Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this taxation problem -230903.jpg Open with CA Mr. Sham was working for Astar motors ltd for a period of 15 years and 5

please solve this taxation problem

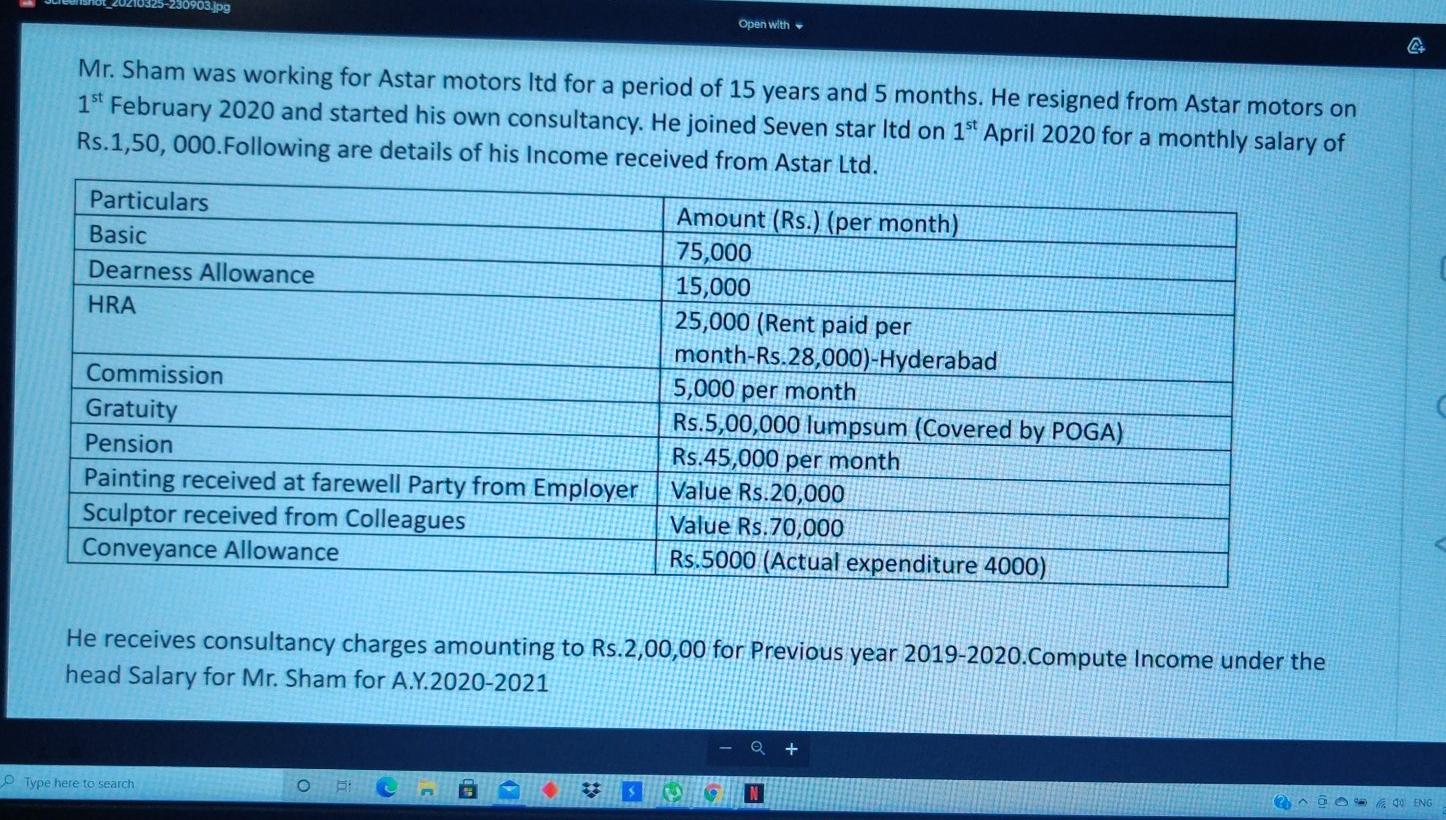

-230903.jpg Open with CA Mr. Sham was working for Astar motors ltd for a period of 15 years and 5 months. He resigned from Astar motors on 1st February 2020 and started his own consultancy. He joined Seven star ltd on 1st April 2020 for a monthly salary of Rs.1,50, 000.Following are details of his Income received from Astar Ltd. Particulars Amount (Rs.) (per month) Basic 75,000 Dearness Allowance 15,000 HRA 25,000 (Rent paid per month-Rs.28,000)-Hyderabad Commission 5,000 per month Gratuity Rs.5,00,000 lumpsum (Covered by POGA) Pension Rs.45,000 per month Painting received at farewell Party from Employer Value Rs.20,000 Sculptor received from Colleagues Value Rs.70,000 Conveyance Allowance Rs.5000 (Actual expenditure 4000) He receives consultancy charges amounting to Rs.2,00,00 for Previous year 2019-2020.Compute Income under the head Salary for Mr. Sham for A.Y.2020-2021 Type here to search & * 990 ENGStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started