Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve.. will upvote!!! begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} hline multicolumn{10}{|c|}{ Star Videos, Inc. } hline multicolumn{10}{|c|}{ Transaction Analysis } hline multicolumn{10}{|c|}{ For the Year Ended December

please solve.. will upvote!!!

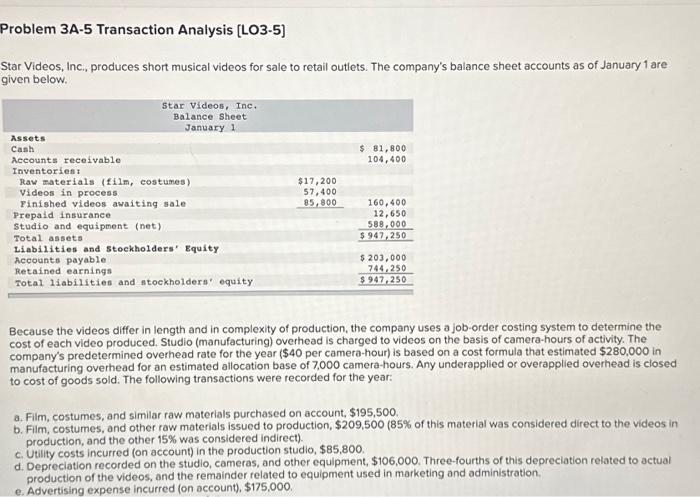

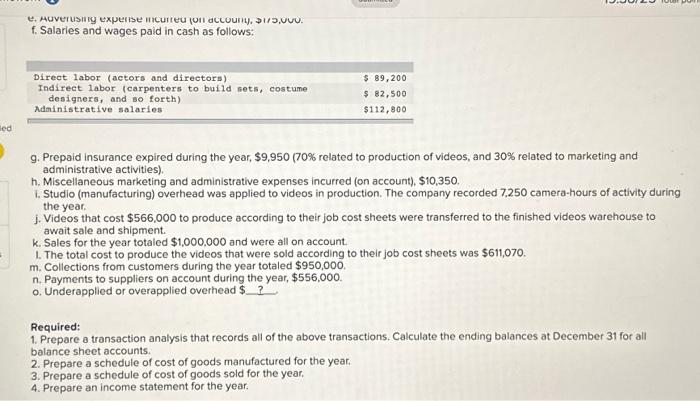

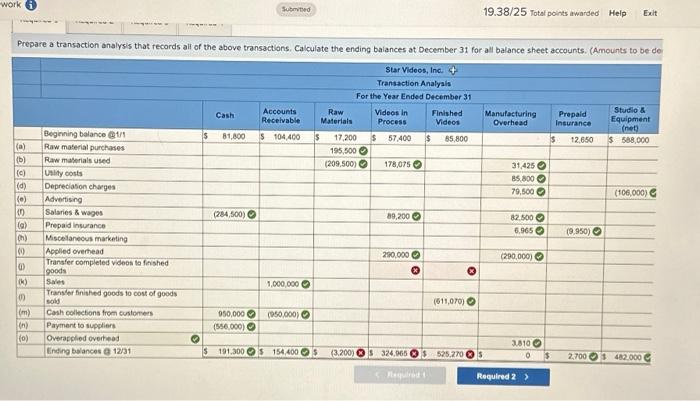

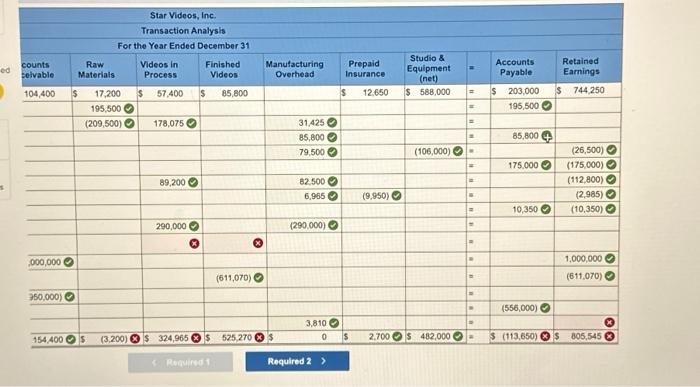

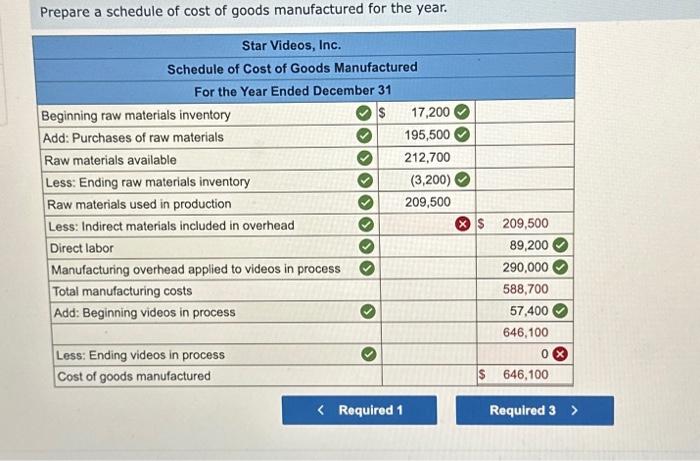

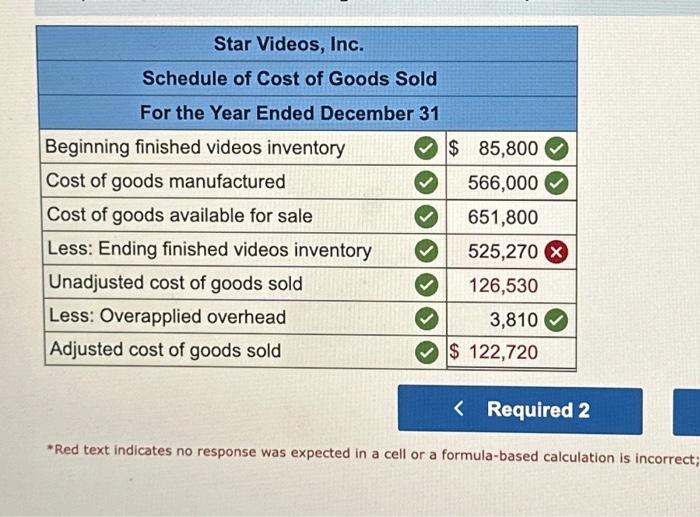

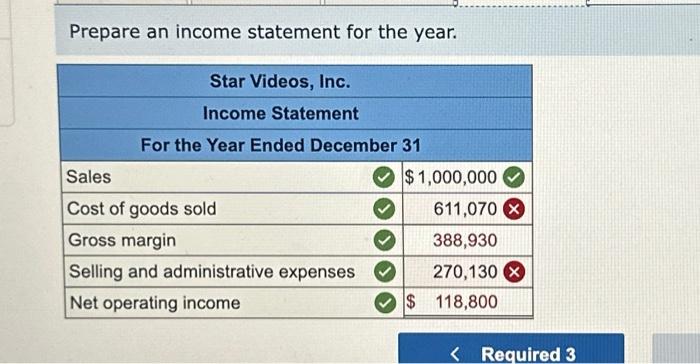

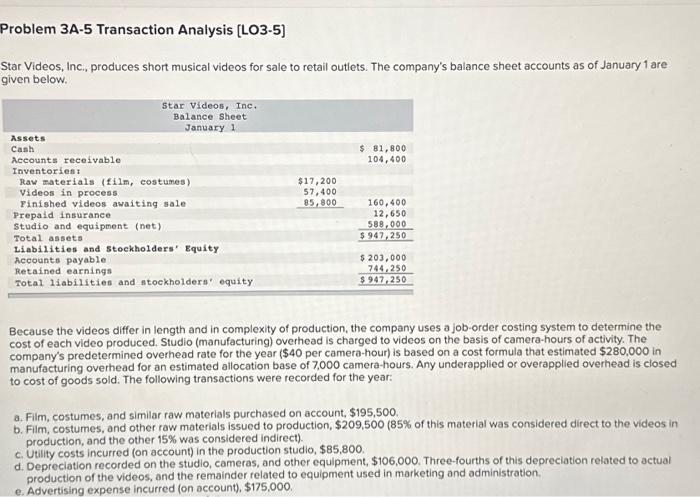

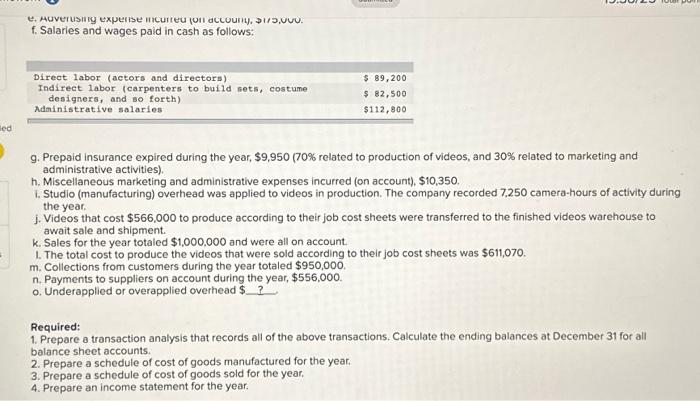

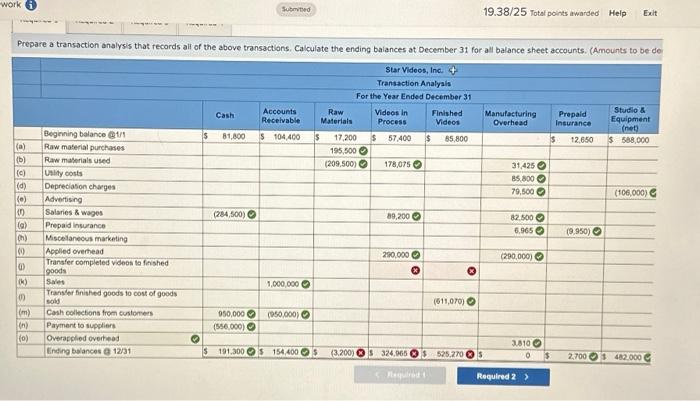

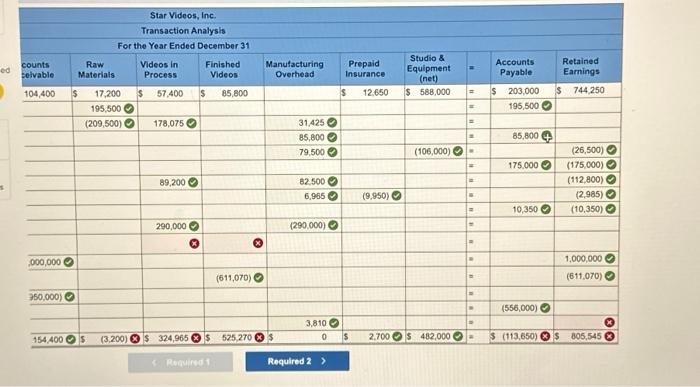

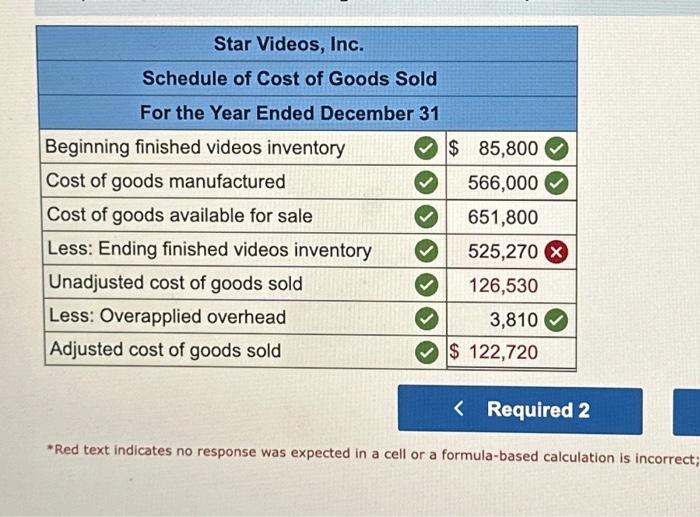

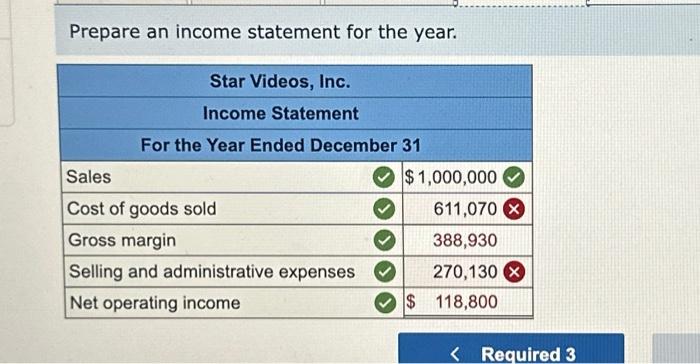

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Star Videos, Inc. } \\ \hline \multicolumn{10}{|c|}{ Transaction Analysis } \\ \hline \multicolumn{10}{|c|}{ For the Year Ended December 31} \\ \hline countssoivable & RawMaterials & VideosinProcess & FinishedVideos & ManufacturingOverhead & PrepaidInsurance & Studio&Equipment(net) & = & AccountsPayable & RetainedEarnings \\ \hline \multirow[t]{11}{*}{104,400} & 17,200 & s 57.400 & 85,800 & & 12.650 & \$ 588,000 & = & $203,000 & s 744,250 \\ \hline & 195,500 & & & & & & = & 195,5000 & \\ \hline & (209,500) & 178,075 & & 31,4250 & & & = & & \\ \hline & & & & 85,8000 & & & = & 85,800 & \\ \hline & & & & 79,5000 & & (106,000)0 & = & & (26,500)0 \\ \hline & & & & & & & = & 175.0000 & (175,000) \\ \hline & & 89,2000 & & 82.5000 & & & = & & (112,800)0 \\ \hline & & & & 6,9650 & (9,950)0 & & = & & (2,985)0 \\ \hline & & & & & & & = & 10,350 & (10,350) \\ \hline & & 290,0000 & & (290.000)0 & & & = & & \\ \hline & & & 8 & & & & = & & \\ \hline \multirow[t]{2}{*}{,000,0000} & & & & & & & = & & 1,000,0000 \\ \hline & & & (611,070) & & & & = & & (611,070) \\ \hline \multirow[t]{3}{*}{750,000)0} & & & & & & & = & & \\ \hline & & & & & & & = & (556,000) & \\ \hline & & & & 3,8100 & & & = & & \\ \hline 154,4000/5 & (3,200)5 & 5324,9658 & $5725,270 & s & 2.7000s & 5482,0000 & = & $(113,650)s & \$ 805,545 \\ \hline \end{tabular} Required 2 > * Red text indicates no response was expected in a cell or a formula-based calculation is incorrect Problem 3A-5 Transaction Analysis [LO3-5] Star Videos, Inc., produces short musical videos for sale to retail outlets. The company's balance sheet accounts as of January 1 are given below. Because the videos differ in length and in complexity of production, the company uses a job-order costing system to determine the cost of each video produced. Studio (manufacturing) overhead is charged to videos on the basis of camera-hours of activity. The company's predetermined