Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve using formula without excell and financial calculator and please show steps Use the following to answer questions 6-10: Terry Tire Company has 12.000

Please solve using formula without excell and financial calculator and please show steps

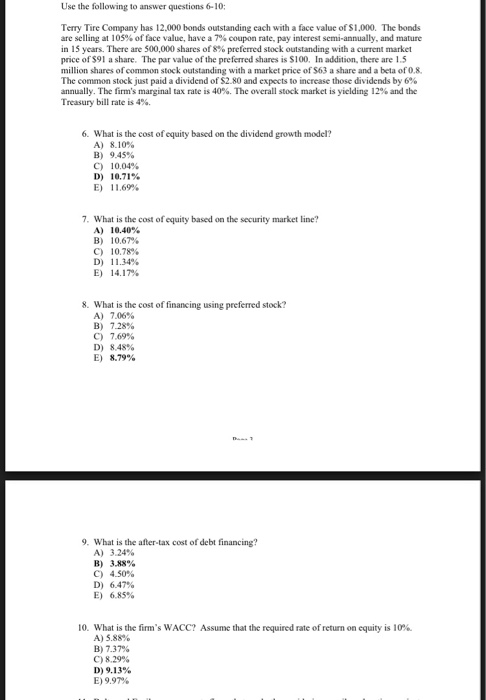

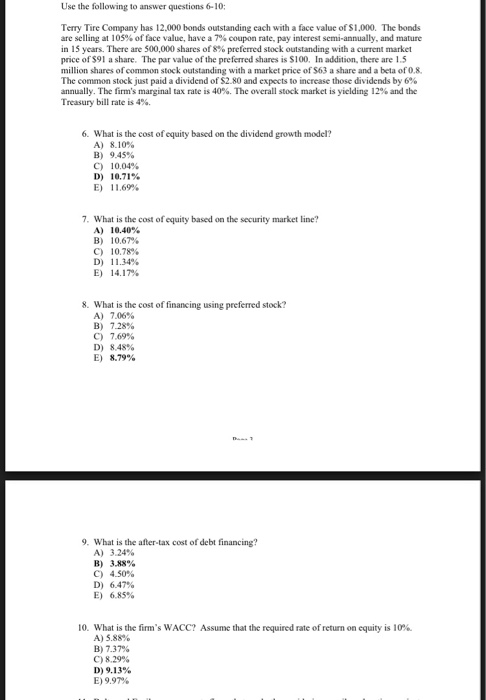

Use the following to answer questions 6-10: Terry Tire Company has 12.000 bonds outstanding each with a face value of $1,000. The bonds are selling at 105% of face value, have a 7% coupon rate, pay interest semi-annually, and mature in 15 years. There are 500,000 shares of 8% preferred stock outstanding with a current market price of $91 a share. The par value of the preferred shares is S100, In addition, there are 1.5 million shares of common stock outstanding with a market price of $63 a share and a beta of 0.8 The common stock just paid a dividend of S2.80 and expects to increase those dividends by 6% annually. The firm's marginal tax rate is 40%. The overall stock market is yielding 12% and the Treasury bill rate is 4%. 6. What is the cost of equity based on the dividend growth model? A) B) C) D) E) 8.10% 9.45% 10.04% 10.71% 11.69% 7. What is the cost of equity based on the security market line? A) B) C) D) E) 10.40% 10.67% 10.78% 11.34% 14.17% 8. What is the cost of financing using preferred stock? A) B) C) D) E) 7.06% 7.28% 7.69% 8.48% 8.79% 9. What is the after-tax cost of debt financing? A) B) C) D) E) 3.24% 3.88% 4.50% 6.47% 6.85% 10. What is the firm's WACC? Assume that the required rate of return on equity is 10%. A) 5.88% B) 7.37% C) 8.29% D) 9.13% E) 9.97%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started