Answered step by step

Verified Expert Solution

Question

1 Approved Answer

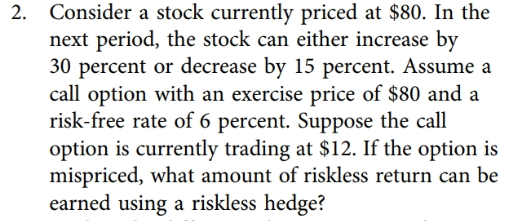

PLEASE SOLVE USING EXCEL 2. Consider a stock currently priced at $80. In the next period, the stock can either increase by 30 percent or

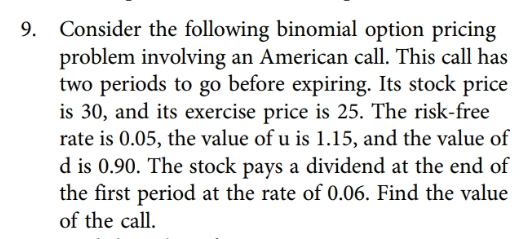

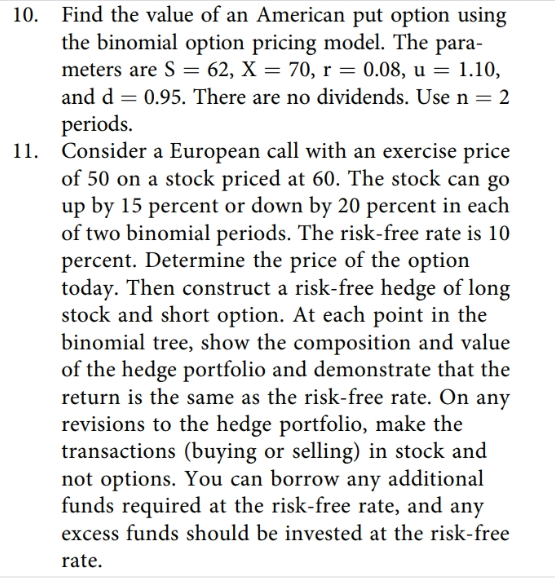

PLEASE SOLVE USING EXCEL

2. Consider a stock currently priced at $80. In the next period, the stock can either increase by 30 percent or decrease by 15 percent. Assume a call option with an exercise price of $80 and a risk-free rate of 6 percent. Suppose the call option is currently trading at $12. If the option is mispriced, what amount of riskless return can be earned using a riskless hedge? 9. Consider the following binomial option pricing problem involving an American call. This call has two periods to go before expiring. Its stock price is 30, and its exercise price is 25. The risk-free rate is 0.05, the value of u is 1.15, and the value of d is 0.90. The stock pays a dividend at the end of the first period at the rate of 0.06. Find the value of the call. 10. Find the value of an American put option using the binomial option pricing model. The para- meters are S = 62, X = 70, r = 0.08, u = 1.10, and d= 0.95. There are no dividends. Use n = 2 periods. 11. Consider a European call with an exercise price of 50 on a stock priced at 60. The stock can go up by 15 percent or down by 20 percent in each of two binomial periods. The risk-free rate is 10 percent. Determine the price of the option today. Then construct a risk-free hedge of long stock and short option. At each point in the binomial tree, show the composition and value of the hedge portfolio and demonstrate that the return is the same as the risk-free rate. On any revisions to the hedge portfolio, make the transactions (buying or selling) in stock and not options. You can borrow any additional funds required at the risk-free rate, and any excess funds should be invested at the risk-free rate. 16. Use the Excel spreadsheet BlackScholes Merton Binomial 10e.xlsm and determine the value of a call option and a put option on a stock currently priced at 100, where the risk-free rate is 5 percent (compounded annually), the exercise price is 100, the volatility is 30 percent, the option expires in one year, and there are no dividends on the stock. Let the number of binomial periods be 25. Verify that put-call parity holds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started