Question

Please specify whether the numbers are a credit or a debit Question 1: At December 31, the unadjusted trial balance of H&R Tacks reports Supplies

Please specify whether the numbers are a credit or a debit

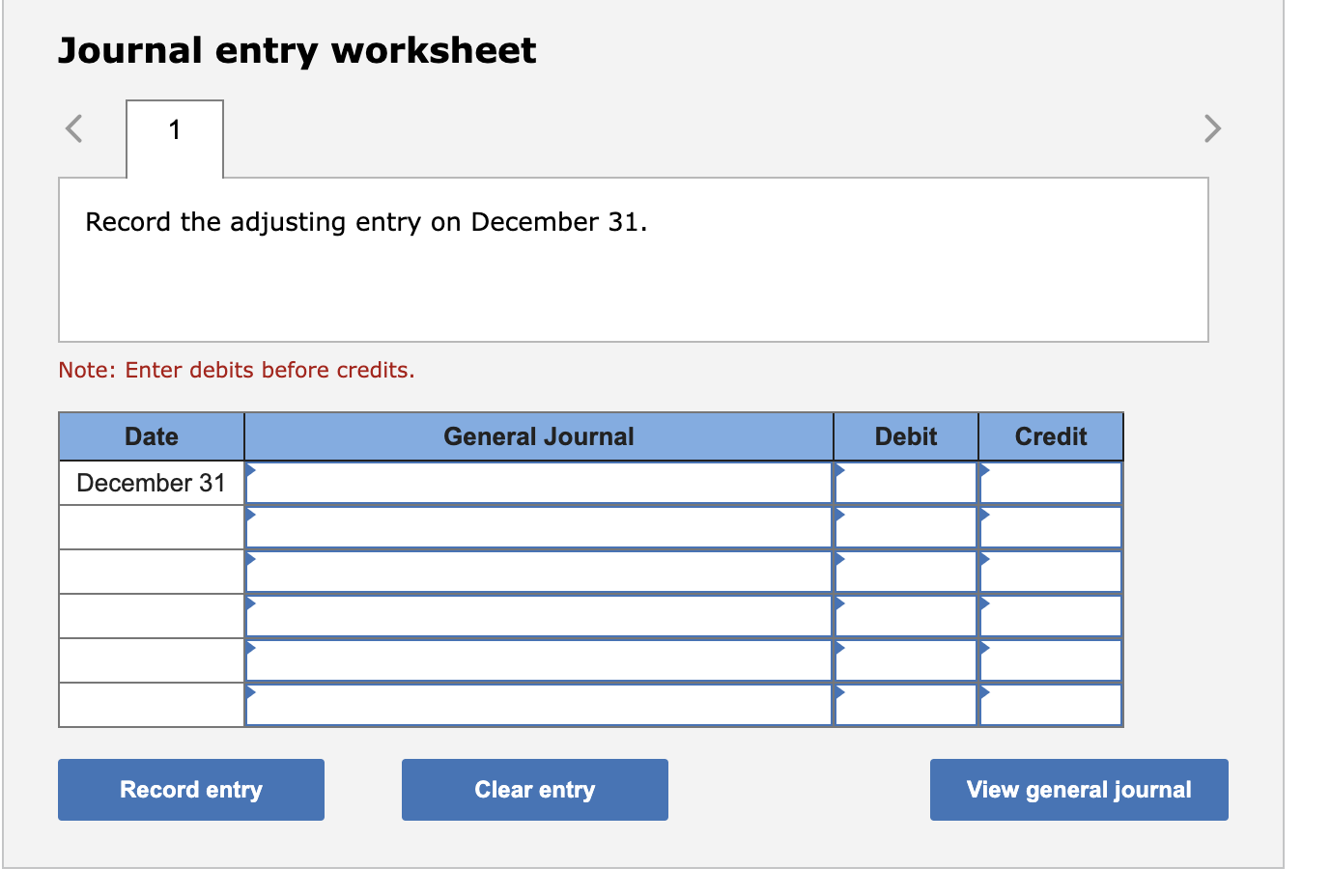

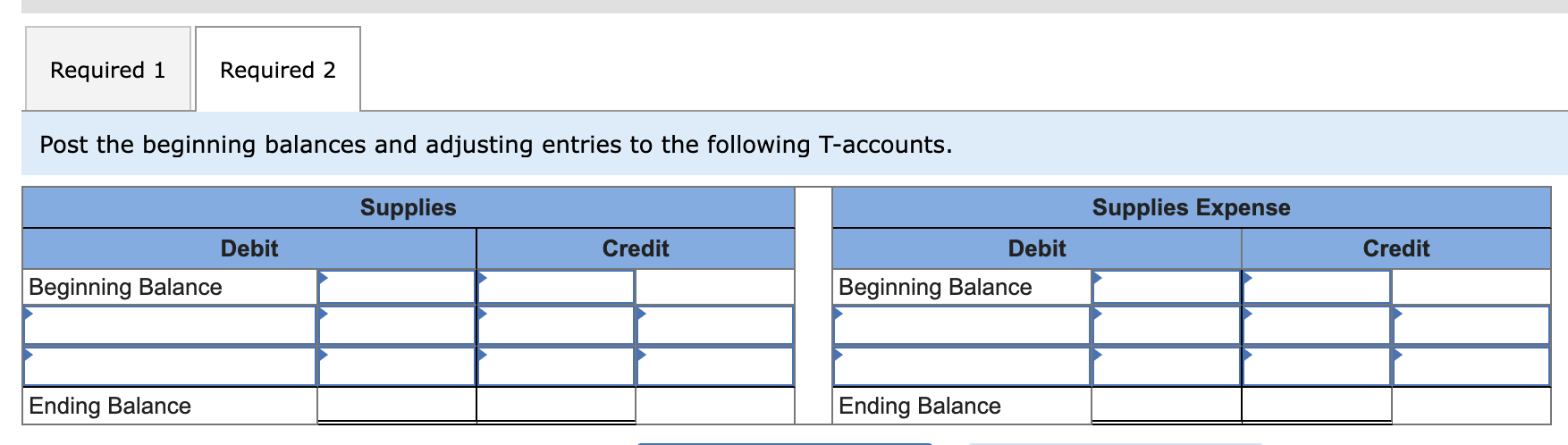

Question 1:

