Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please somebody do step by step for this problem so i can understand it The stock of Business Adventures sells for $40 a share. Its

Please somebody do step by step for this problem so i can understand it

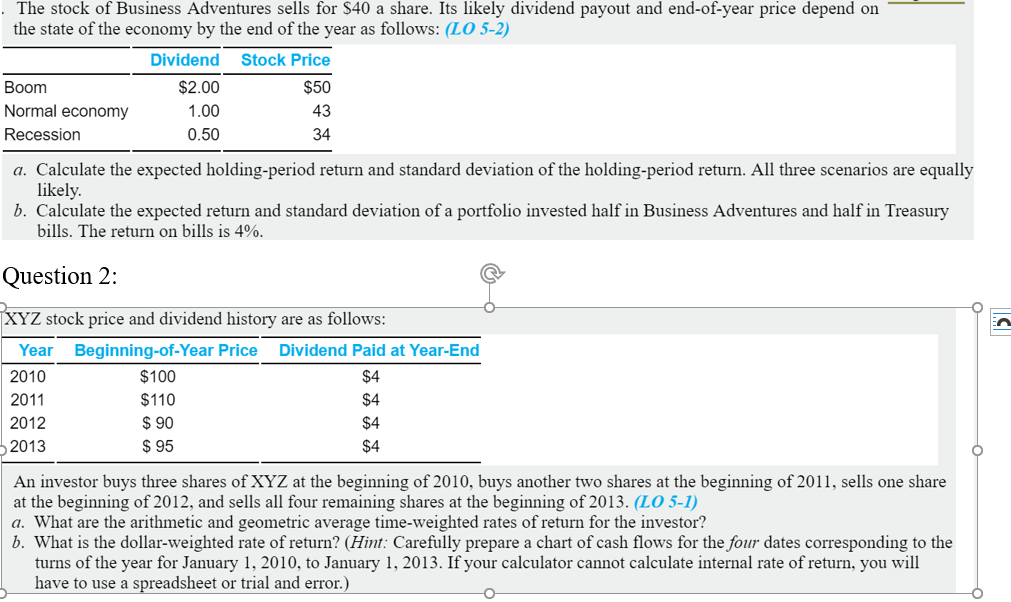

The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: (LO 5-2) Dividend Stock Price Boom $2.00 $50 Normal economy 1.00 43 Recession 0.50 a. Calculate the expected holding-period return and standard deviation of the holding-period return. All three scenarios are equally likely. b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%. Question 2: XYZ stock price and dividend history are as follows: Year Beginning-of-Year Price Dividend Paid at Year-End 2010 $100 2011 $110 2012 $ 90 2013 $4 $ 95 An investor buys three shares of XYZ at the beginning of 2010, buys another two shares at the beginning of 2011, sells one share at the beginning of 2012, and sells all four remaining shares at the beginning of 2013. (LO 5-1) a. What are the arithmetic and geometric average time-weighted rates of return for the investor? b. What is the dollar-weighted rate of return? (Hint: Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2010, to January 1, 2013. If your calculator cannot calculate internal rate of return, you will have to use a spreadsheet or trial and error.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started