Question: Please solve WITHOUT EXCEL 8-5 A stockbroker has proposed two investments in low E rated corporate bonds paying high interest rates and selling at steep

Please solve WITHOUT EXCEL

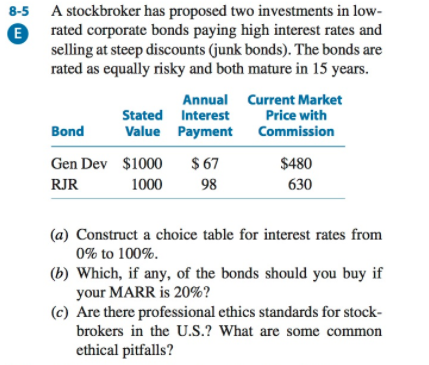

8-5 A stockbroker has proposed two investments in low E rated corporate bonds paying high interest rates and selling at steep discounts (junk bonds). The bonds are rated as equally risky and both mature in 15 years. AnnualCurrent Market Stated Interest Price with Bond Value Payment Commission Gen Dev $1000 $67 RJR $480 630 1000 98 (a) Construct a choice table for interest rates from (b) Which, if any, of the bonds should you buy if (c) Are there professional ethics standards for stock- 0% to 100%. your MARR is 20%? brokers in the U.S.? What are some common ethical pitfalls? 8-5 A stockbroker has proposed two investments in low E rated corporate bonds paying high interest rates and selling at steep discounts (junk bonds). The bonds are rated as equally risky and both mature in 15 years. AnnualCurrent Market Stated Interest Price with Bond Value Payment Commission Gen Dev $1000 $67 RJR $480 630 1000 98 (a) Construct a choice table for interest rates from (b) Which, if any, of the bonds should you buy if (c) Are there professional ethics standards for stock- 0% to 100%. your MARR is 20%? brokers in the U.S.? What are some common ethical pitfalls

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts