Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please state if answer is correct if not please correct me Stephen, an unmarried taxpayer filing single with no dependents, has AGI of $610,000 and

Please state if answer is correct if not please correct me

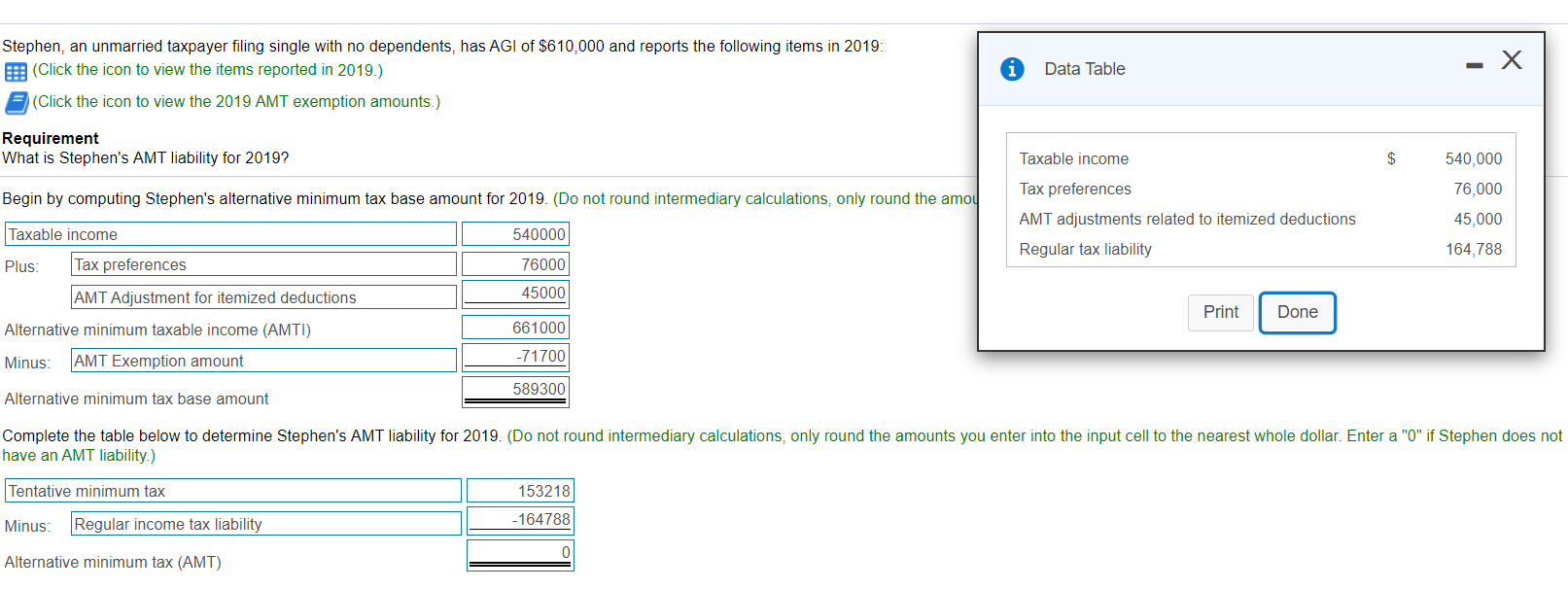

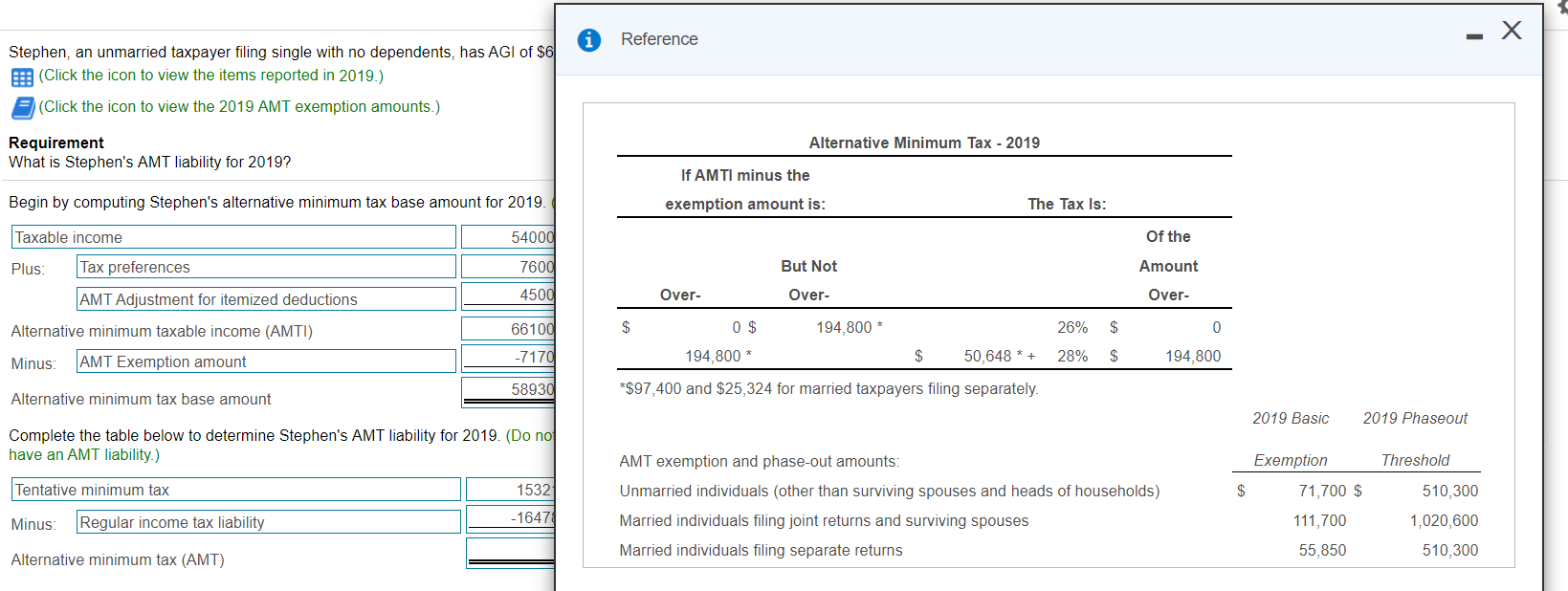

Stephen, an unmarried taxpayer filing single with no dependents, has AGI of $610,000 and reports the following items in 2019: (Click the icon to view the items reported in 2019.) (Click the icon to view the 2019 AMT exemption amounts.) Data Table Requirement What is Stephen's AMT liability for 2019? Taxable income $ 540,000 Begin by computing Stephen's alternative minimum tax base amount for 2019. (Do not round intermediary calculations, only round the amou Tax preferences AMT adjustments related to itemized deductions Regular tax liability 76,000 45,000 164,788 Taxable income 540000 Plus: Tax preferences 76000 AMT Adjustment for itemized deductions 45000 Print Done 661000 Alternative minimum taxable income (AMTI) Minus: AMT Exemption amount -71700 589300 Alternative minimum tax base amount Complete the table below to determine Stephen's AMT liability for 2019. (Do not round intermediary calculations, only round the amounts you enter into the input cell to the nearest whole dollar. Enter a "0" if Stephen does not have an AMT liability.) Tentative minimum tax 153218 Minus: