Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this question Q1) Beximco Pharmaceuticals is evaluating a four-year project in Wakanda, where the discount rate estimated to be 13%. The project will

please solve this question

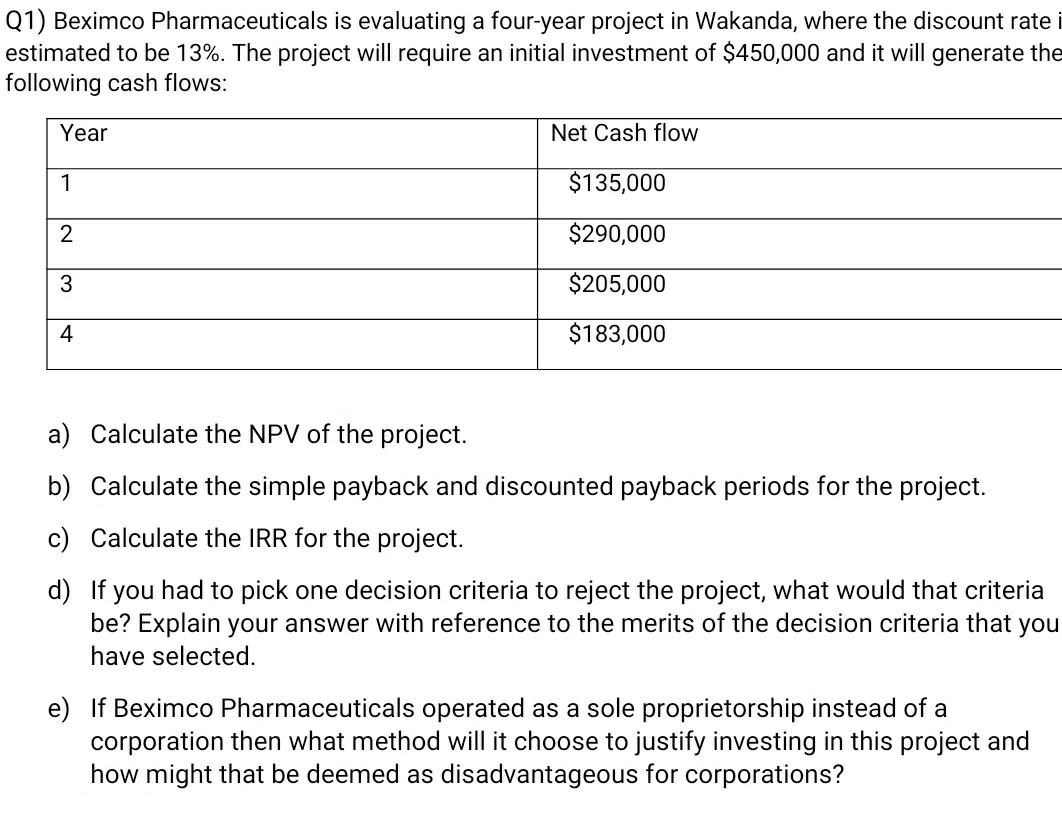

Q1) Beximco Pharmaceuticals is evaluating a four-year project in Wakanda, where the discount rate estimated to be 13%. The project will require an initial investment of $450,000 and it will generate the following cash flows: Year Net Cash flow 1 $135,000 NI $290,000 $205,000 4 $183,000 a) Calculate the NPV of the project. b) Calculate the simple payback and discounted payback periods for the project. c) Calculate the IRR for the project. d) If you had to pick one decision criteria to reject the project, what would that criteria be? Explain your answer with reference to the merits of the decision criteria that you have selected. e) If Beximco Pharmaceuticals operated as a sole proprietorship instead of a corporation then what method will it choose to justify investing in this project and how might that be deemed as disadvantageous for corporationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started