Question

Please solve using excel 1.Your firm is about to issue a 5-year AA-rated bond. What kind of maturity risk premium should you expect? 2.What is

Please solve using excel

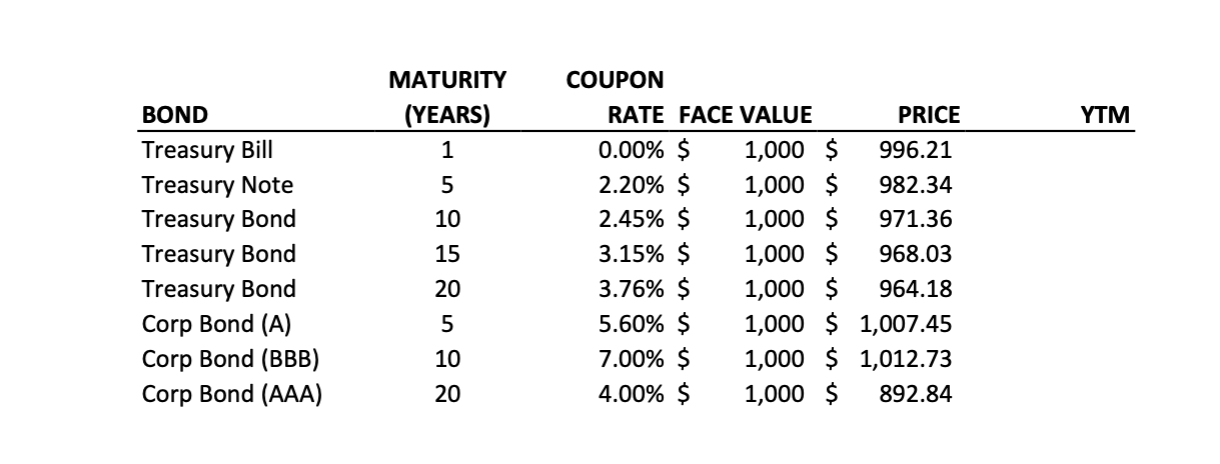

1.Your firm is about to issue a 5-year AA-rated bond. What kind of maturity risk premium should you expect?

2.What is the default risk premium on a AAA-rated bond?

3.Your firm plans to issue a 10-year bond you believe will be AAA-rated. What yield are your expecting?

4.What is the maturity risk premium on the 10-year Treasury?

5.Your company's 5-year, A-rated bond is expected to be downgraded to BBB. What will the new default risk premium be?

6.What is the yield on the 10-year BBB-rated corporate bond?

7.What is the yield on the 5-year Treasury?

\begin{tabular}{lcccccc} BOND & MATURITY(YEARS) & COUPONRATEFACEVALUE & PRICE & YTM \\ \hline Treasury Bill & 1 & 0.00%$ & 1,000 & $ & 996.21 & \\ Treasury Note & 5 & 2.20%$ & 1,000 & $ & 982.34 & \\ Treasury Bond & 10 & 2.45%$ & 1,000 & $ & 971.36 & \\ Treasury Bond & 15 & 3.15%$ & 1,000 & $ & 968.03 & \\ Treasury Bond & 20 & 3.76%$ & 1,000 & $ & 964.18 & \\ Corp Bond (A) & 5 & 5.60%$ & 1,000 & $ & 1,007.45 & \\ Corp Bond (BBB) & 10 & 7.00%$ & 1,000 & $ & 1,012.73 & \\ Corp Bond (AAA) & 20 & 4.00%$ & 1,000 & $ & 892.84 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started