Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve with the list of accounts given. Thanks! Fill out journal entries under ifrs and aspe On January 1,2023 , Martinez Limited pays $84,925

Please solve with the list of accounts given. Thanks!

Fill out journal entries under ifrs and aspe

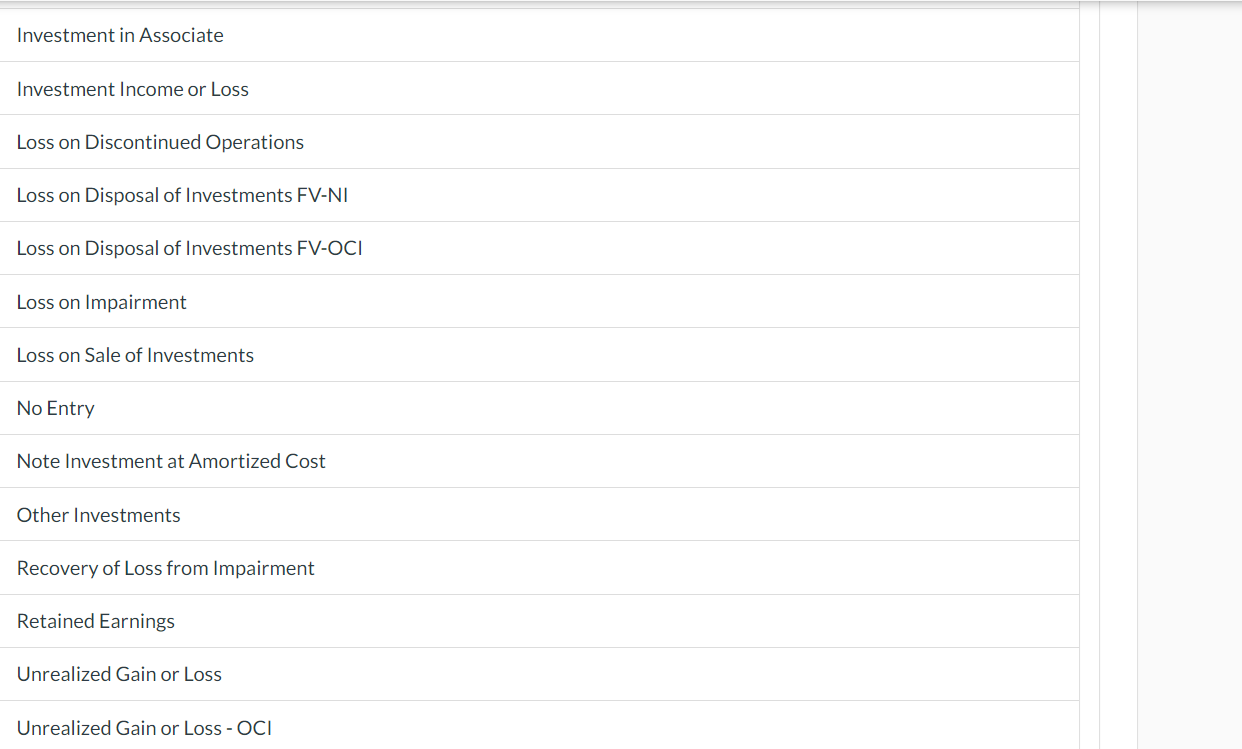

On January 1,2023 , Martinez Limited pays $84,925 to purchase $100,000 of Chan Corporation 7% bonds. The market rate of interest at the time was 11%. Martinez accounts for this investment at amortized cost using the effective interest method. The bonds mature on January 1, 2028, and interest is payable each July 1 and January 1 . Note that the bond is acquired on an interest payment date and there is therefore no accrued interest for Martinez to pay on January 1. Martinez has an August 31 year end. (a) Your answer is correct. Calculate the amortization of the discount per month using the straight-line method. (Round answer to 2 decimal places, e.g. 125.55.) Amortization of the discount per month $ IFRS: Effective interest method ASPE: Straight-line method Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OCI Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FVOCl Gain on Sale of Investments GST Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments FV-NI Loss on Disposal of Investments FV-OCl Loss on Impairment Loss on Sale of Investments No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OClStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started