Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve using excel spreadsheet, and show the formulas and calculation. The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering

Please solve using excel spreadsheet, and show the formulas and calculation.

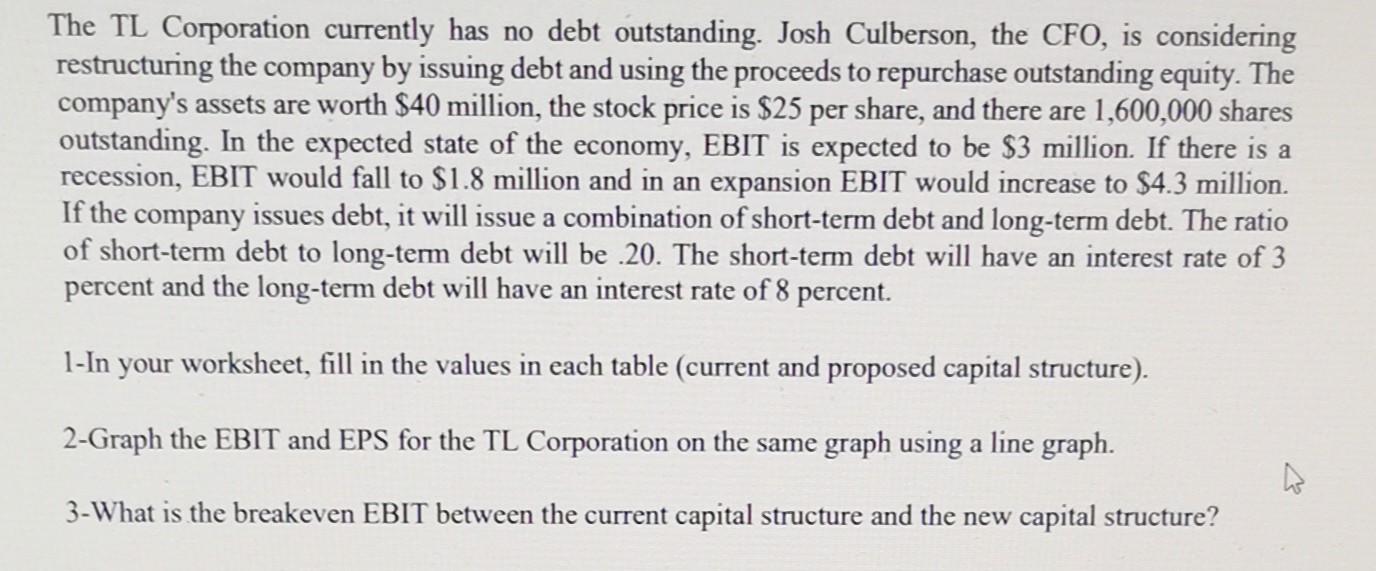

The TL Corporation currently has no debt outstanding. Josh Culberson, the CFO, is considering restructuring the company by issuing debt and using the proceeds to repurchase outstanding equity. The company's assets are worth $40 million, the stock price is $25 per share, and there are 1,600,000 shares outstanding. In the expected state of the economy, EBIT is expected to be $3 million. If there is a recession, EBIT would fall to $1.8 million and in an expansion EBIT would increase to $4.3 million. If the company issues debt, it will issue a combination of short-term debt and long-term debt. The ratio of short-term debt to long-term debt will be .20 . The short-term debt will have an interest rate of 3 percent and the long-term debt will have an interest rate of 8 percent. 1-In your worksheet, fill in the values in each table (current and proposed capital structure). 2-Graph the EBIT and EPS for the TL Corporation on the same graph using a line graph. 3-What is the breakeven EBIT between the current capital structure and the new capital structureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started