Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please stop answering my questions incorrectly. do not complete my question if you do not do it right. please make sure to understand it before

please stop answering my questions incorrectly. do not complete my question if you do not do it right. please make sure to understand it before just giving me whatever answer.

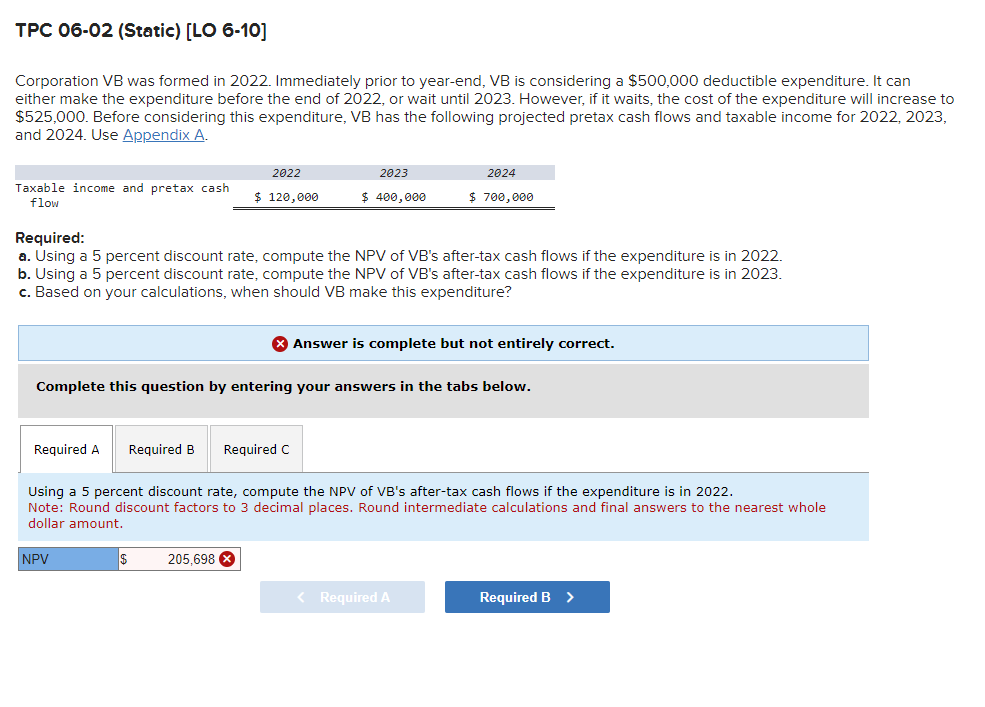

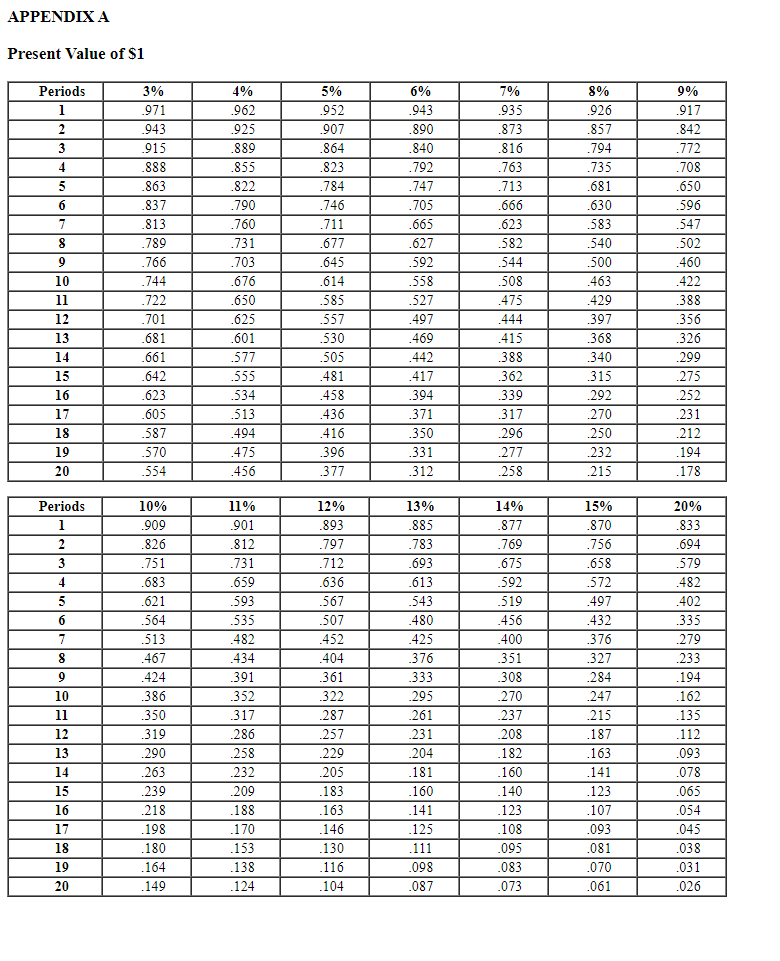

Corporation VB was formed in 2022. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2022 , or wait until 2023 . However, if it waits, the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pretax cash flows and taxable income for 2022,2023 , and 2024. Use Appendix A. Required: a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2022. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2023. c. Based on your calculations, when should VB make this expenditure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2022. Note: Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Present Value of $1 Corporation VB was formed in 2022. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2022 , or wait until 2023 . However, if it waits, the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pretax cash flows and taxable income for 2022,2023 , and 2024. Use Appendix A. Required: a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2022. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2023. c. Based on your calculations, when should VB make this expenditure? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2022. Note: Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Present Value of $1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started