Regular income tax liability -164788 Alternative minimum tax (AMT) Reference Stephen, an unmarried taxpayer filing single with no dependents, has AGI of $6 E: (Click the icon to view the items reported in 2019.) (Click the icon to view the 2019 AMT exemption amounts.) Alternative Minimum Tax - 2019 Requirement What is Stephen's AMT liability for 2019? If AMTI minus the Begin by computing Stephen's alternative minimum tax base amount for 2019. exemption amount is: The Tax ls: 54000 Of the Taxable income Plus: Tax preferences AMT Adjustment for itemized deductions 7600 But Not Amount 4500 Over- Over- Over- 66100 $ 0 $ 194,800 * 26% $ 0 Alternative minimum taxable income (AMTI) Minus: AMT Exemption amount -7170 194,800 * $ 50,648 * + 28% $ 194,800 58930 *$97,400 and $25,324 for married taxpayers filing separately. Alternative minimum tax base amount 2019 Basic 2019 Phaseout Complete the table below to determine Stephen's AMT liability for 2019. (Do no have an AMT liability.) Threshold AMT exemption and phase-out amounts: Unmarried individuals (other than surviving spouses and heads of households) Exemption 71,700 $ Tentative minimum tax 1532 $ 510,300 Minus: Regular income tax liability -1647 111,700 Married individuals filing joint returns and surviving spouses Married individuals filing separate returns 1,020,600 510,300 Alternative minimum tax (AMT) 55,850Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started