Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please someone help!!! Use the Dividend Discount Model to compute the expected price of a stock in 4 years. Each share is expected to pay

please someone help!!!

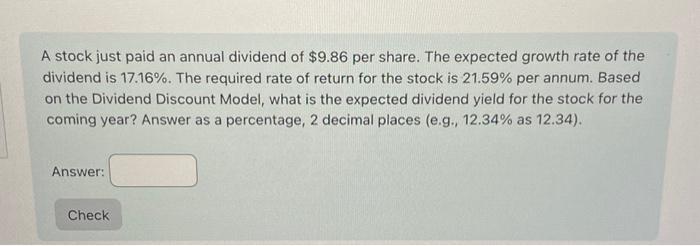

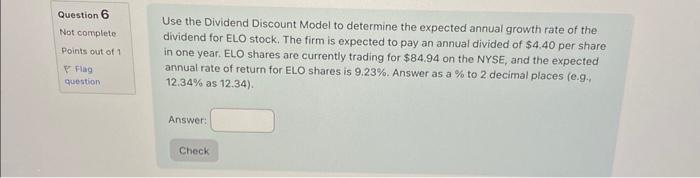

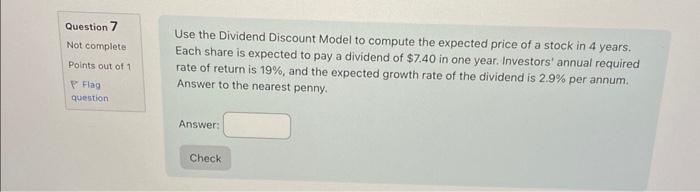

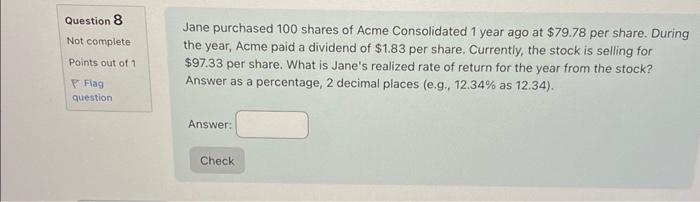

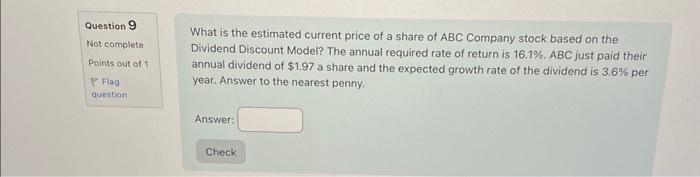

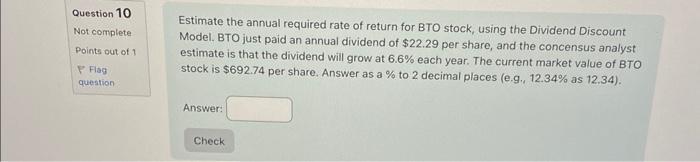

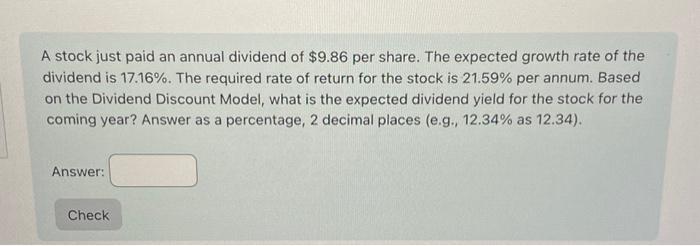

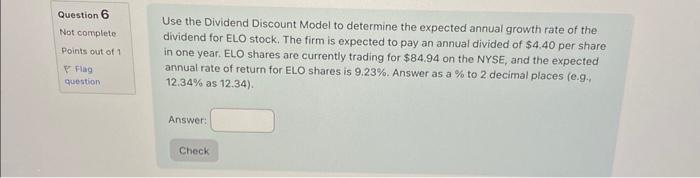

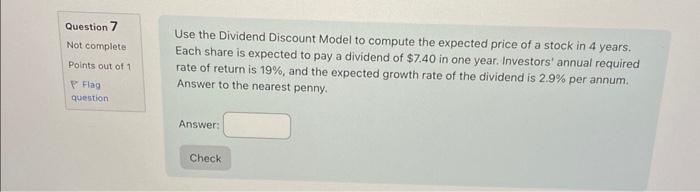

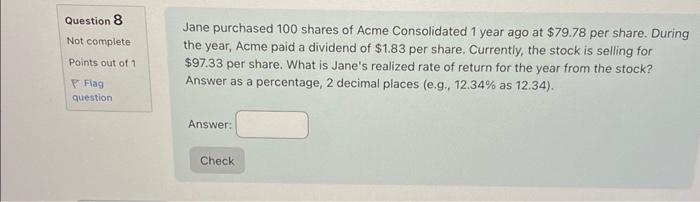

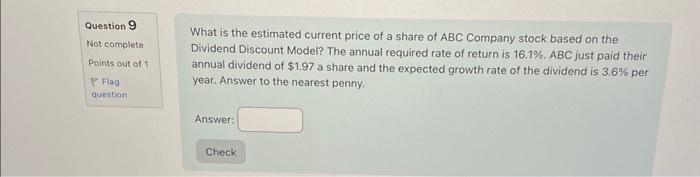

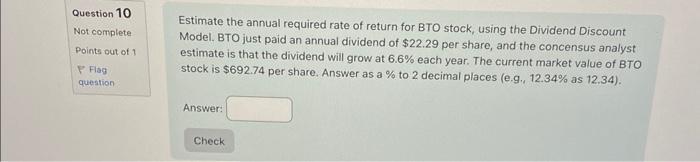

Use the Dividend Discount Model to compute the expected price of a stock in 4 years. Each share is expected to pay a dividend of $7.40 in one year. Investors' annual required rate of return is 19%, and the expected growth rate of the dividend is 2.9% per annum. Answer to the nearest penny. Answer: What is the estimated current price of a share of ABC Company stock based on the Dividend Discount Model? The annual required rate of return is 16.1%. ABC just paid their annual dividend of $1.97 a share and the expected growth rate of the dividend is 3.6% per year. Answer to the nearest penny. Answer: Estimate the annual required rate of return for BTO stock, using the Dividend Discount Model. BTO just paid an annual dividend of $22.29 per share, and the concensus analyst estimate is that the dividend will grow at 6.6% each year. The current market value of BTO stock is $692.74 per share. Answer as a % to 2 decimal places (e.g., 12.34% as 12.34 ). Answer: A stock just paid an annual dividend of $9.86 per share. The expected growth rate of the dividend is 17.16%. The required rate of return for the stock is 21.59% per annum. Based on the Dividend Discount Model, what is the expected dividend yield for the stock for the coming year? Answer as a percentage, 2 decimal places (e.g., 12.34% as 12.34 ). Answer: Question 6 Not complete Points out of 1 P Flag question Use the Dividend Discount Model to determine the expected annual growth rate of the dividend for ELO stock. The firm is expected to pay an annual divided of $4.40 per share in one year. ELO shares are currently trading for $84.94 on the NYSE, and the expected annual rate of return for ELO shares is 9.23%. Answer as a % to 2 decimal places (e.g. 12.34% as 12.34). Answer: Jane purchased 100 shares of Acme Consolidated 1 year ago at $79.78 per share. During the year, Acme paid a dividend of $1.83 per share. Currently, the stock is selling for $97.33 per share. What is Jane's realized rate of return for the year from the stock? Answer as a percentage, 2 decimal places (e.g., 12.34% as 12.34)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started