Answered step by step

Verified Expert Solution

Question

1 Approved Answer

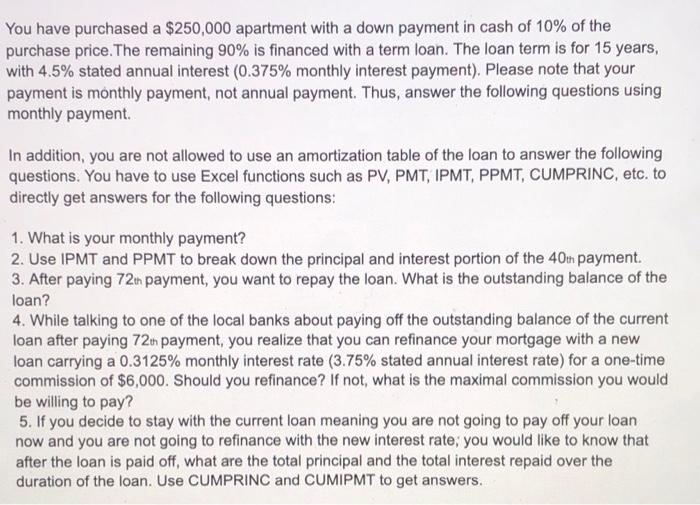

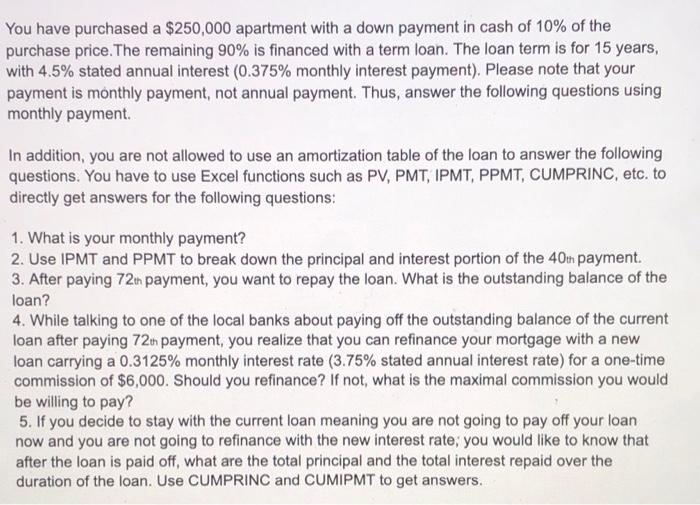

*PLEASE SOLVE USING EXCEL You have purchased a $250,000 apartment with a down payment in cash of 10% of the purchase price. The remaining 90%

*PLEASE SOLVE USING EXCEL

You have purchased a $250,000 apartment with a down payment in cash of 10% of the purchase price. The remaining 90% is financed with a term loan. The loan term is for 15 years, with 4.5% stated annual interest (0.375% monthly interest payment). Please note that your payment is monthly payment, not annual payment. Thus, answer the following questions using monthly payment In addition, you are not allowed to use an amortization table of the loan to answer the following questions. You have to use Excel functions such as PV, PMT, IPMT, PPMT, CUMPRINC, etc. to directly get answers for the following questions: 1. What is your monthly payment? 2. Use IPMT and PPMT to break down the principal and interest portion of the 40in payment. 3. After paying 724 payment, you want to repay the loan. What is the outstanding balance of the loan? 4. While talking to one of the local banks about paying off the outstanding balance of the current loan after paying 72n payment, you realize that you can refinance your mortgage with a new loan carrying a 0.3125% monthly interest rate (3.75% stated annual interest rate) for a one-time commission of $6,000. Should you refinance? If not, what is the maximal commission you would be willing to pay? 5. If you decide to stay with the current loan meaning you are not going to pay off your loan now and you are not going to refinance with the new interest rate, you would like to know that after the loan is paid off, what are the total principal and the total interest repaid over the duration of the loan. Use CUMPRINC and CUMIPMT to get answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started