Answered step by step

Verified Expert Solution

Question

1 Approved Answer

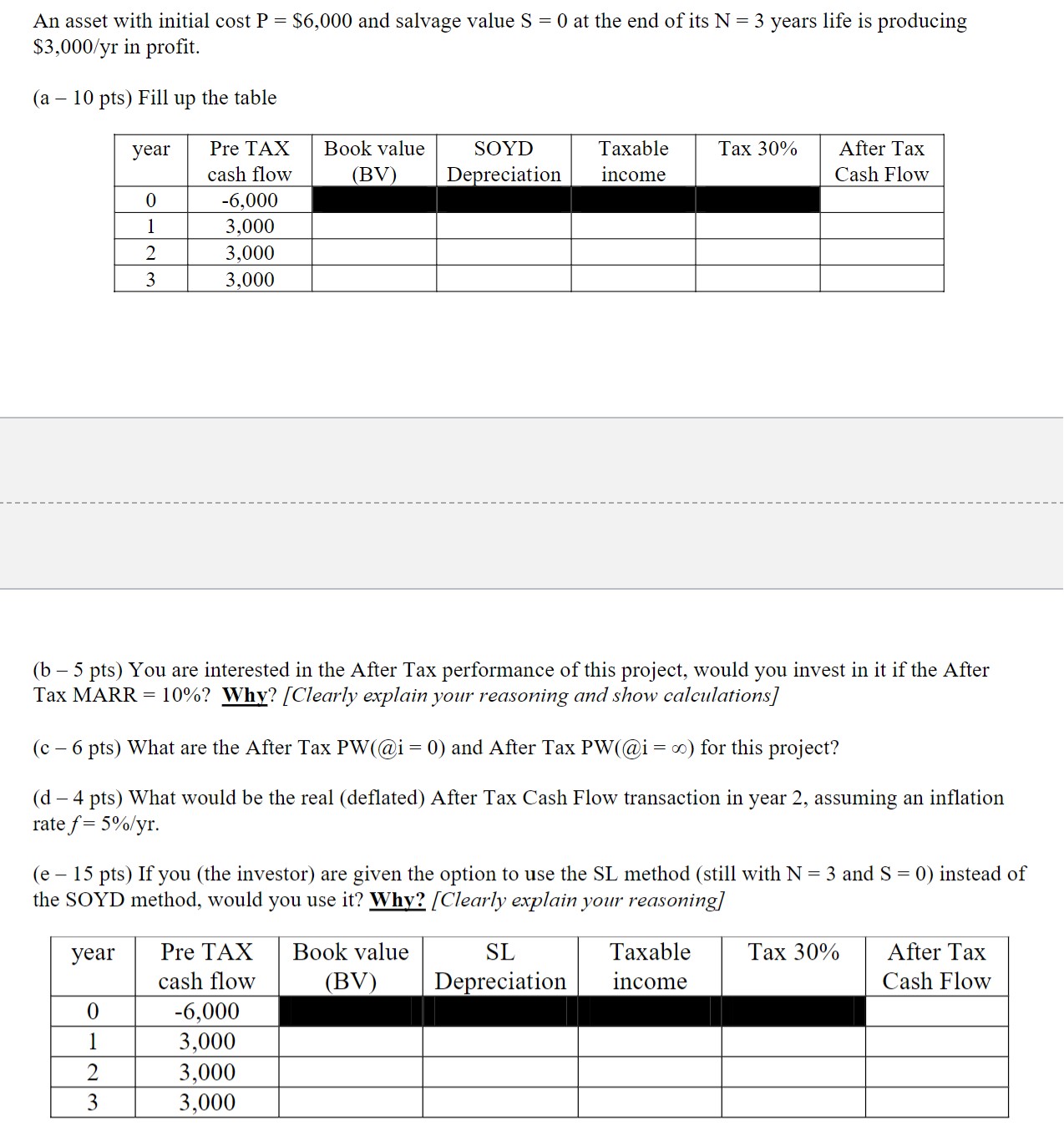

please solve with all steps An asset with initial cost P=$6,000 and salvage value S=0 at the end of its N=3 years life is producing

please solve with all steps

An asset with initial cost P=$6,000 and salvage value S=0 at the end of its N=3 years life is producing $3,000/ yr in profit. (a - 10 pts) Fill up the table (b-5 pts) You are interested in the After Tax performance of this project, would you invest in it if the After Tax MARR =10% ? Why? [Clearly explain your reasoning and show calculations] (d -4 pts) What would be the real (deflated) After Tax Cash Flow transaction in year 2, assuming an inflation rate f=5%/yr. (e - 15 pts) If you (the investor) are given the option to use the SL method (still with N=3 and S=0 ) instead of the SOYD method, would you use it? Why? [Clearly explain your reasoning]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started