The exercise will be based on - The second calculation well be to compons this na the firture vake of all their - In the event thue the futare valse of the serings in act suffoient to suspert the present value of seir mat retrement expendines, you will culculane what additional annual savingen needed ever the ment it yoars to balance these too celculatisns - In the tevent that the futare vaiue ef the saings exiseds the prasent value of would be able to attord ever the hext 15 ywars to balance these heo calculatons important Consideratiens - Anseame in your annhysis that the ancuatinfukson ratir veer the sntire pre and posa. 4. iefurn the clae-back (id any) bosed an their netireventincome at that time. so 1 can folow how you caried out your caicalietsona How much have they got? - Detemine OMS tull amount each at th? - Deteration CPP asturn they quath far best - Belermine Jaarne is jtheish frisaid) Bob is 52 , Sandra is 23. They have a large house worth $700,000 in Toronto and a cottage worth $100,000 in Muskoka. Mortgage payment on these properties is 40,000 p.a. and they will e paid off in 10 years. They have no other debts, although they just finished paying off a car loan. They each own a recent model car and they replace their car every three to four years because they do not want to be seen driving older models. Bob's net income or take-home income was 90,000 last year after tax, CPP. El premiums, medical insurance, etc. Sandra's take-home income was 38,000 p.a after the same set of deduction and contribution to her employer pension plan. They have two children whom they are currently helping through school at a cost of 20,000 p.a. this cost will continue for another five years, after which the children are on their own. They are both caring substantial life insurance and disability insurance all of the cost of which deducted from gross pay in arriving at the net income reported above. They have 8,000 in a chequing accounting and a substantial line if credit at the bank if they need it. Bob has 30,000 in oil and gas mutual fund. He has no pension plan. Sandra has 20,000 invested in GIC in an RRSP she expects an indexed pension plan of 25,000 (in today's dollar) if she retires at age 61 . They would each qualify for only 80% of maximum Canada pension, and that would be further reduced if they start receiving it before age 65. Bob has been eaming gross income over 90,000 p.a for five year and he expects the 90,000 net income of last year to be sustainable until he retires. He started saving money only in the last two years. Last year he deposited 15,000 in mutual funds (this amount is included in the 30,000 balance). Sandra has been contributing 1,0002,000 p.a to her RRSP for 10 years. They would like to retire in 10 years. Advice them in their retirement planning. How much have they got? - Determine OAS full amount each at 67 - Determine CPP, assume they qualify for 80% - Determine Joanne's pension Outline any assumptions (income splitting, investment portfolio, RRSP's, TFSA's) Case Study Pequirerment equivalent to 06\% what they are currester erperiencing - These calculations wif be umbertaken en an CXCCL spreaditeet. The exercise will be based on - The second calculation well be to compons this na the firture vake of all their - In the event thue the futare valse of the serings in act suffoient to suspert the present value of seir mat retrement expendines, you will culculane what additional annual savingen needed ever the ment it yoars to balance these too celculatisns - In the tevent that the futare vaiue ef the saings exiseds the prasent value of would be able to attord ever the hext 15 ywars to balance these heo calculatons important Consideratiens - Anseame in your annhysis that the ancuatinfukson ratir veer the sntire pre and posa. 4. iefurn the clae-back (id any) bosed an their netireventincome at that time. so 1 can folow how you caried out your caicalietsona How much have they got? - Detemine OMS tull amount each at th? - Deteration CPP asturn they quath far best - Belermine Jaarne is jtheish frisaid) Bob is 52 , Sandra is 23. They have a large house worth $700,000 in Toronto and a cottage worth $100,000 in Muskoka. Mortgage payment on these properties is 40,000 p.a. and they will e paid off in 10 years. They have no other debts, although they just finished paying off a car loan. They each own a recent model car and they replace their car every three to four years because they do not want to be seen driving older models. Bob's net income or take-home income was 90,000 last year after tax, CPP. El premiums, medical insurance, etc. Sandra's take-home income was 38,000 p.a after the same set of deduction and contribution to her employer pension plan. They have two children whom they are currently helping through school at a cost of 20,000 p.a. this cost will continue for another five years, after which the children are on their own. They are both caring substantial life insurance and disability insurance all of the cost of which deducted from gross pay in arriving at the net income reported above. They have 8,000 in a chequing accounting and a substantial line if credit at the bank if they need it. Bob has 30,000 in oil and gas mutual fund. He has no pension plan. Sandra has 20,000 invested in GIC in an RRSP she expects an indexed pension plan of 25,000 (in today's dollar) if she retires at age 61 . They would each qualify for only 80% of maximum Canada pension, and that would be further reduced if they start receiving it before age 65. Bob has been eaming gross income over 90,000 p.a for five year and he expects the 90,000 net income of last year to be sustainable until he retires. He started saving money only in the last two years. Last year he deposited 15,000 in mutual funds (this amount is included in the 30,000 balance). Sandra has been contributing 1,0002,000 p.a to her RRSP for 10 years. They would like to retire in 10 years. Advice them in their retirement planning. How much have they got? - Determine OAS full amount each at 67 - Determine CPP, assume they qualify for 80% - Determine Joanne's pension Outline any assumptions (income splitting, investment portfolio, RRSP's, TFSA's)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started