Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SOLVE USING BPMN IO xercise 4.32 Draw a collaboration diagram for the following mortgage applica on process at BestLoans. The mortgage application process starts

PLEASE SOLVE USING BPMN IO

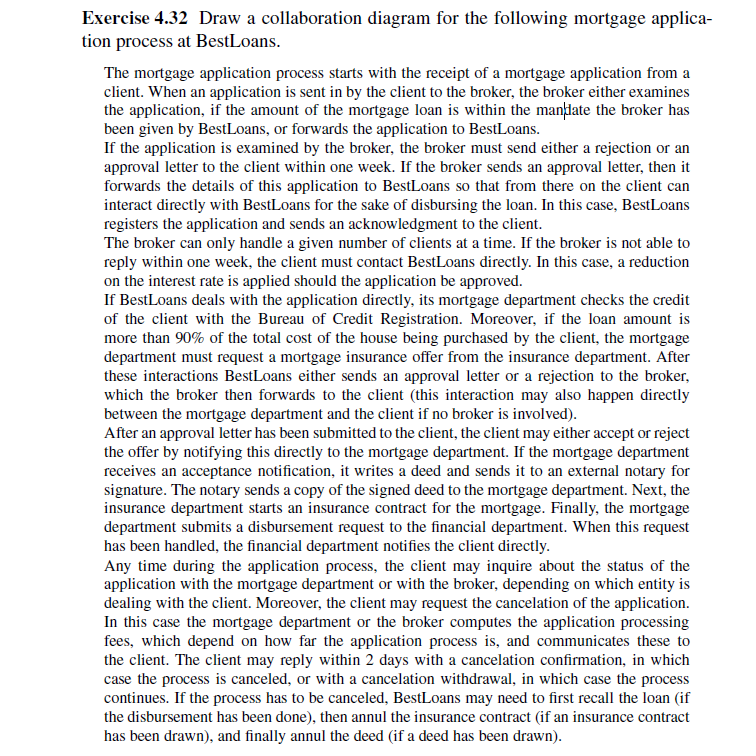

xercise 4.32 Draw a collaboration diagram for the following mortgage applica on process at BestLoans. The mortgage application process starts with the receipt of a mortgage application from a client. When an application is sent in by the client to the broker, the broker either examines the application, if the amount of the mortgage loan is within the mandate the broker has been given by BestLoans, or forwards the application to BestLoans. If the application is examined by the broker, the broker must send either a rejection or an approval letter to the client within one week. If the broker sends an approval letter, then it forwards the details of this application to BestLoans so that from there on the client can interact directly with BestLoans for the sake of disbursing the loan. In this case, BestLoans registers the application and sends an acknowledgment to the client. The broker can only handle a given number of clients at a time. If the broker is not able to reply within one week, the client must contact BestLoans directly. In this case, a reduction on the interest rate is applied should the application be approved. If BestLoans deals with the application directly, its mortgage department checks the credit of the client with the Bureau of Credit Registration. Moreover, if the loan amount is more than 90% of the total cost of the house being purchased by the client, the mortgage department must request a mortgage insurance offer from the insurance department. After these interactions BestLoans either sends an approval letter or a rejection to the broker, which the broker then forwards to the client (this interaction may also happen directly between the mortgage department and the client if no broker is involved). After an approval letter has been submitted to the client, the client may either accept or reject the offer by notifying this directly to the mortgage department. If the mortgage department receives an acceptance notification, it writes a deed and sends it to an external notary for signature. The notary sends a copy of the signed deed to the mortgage department. Next, the insurance department starts an insurance contract for the mortgage. Finally, the mortgage department submits a disbursement request to the financial department. When this request has been handled, the financial department notifies the client directly. Any time during the application process, the client may inquire about the status of the application with the mortgage department or with the broker, depending on which entity is dealing with the client. Moreover, the client may request the cancelation of the application. In this case the mortgage department or the broker computes the application processing fees, which depend on how far the application process is, and communicates these to the client. The client may reply within 2 days with a cancelation confirmation, in which case the process is canceled, or with a cancelation withdrawal, in which case the process continues. If the process has to be canceled, BestLoans may need to first recall the loan (if the disbursement has been done), then annul the insurance contract (if an insurance contract has been drawn), and finally annul the deed (if a deed has been drawn). xercise 4.32 Draw a collaboration diagram for the following mortgage applica on process at BestLoans. The mortgage application process starts with the receipt of a mortgage application from a client. When an application is sent in by the client to the broker, the broker either examines the application, if the amount of the mortgage loan is within the mandate the broker has been given by BestLoans, or forwards the application to BestLoans. If the application is examined by the broker, the broker must send either a rejection or an approval letter to the client within one week. If the broker sends an approval letter, then it forwards the details of this application to BestLoans so that from there on the client can interact directly with BestLoans for the sake of disbursing the loan. In this case, BestLoans registers the application and sends an acknowledgment to the client. The broker can only handle a given number of clients at a time. If the broker is not able to reply within one week, the client must contact BestLoans directly. In this case, a reduction on the interest rate is applied should the application be approved. If BestLoans deals with the application directly, its mortgage department checks the credit of the client with the Bureau of Credit Registration. Moreover, if the loan amount is more than 90% of the total cost of the house being purchased by the client, the mortgage department must request a mortgage insurance offer from the insurance department. After these interactions BestLoans either sends an approval letter or a rejection to the broker, which the broker then forwards to the client (this interaction may also happen directly between the mortgage department and the client if no broker is involved). After an approval letter has been submitted to the client, the client may either accept or reject the offer by notifying this directly to the mortgage department. If the mortgage department receives an acceptance notification, it writes a deed and sends it to an external notary for signature. The notary sends a copy of the signed deed to the mortgage department. Next, the insurance department starts an insurance contract for the mortgage. Finally, the mortgage department submits a disbursement request to the financial department. When this request has been handled, the financial department notifies the client directly. Any time during the application process, the client may inquire about the status of the application with the mortgage department or with the broker, depending on which entity is dealing with the client. Moreover, the client may request the cancelation of the application. In this case the mortgage department or the broker computes the application processing fees, which depend on how far the application process is, and communicates these to the client. The client may reply within 2 days with a cancelation confirmation, in which case the process is canceled, or with a cancelation withdrawal, in which case the process continues. If the process has to be canceled, BestLoans may need to first recall the loan (if the disbursement has been done), then annul the insurance contract (if an insurance contract has been drawn), and finally annul the deed (if a deed has been drawn)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started