Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve using Microsoft Excel An airline is considering two types of engines for use in its planes. Each engine has the same life, the

Please solve using Microsoft Excel

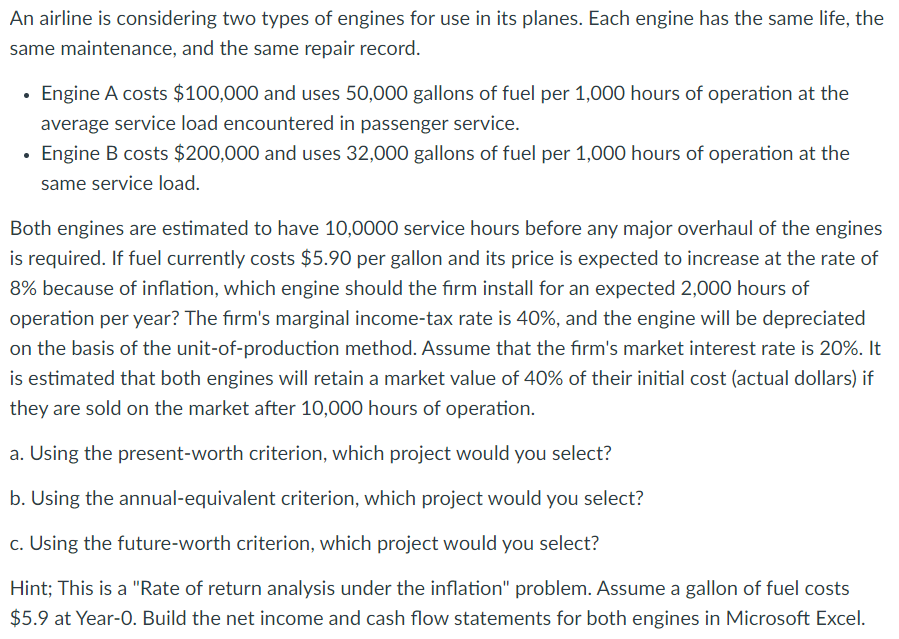

An airline is considering two types of engines for use in its planes. Each engine has the same life, the same maintenance, and the same repair record. - Engine A costs $100,000 and uses 50,000 gallons of fuel per 1,000 hours of operation at the average service load encountered in passenger service. - Engine B costs $200,000 and uses 32,000 gallons of fuel per 1,000 hours of operation at the same service load. Both engines are estimated to have 10,0000 service hours before any major overhaul of the engines is required. If fuel currently costs $5.90 per gallon and its price is expected to increase at the rate of 8% because of inflation, which engine should the firm install for an expected 2,000 hours of operation per year? The firm's marginal income-tax rate is 40%, and the engine will be depreciated on the basis of the unit-of-production method. Assume that the firm's market interest rate is 20%. It is estimated that both engines will retain a market value of 40% of their initial cost (actual dollars) if they are sold on the market after 10,000 hours of operation. a. Using the present-worth criterion, which project would you select? b. Using the annual-equivalent criterion, which project would you select? c. Using the future-worth criterion, which project would you select? Hint; This is a "Rate of return analysis under the inflation" problem. Assume a gallon of fuel costs $5.9 at Year-0. Build the net income and cash flow statements for both engines in Microsoft ExcelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started