overhead rate for the year ( $40 per camera-hour) is based on a cost formula that estimated $280,000 in manufacturing overhead for an estimated allocation base of 7,000 camera-hours. Any underapplied or overapplied overhead is closed to cost of goods sold. The following transactions were recorded for the year: a. Film, costumes, and similar raw materials purchased on account, $195,500. b. Film, costumes, and other raw materials issued to production, $209,500 ( 85% of this material was considered direct to the videos in production, and the other 15% was considered indirect). c. Utility costs incurred (on account) in the production studio, $85,800. d. Depreciation recorded on the studio, cameras, and other equipment, $106,000. Three-fourths of this depreciation related to actual production of the videos, and the remainder related to equipment used in marketing and administration. e. Advertising expense incurred (on account), $175,000. Prepare a schedule of cost of goods manufactured for the year. Prepare an income statement for the year. Submited 19.38/25 Total points awarded Help Exit Prepare a transaction analysis that records all of the above transactions. Calculate the ending balances at December 31 for all balance sheet accounts. (Amounts to be de \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & & \multicolumn{8}{|c|}{ Star Videos, Inc \& } \\ \hline & & \multicolumn{8}{|c|}{ Transaction Analyals } \\ \hline & & \multicolumn{8}{|c|}{ For the Year Ended December 31} \\ \hline & & Cash & AccountsRecelvable & RawMaterials & VideosinProcess & FinishedVideos & \multirow{2}{*}{ManufacturingOverhead} & PrepaidInsurance & Studio&Equipment(net) \\ \hline & Beginning balance BVII & 81,800 & 5104,460 & 17,200 & s 57,400 & $55,800 & & 12,650 & s $88,000 \\ \hline (a) & Raw maserial purchases & & & 195,5000 & & & & & \\ \hline (b) & Raw maserials used & & & (209,500)0 & 178,0750 & & 31,4250 & & \\ \hline (c) & Vility oosts & & & & & & Bs, 8000 & & \\ \hline (d) & Depreciason charges & & & & & & 79,5000 & & (106,000)e \\ \hline (o) & Advertising & & & & & & & & \\ \hline (i) & Solsries \& wages & (284,500) & & & 89,2000 & & 82,5000 & & \\ \hline (a) & Prepald insurance & & & & & & 6.9650 & (9.950)0 & \\ \hline (h) & Miscelanecous marketing & & & & & & & & \\ \hline (9) & Applied overhead & & & & 280,0000 & & (290,000)0 & & \\ \hline (i) & Transfercompletedvideostofinshedgoods & & & & & (9) & & & \\ \hline (6) & Sales & & 1,000,0000 & & & & & & \\ \hline (9) & Trunsderfinithedgoodstocostofgoodssols & & & & & (611,070) & & & \\ \hline (m) & Cosh collections from cuntomen & 950,0000 & (850,000)0 & & & & & & \\ \hline (n) & Payment to suppliers & (856000)0 & & & & & & & \\ \hline \multirow[t]{2}{*}{ (0) } & Overabpled everteas & & & & & & 28100 & & \\ \hline & Encing balances a 1231 & 5191,3000 & I5 154,4000 & (3.200) & s 324,0650 & 5525,27005 & 05 & 2,70001 & 1402000C \\ \hline \end{tabular} f. Salaries and wages paid in cash as follows: g. Prepaid insurance expired during the year, $9,950 (70\% related to production of videos, and 30% related to marketing and administrative activities). h. Miscellaneous marketing and administrative expenses incurred (on account), $10,350. i. Studio (manufacturing) overhead was applied to videos in production. The company recorded 7,250 camera-hours of activity during the year. j. Videos that cost $566,000 to produce according to their job cost sheets were transferred to the finished videos warehouse to await sale and shipment. k. Sales for the year totaled $1,000,000 and were all on account. L. The total cost to produce the videos that were sold according to their job cost sheets was $611,070. m. Collections from customers during the year totaled $950,000. n. Payments to suppliers on account during the year, $556,000. o. Underapplied or overapplied overhead \$? Required: 1. Prepare a transaction analysis that records all of the above transactions. Calculate the ending balances at December 31 for all balance sheet accounts. 2. Prepare a schedule of cost of goods manufactured for the year. 3. Prepare a schedule of cost of goods sold for the year. 4. Prepare an income statement for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started