Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please step by step teach me how to do this question. (don't use excel) This question is already with correct answer. Practice Problems for Black

Please step by step teach me how to do this question. (don't use excel)

This question is already with correct answer.

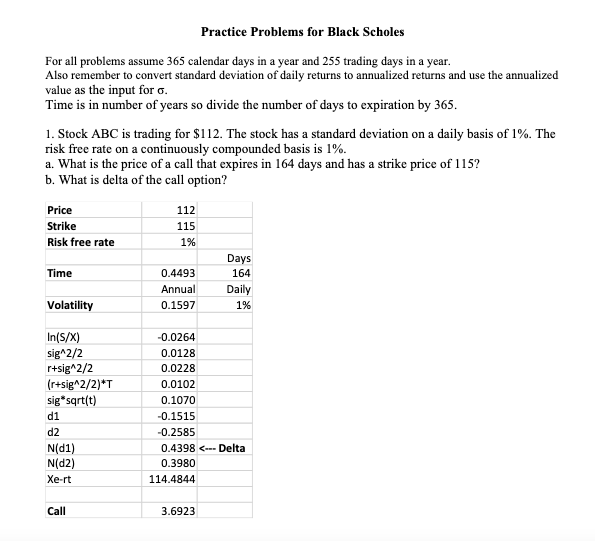

Practice Problems for Black Scholes For all problems assume 365 calendar days in a year and 255 trading days in a year. Also remember to convert standard deviation of daily returns to annualized returns and use the annualized value as the input for . Time is in number of years so divide the number of days to expiration by 365 . 1. Stock ABC is trading for $112. The stock has a standard deviation on a daily basis of 1%. The risk free rate on a continuously compounded basis is 1%. a. What is the price of a call that expires in 164 days and has a strike price of 115? b. What is delta of the call optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started