At December 31, the unadjusted trial balance of H&R Tacks reports Supplies of $9,800 and Supplies Expense of $0. On December 31, supplies costing $8,100 are on hand.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

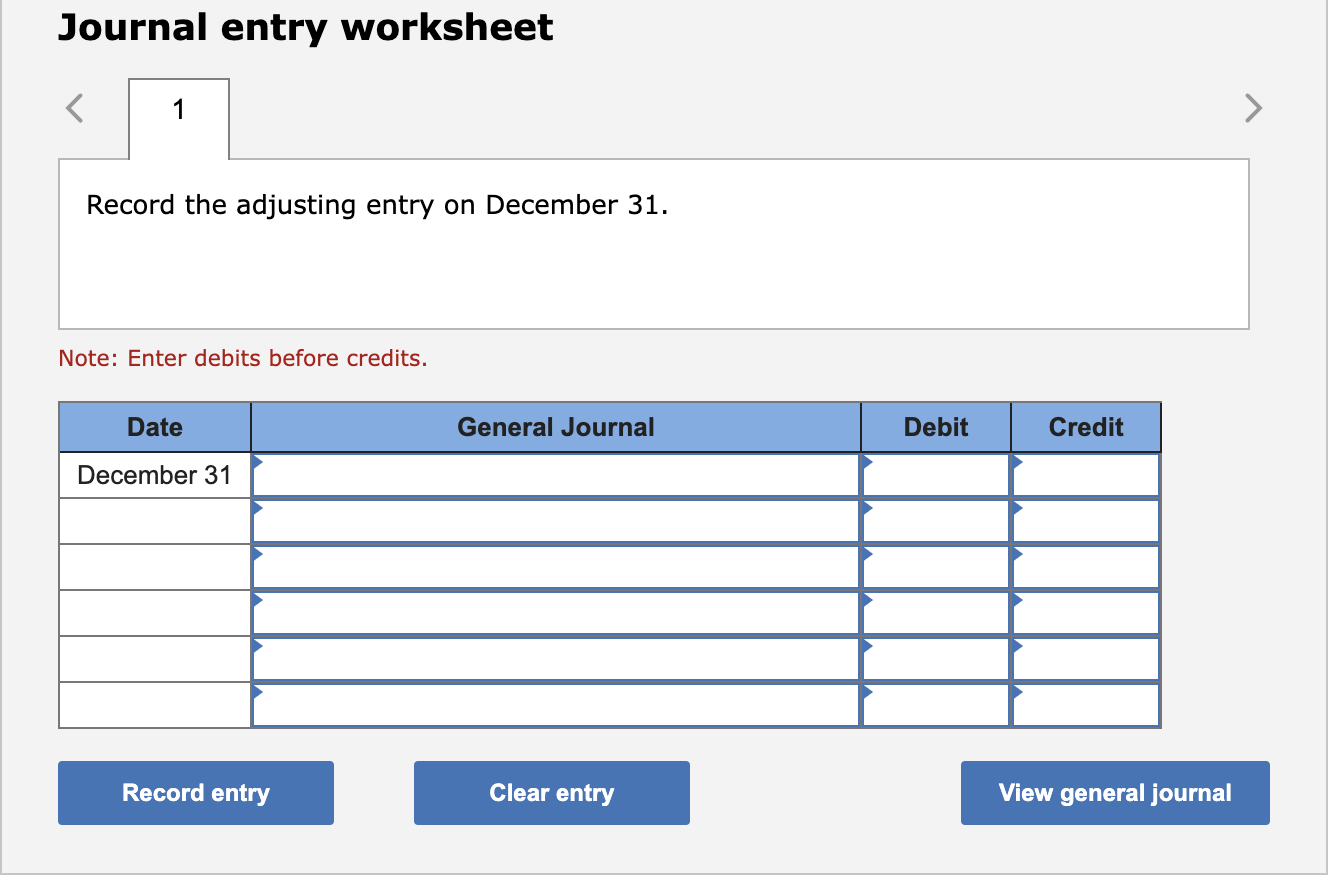

