Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve with very detailed steps. correct answer is provided solve all parts of 17 17. Quinn Spellman formed Spellman Tutoring, Ine (STI) and it

please solve with very detailed steps. correct answer is provided

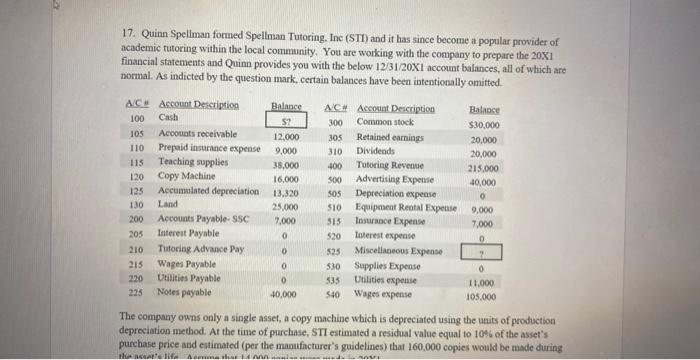

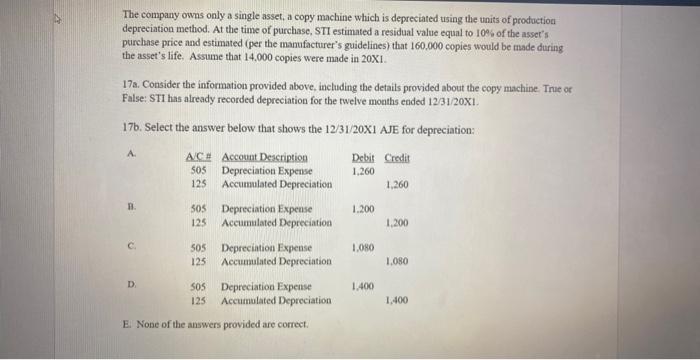

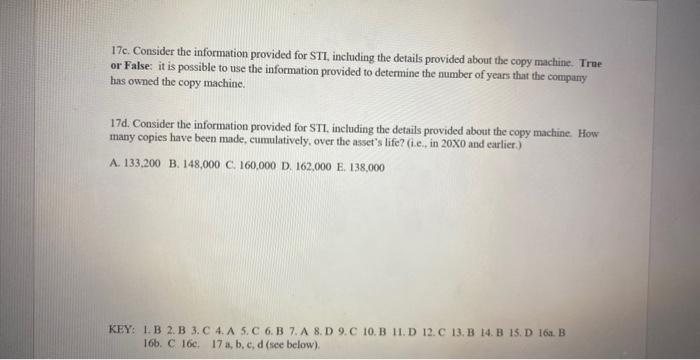

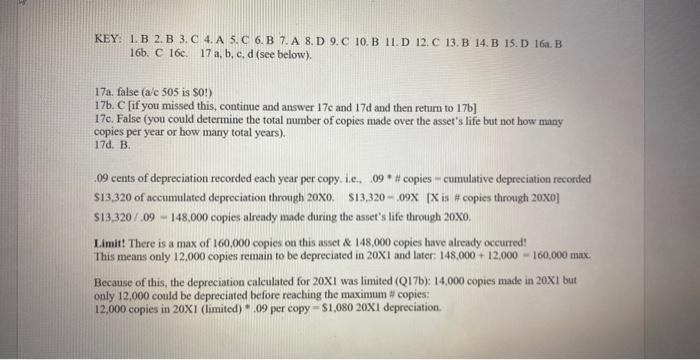

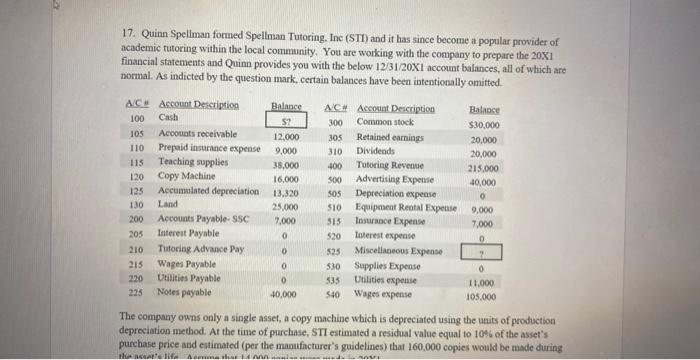

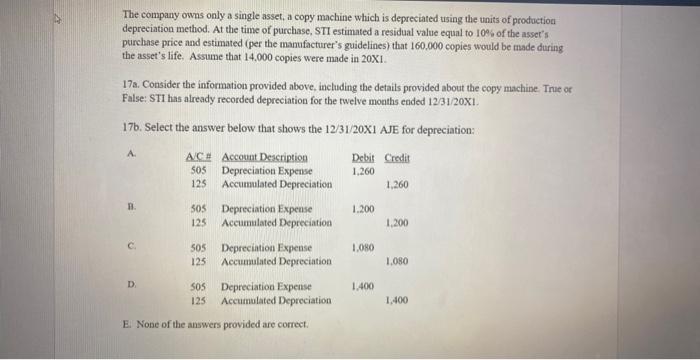

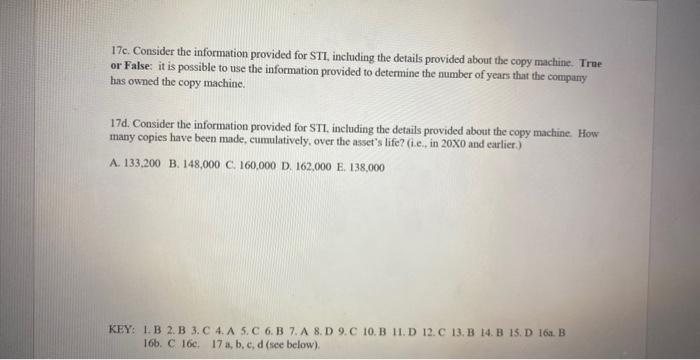

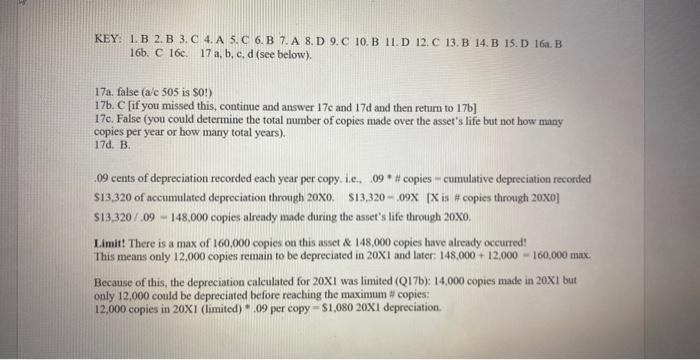

17. Quinn Spellman formed Spellman Tutoring, Ine (STI) and it has since become a popular provider of academic tutoring within the local community. You are working with the company to prepare the 20X1 financial statements and Quinn provides you with the below 12/31/20X1 account balances, all of which are normal. As indicted by the question mark, certain balances have been intentionally omitted. The company owns only a single asset, a copy machine which is depreciated using the units of production depreciation method. At the time of purchase, STI estimated a residual value equal to 106 of the asset's purchase price and estimated (per the manuficturer's guidelines) that 160,000 copies would be made during The company owns only a single asset, a copy machine which is depreciated using the units of production depreciation method. At the time of purchase, STI estimated a residual value equal to 108 s of the asset's purchase price and estimated (per the manufacturer's guidelines) that 160.000 copies would be made during the asset's life. Assume that 14,000 copies were made in 20X1. 17a. Consider the information provided above, including the details provided about the copy machine. Tne or False: STI has already recorded depreciation for the twelve months ended 12/31/20X1. 