Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please specific! thanks EXERCISE 8-12 Schedules of Expected Cash Collections and Disbursements; Income Statement; Balance Sheet Beech Corporation is a merchandising company that is preparing

please specific! thanks

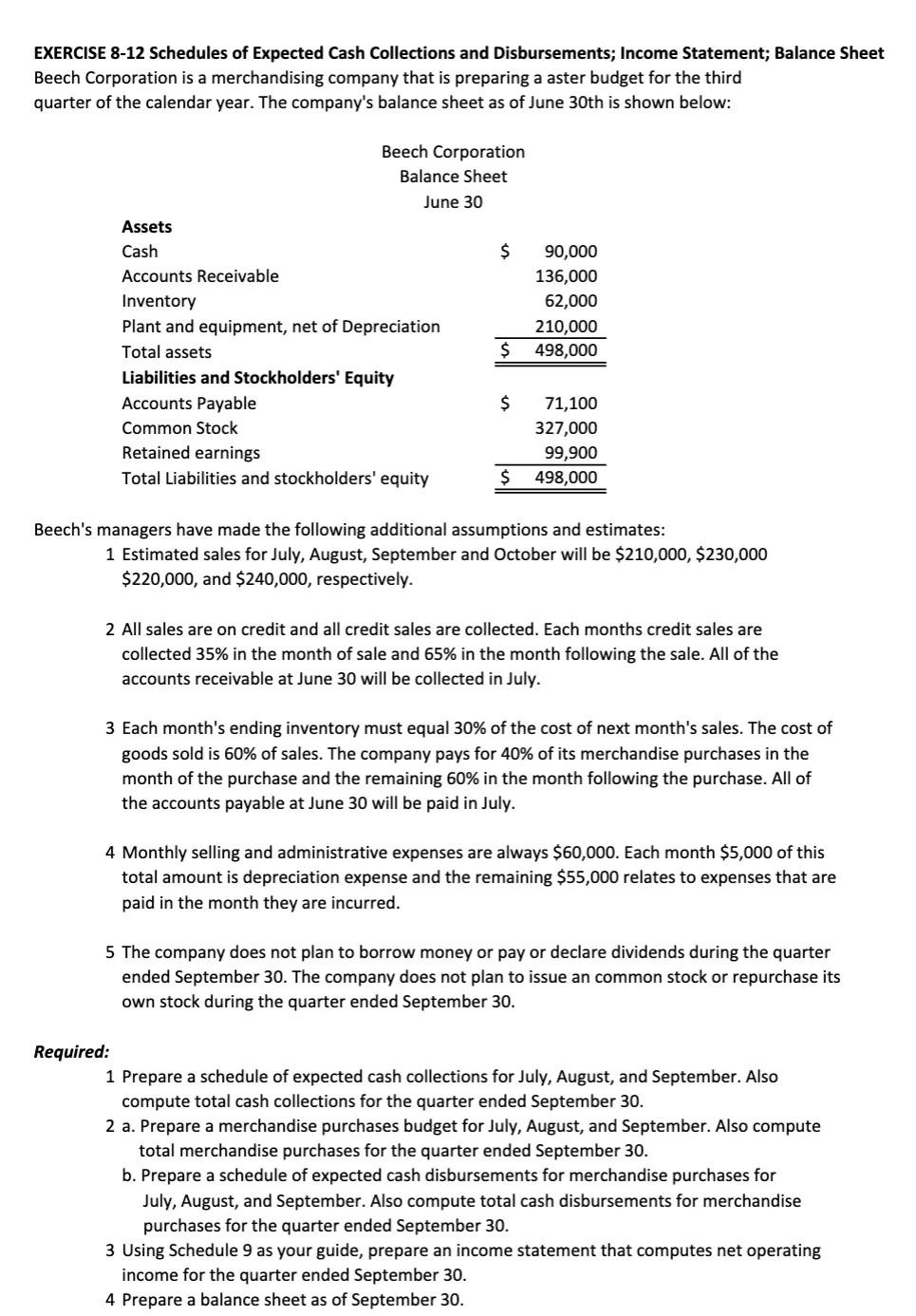

EXERCISE 8-12 Schedules of Expected Cash Collections and Disbursements; Income Statement; Balance Sheet Beech Corporation is a merchandising company that is preparing a aster budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech's managers have made the following additional assumptions and estimates: 1 Estimated sales for July, August, September and October will be $210,000,$230,000 $220,000, and $240,000, respectively. 2 All sales are on credit and all credit sales are collected. Each months credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at June 30 will be collected in July. 3 Each month's ending inventory must equal 30% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at June 30 will be paid in July. 4 Monthly selling and administrative expenses are always $60,000. Each month $5,000 of this total amount is depreciation expense and the remaining $55,000 relates to expenses that are paid in the month they are incurred. 5 The company does not plan to borrow money or pay or declare dividends during the quarter ended September 30 . The company does not plan to issue an common stock or repurchase its own stock during the quarter ended September 30. Required: 1 Prepare a schedule of expected cash collections for July, August, and September. Also compute total cash collections for the quarter ended September 30. 2 a. Prepare a merchandise purchases budget for July, August, and September. Also compute total merchandise purchases for the quarter ended September 30. b. Prepare a schedule of expected cash disbursements for merchandise purchases for July, August, and September. Also compute total cash disbursements for merchandise purchases for the quarter ended September 30. 3 Using Schedule 9 as your guide, prepare an income statement that computes net operating income for the quarter ended September 30. 4 Prepare a balance sheet as of September 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started