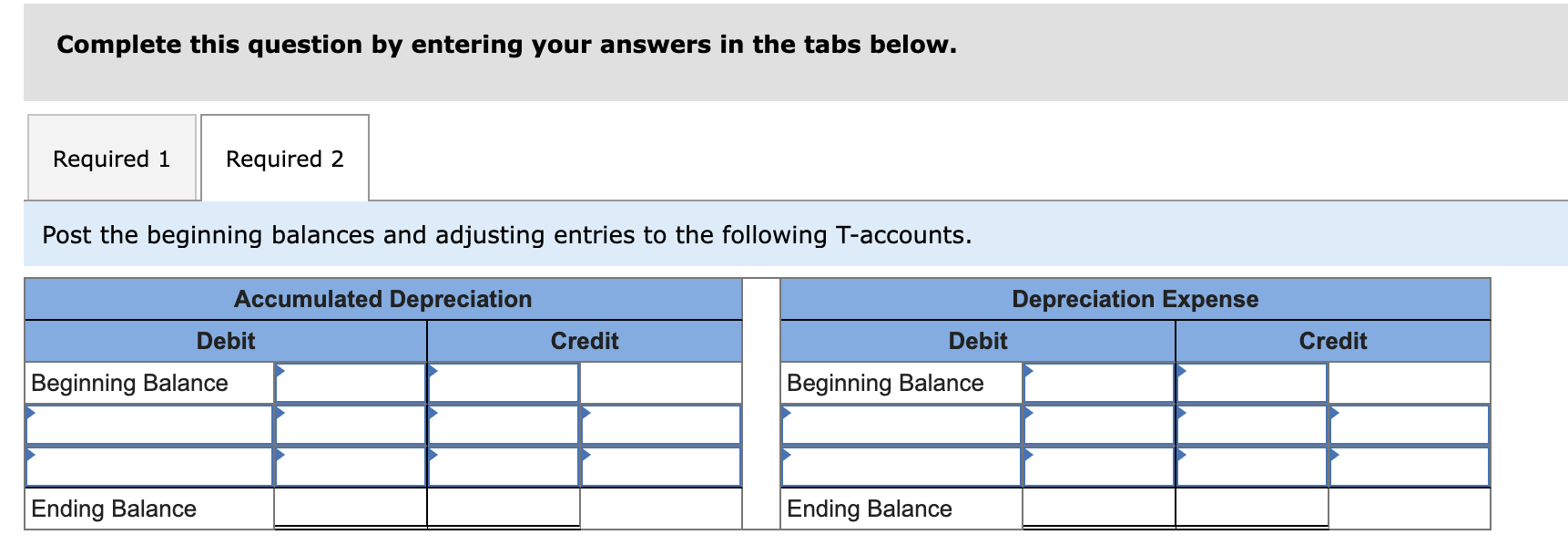

Question 2:

At December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $33,000 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $6,600.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

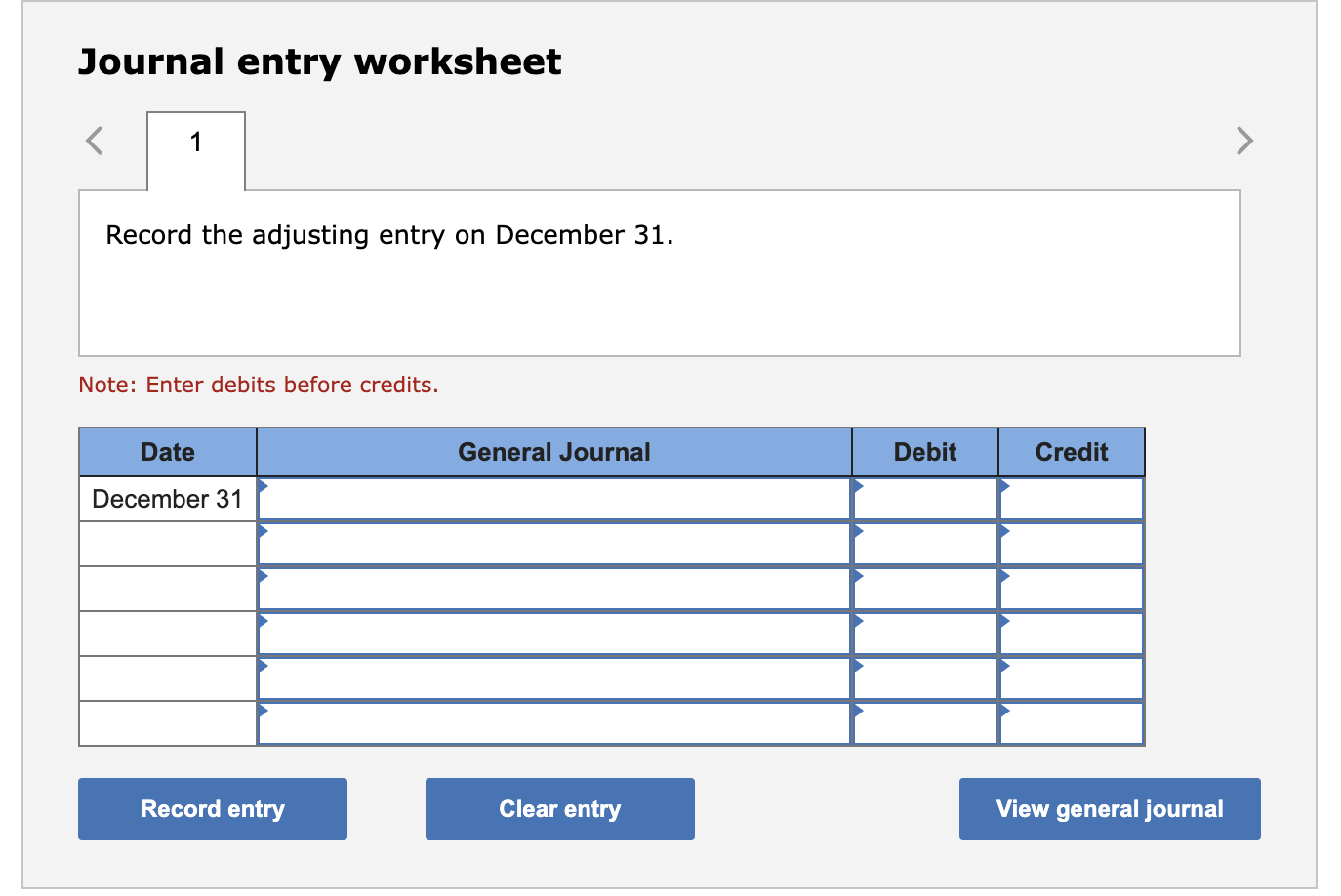

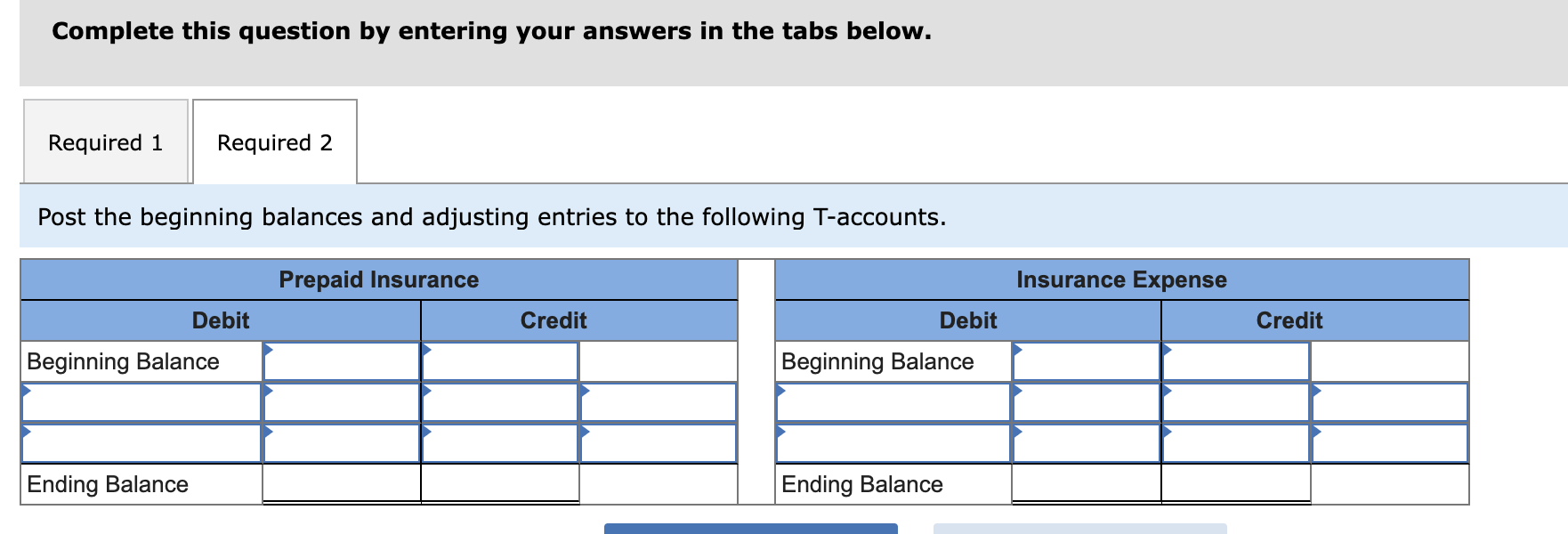

Question 3:

At December 31, the unadjusted trial balance of H&R Tacks reports Prepaid Insurance of $8,160 and Insurance Expense of $0. The insurance was purchased on July 1 and provides coverage for 24 months.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