17b. Select the answer below that shows the 12/31/20X1 AJE for depreciation: E. None of the answers provided are correct. 17c. Consider the information provided for STI, including the details provided about the copy machine. Trae or False: it is possible to use the information provided to determine the number of years that the company has owned the copy machine. 17d. Consider the information provided for $T, including the details provided about the copy machine. How many copies have been made, cumulatively, over the asset's life? (i.e., in 20XO and earlier.) A. 133,200 B. 148,000 C. 160,000 D. 162,000 E. 138,000 KEY: 1. B 2. B 3.C 4.A 5.C 6. B 7. A 8. D 9. C 10. B 11. D 12. C 13. B 14. B 15. D 16.. B 16b. C 16e,17a,b,c,d (see below). KEY: 1. B 2. B 3. C 4.A 5. C 6. B 7. A 8.D 9.C 10. B 11.D 12, C 13.B 14. B is. D I6a. B 16b. C 16c, 17 a, b, c, d (see below). 17a. false (a/e 505 is $0!) 17b. C [if you missed this, continue and answer 17c and 17d and then return to 17b ] 17e. False (you could determine the total number of copies made over the asset's life but not how many copies per year or how many total years). 17d. B. .09 cents of depreciation recorded each year per copy. i.e, 09 \# copies - cumulative depreciation recorded $13,320 of accumulated depreciation through 20X0. \$13,320 -.09X [X is \# copies through 20X0] $13,320/.09=148,000 copies already made during the asset's life through 20X0. L.imit! There is a max of 160,000 copies on this asset \& 148,000 copies have already oceurred! This means only 12,000 copies remain to be depreciated in 20X and later: 148,000+12,000160,000 max Because of this, the depreciation calculated for 20XI was limited (Q17b): 14,000 copies made in 20XI but only 12,000 could be depreciated before reaching the maximum H copies: 12,000 copies in 20XI (limited) * 09 per copy =$1,08020X1 depreciation solve all parts of 17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started