Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve with Excel. You are considering a 5/1 ARM and a 30 Year fixed rate mortgage to finance your property. The loan will be

Please solve with Excel.

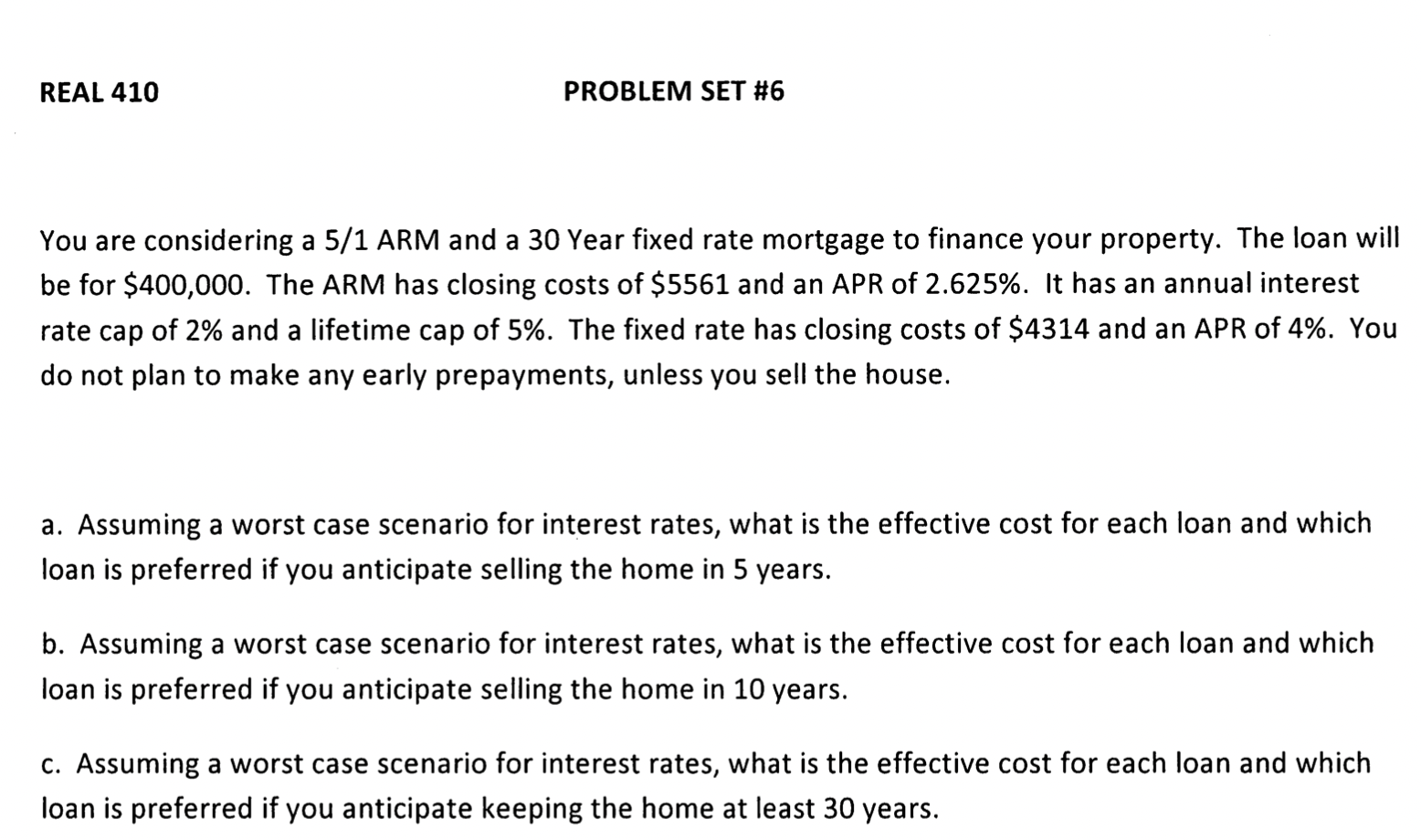

You are considering a 5/1 ARM and a 30 Year fixed rate mortgage to finance your property. The loan will be for $400,000. The ARM has closing costs of $5561 and an APR of 2.625%. It has an annual interest rate cap of 2% and a lifetime cap of 5%. The fixed rate has closing costs of $4314 and an APR of 4%. You do not plan to make any early prepayments, unless you sell the house. a. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate selling the home in 5 years. b. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate selling the home in 10 years. c. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate keeping the home at least 30 years

You are considering a 5/1 ARM and a 30 Year fixed rate mortgage to finance your property. The loan will be for $400,000. The ARM has closing costs of $5561 and an APR of 2.625%. It has an annual interest rate cap of 2% and a lifetime cap of 5%. The fixed rate has closing costs of $4314 and an APR of 4%. You do not plan to make any early prepayments, unless you sell the house. a. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate selling the home in 5 years. b. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate selling the home in 10 years. c. Assuming a worst case scenario for interest rates, what is the effective cost for each loan and which loan is preferred if you anticipate keeping the home at least 30 years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started