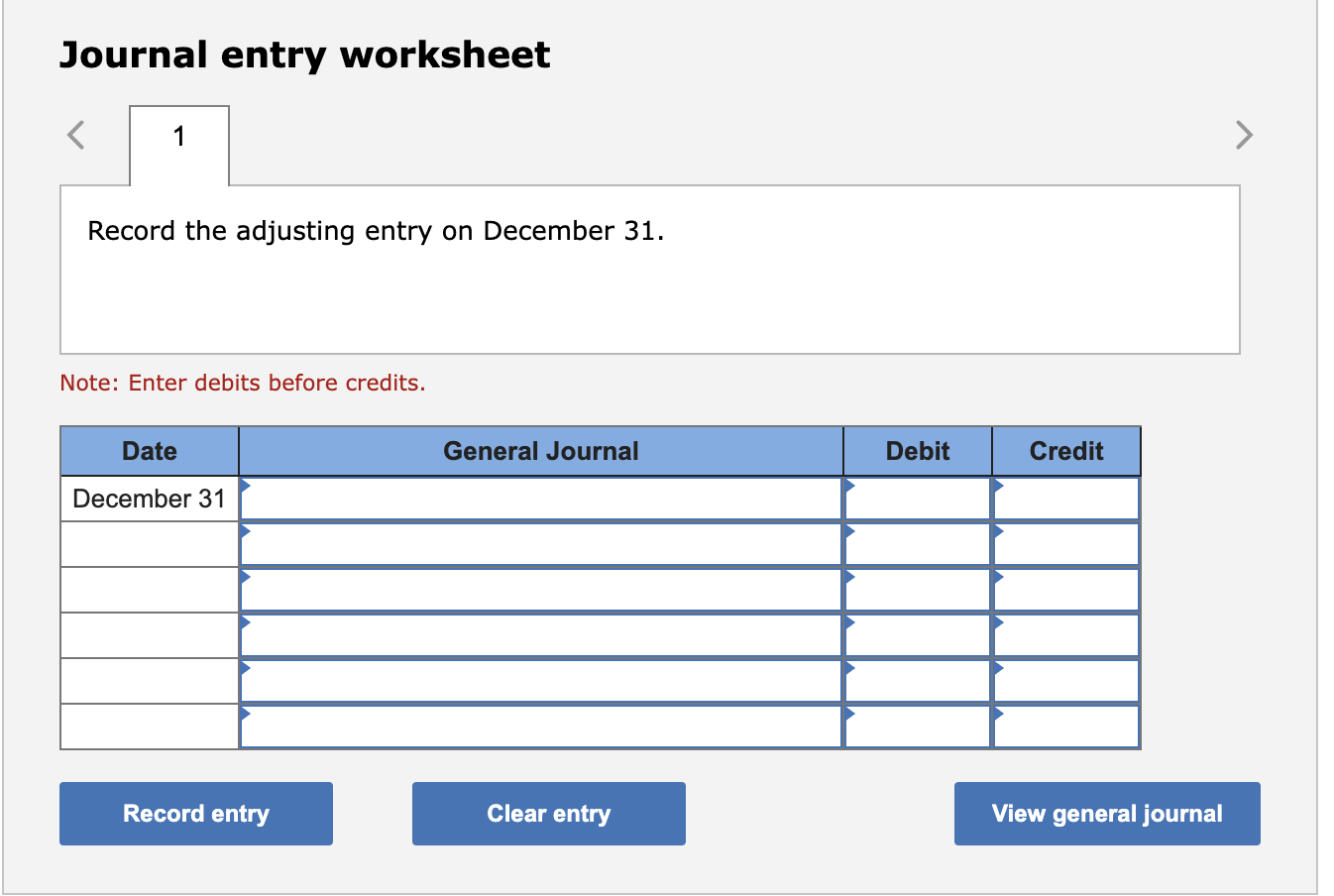

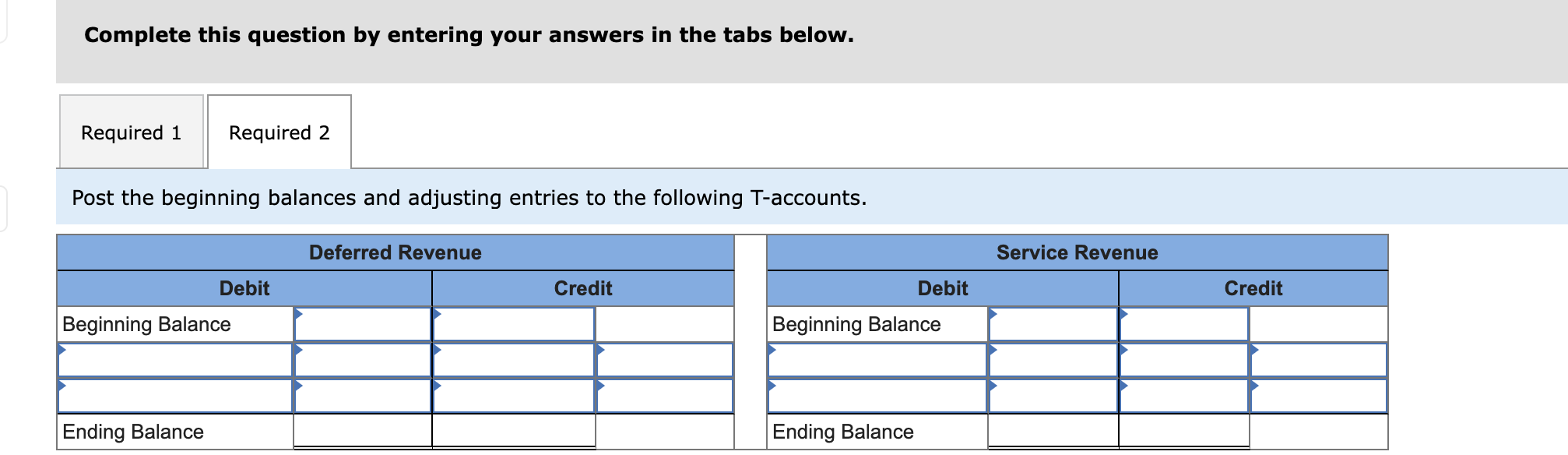

Question 4:

At December 31, the unadjusted trial balance of H&R Tacks reports Deferred Revenue of $4,300 and Service Revenues of $33,100. Obligations for one-half of the deferred revenue have been fulfilled as of December 31.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

