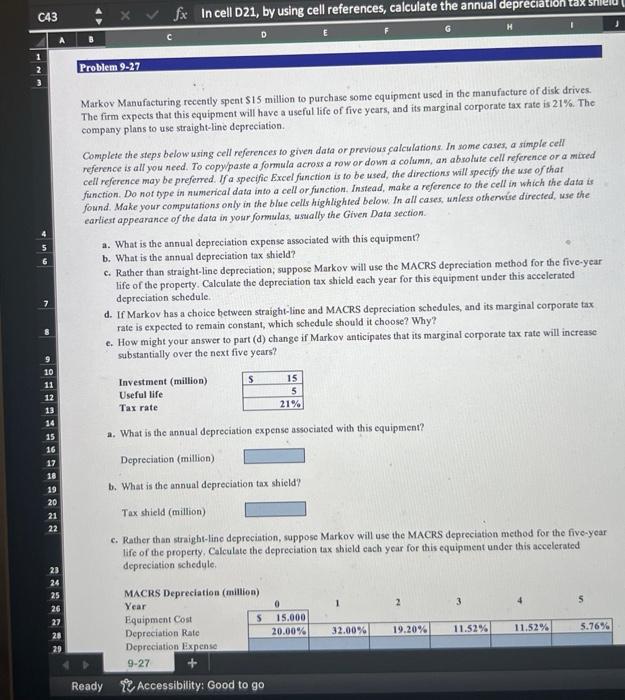

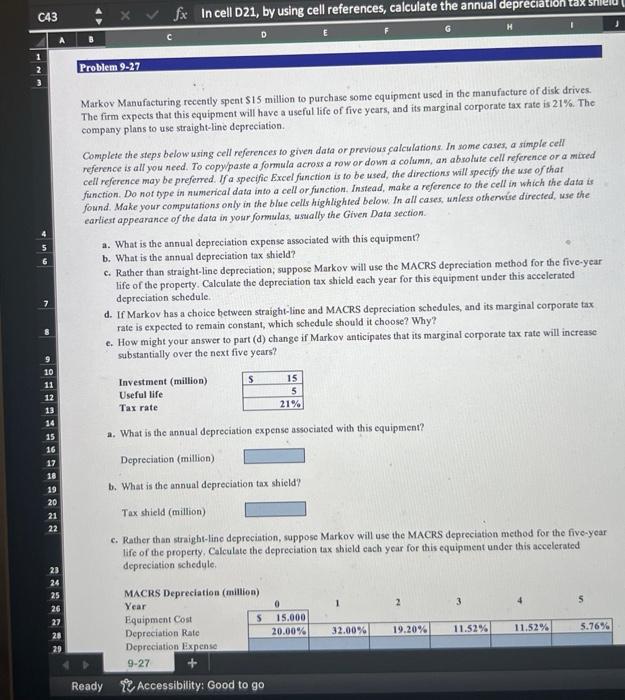

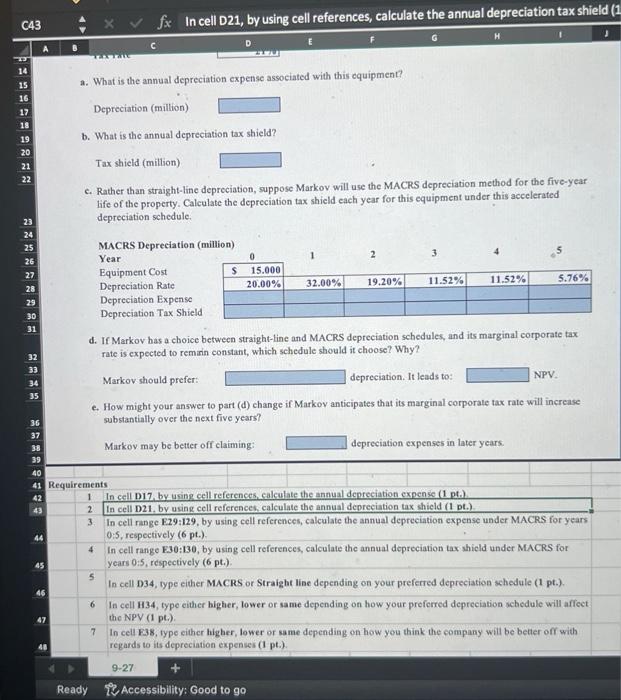

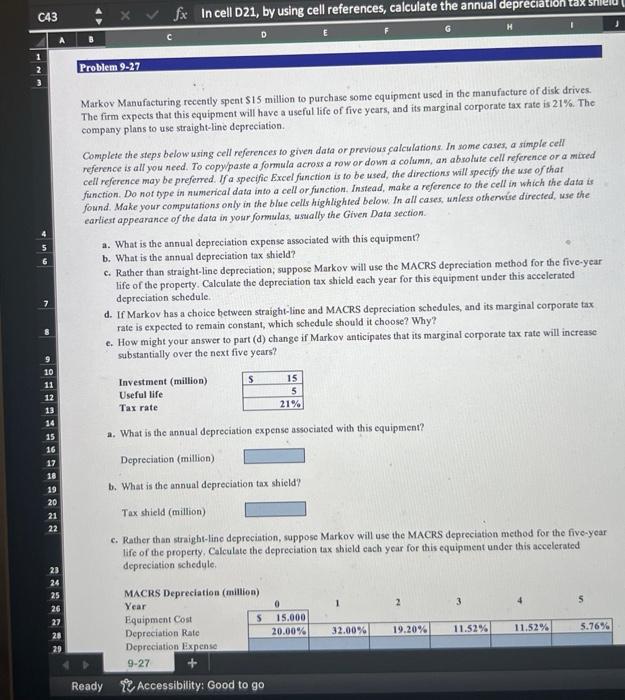

please solve this question using excel reference. please use the cell numbers that are on the left side of the pictures i provided.

Markov Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. The firm expects that this equipment will have a useful life of five years, and its marginal corporate tax rate is 21%. The company plans to use straight-line depreciation. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a muxed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, ussally the Given Data section. a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield? c. Rather than straight-line depreciation; suppose Markov will use the MACRS depreciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule. d. If Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why? c. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What is the annual depreciation expense associated with this equipment? Depreciation (million) b. What is the annual depreciation tax shield? Tax shield (million) c. Rather than stright-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule. 9-27 Ready Accessibility: Good to go a. What is the annual depreciation expense associated with this equipment? Depreciation (million) b. What is the annual depreciation tax shield? Tax shicld (million) c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule. MACRS Depreciation (million) Year Equipment Cost Depreciation Rate Depreciation Expense Depreciation Tax Shield d. If Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax rate is expected to remin constant, which schedule should it choose? Why? Markov should prefer: depreciation. It leads to: NPV. e. How might your answer to part (d) change if Markov anticipates that its marginal corporale tax rate will increase substantially over the next five years? depreciation expenses in later ycars