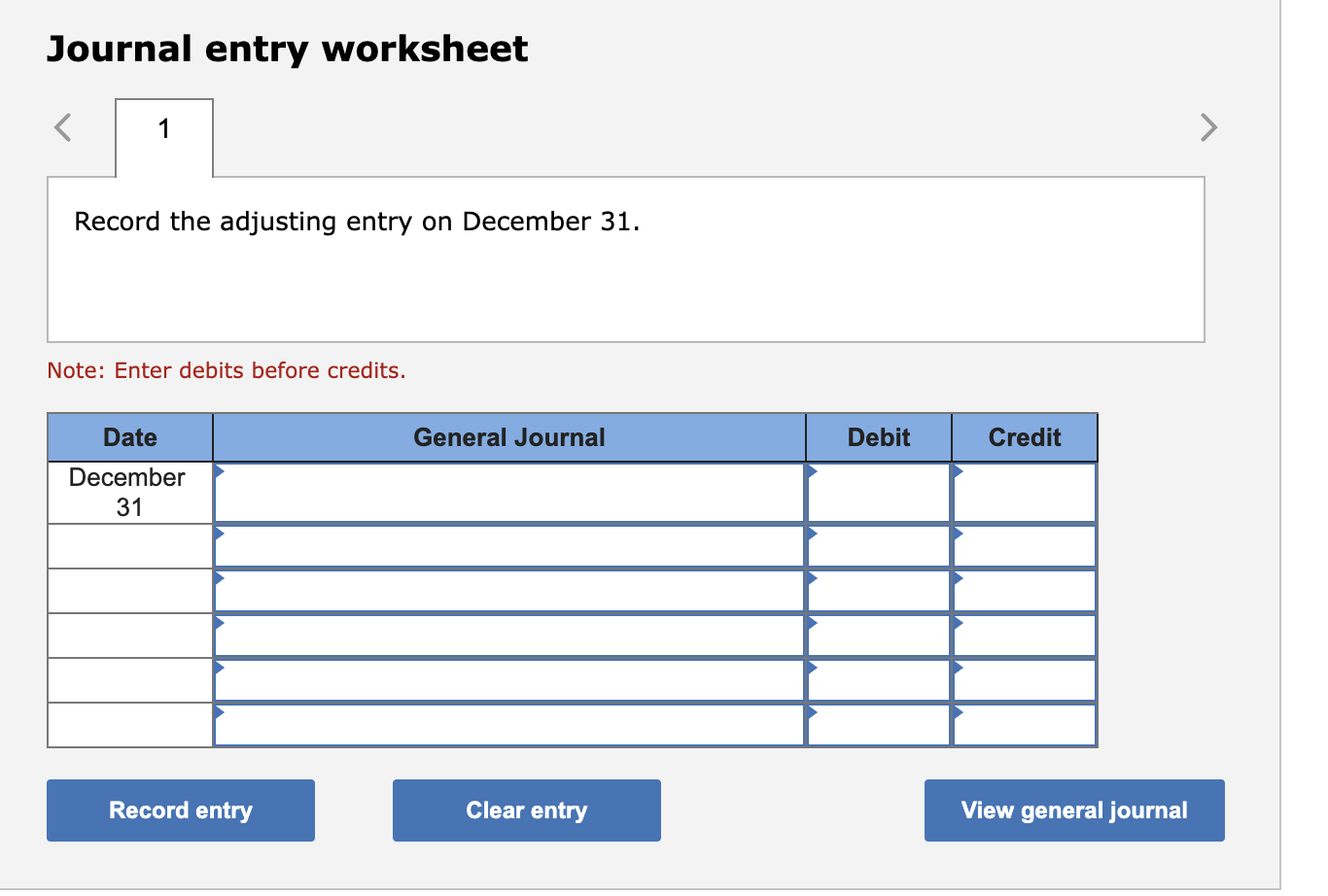

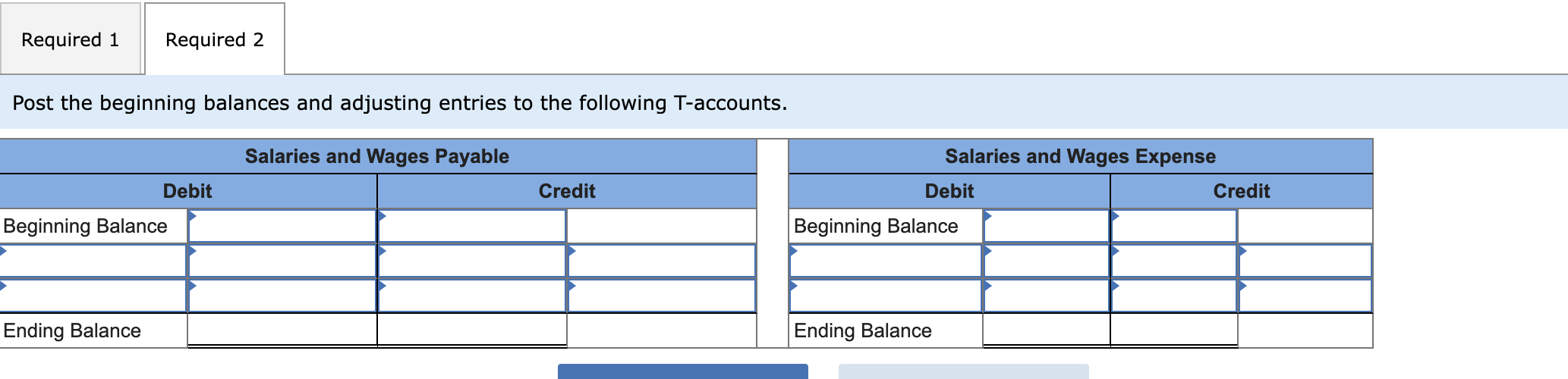

Question 5:

At December 31, the unadjusted trial balance of H&R Tacks reports Salaries and Wages Payable of $0 and Salaries and Wages Expense of $10,000. Employees have been paid for work done up to December 27, but the $1,100 they have earned for December 28 to 31 has not yet been paid or recorded.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

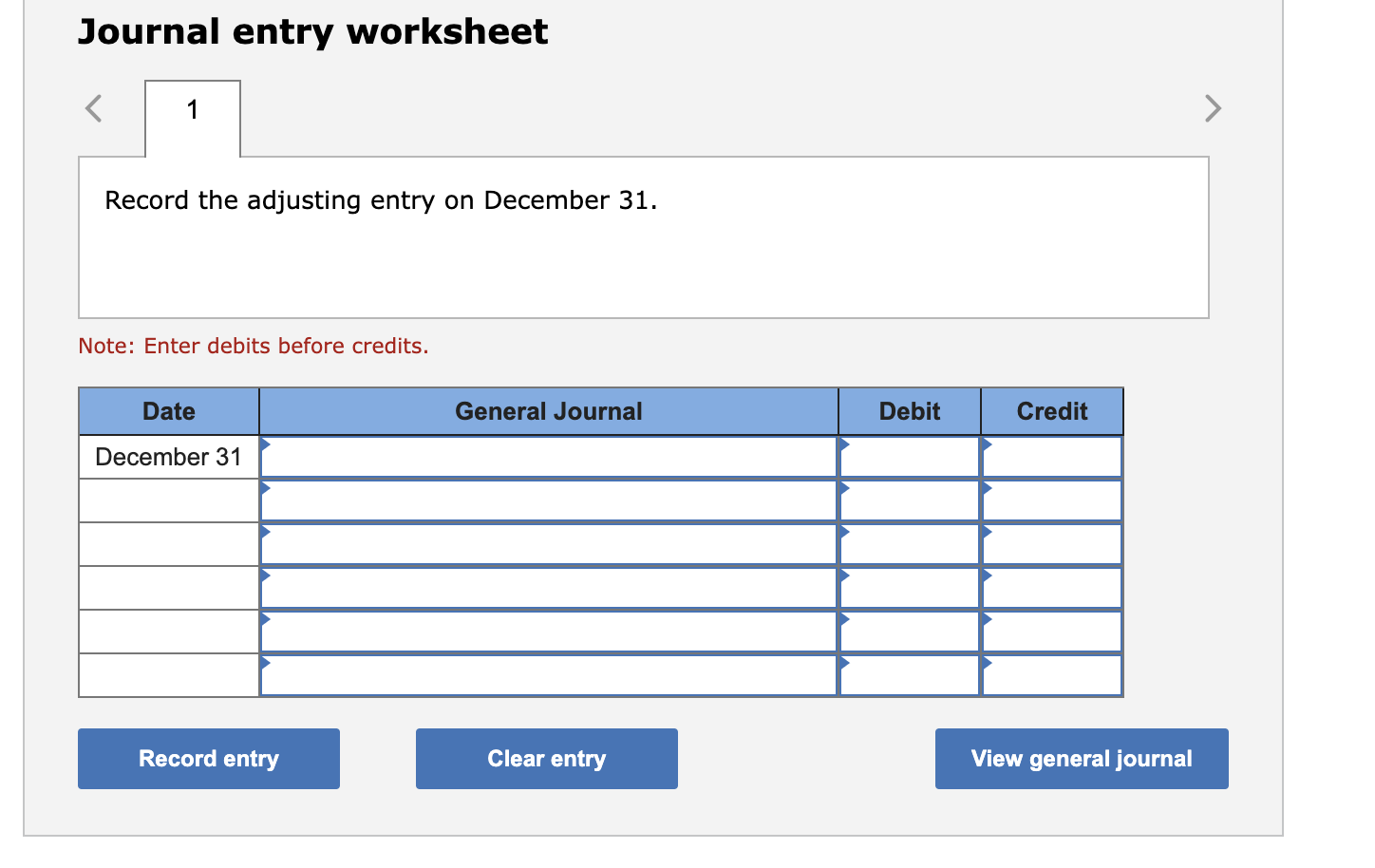

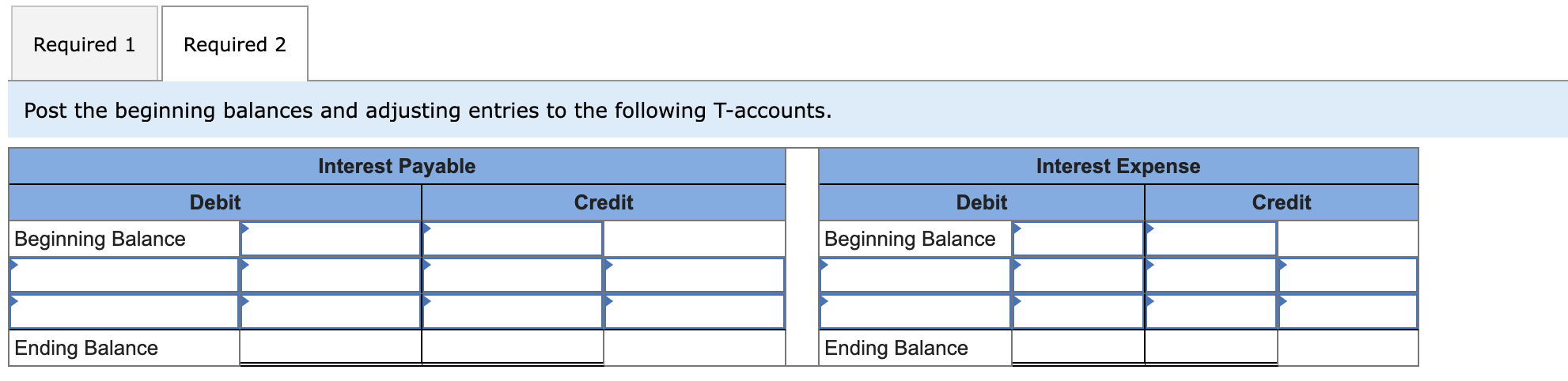

Question 6:

At December 31, the unadjusted trial balance of H&R Tacks reports Interest Payable of $0 and Interest Expense of $0. Interest incurred and owed in December totals $410.

Required:

Prepare the adjusting journal entry on December 31.

Post the beginning balances and adjusting entries to the following T-accounts.

Question 7: (FINAL ONE)

At December 31, the unadjusted trial balance of H&R Tacks reports Software of $23,500 and and zero balances in Accumulated Amortization and Amortization Expense. Amortization for the period is estimated to be $4,700.

Required:

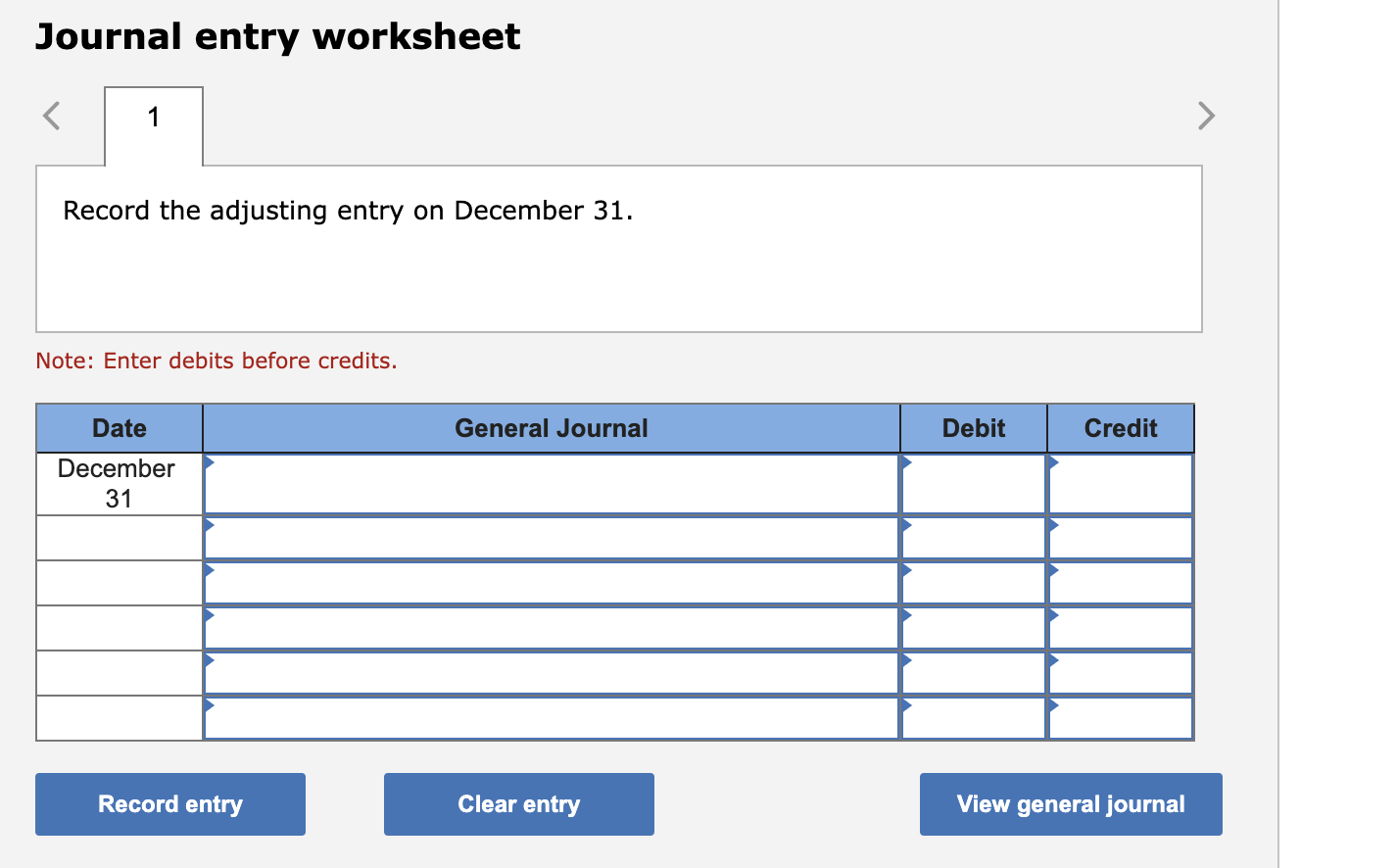

Prepare the adjusting journal entry on December 31.

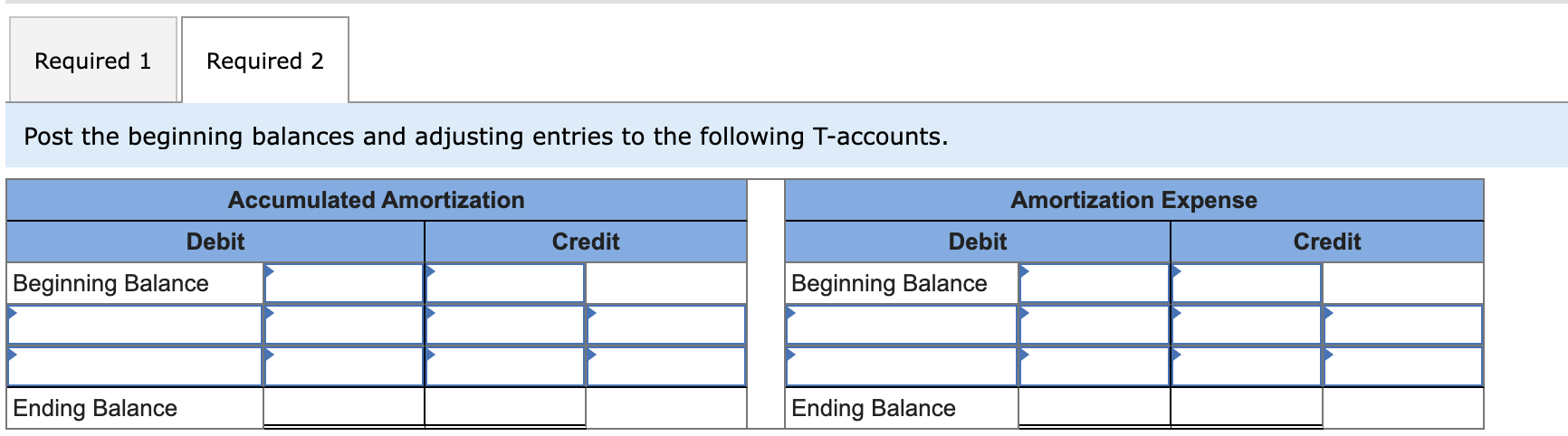

Post the beginning balances and adjusting entries to the following T-accounts.

Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Dost the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31 . Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts

Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Dost the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31 . Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Record the adjusting entry on December 31. Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts. Journal entry worksheet Note: Enter debits before credits. Post the beginning balances and adjusting entries to the following T-accounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started