Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please submit a scanned or photographed copy of your carefully hand-written solutions to the Topic 6 homework problems. (If you take photographs of individual pages

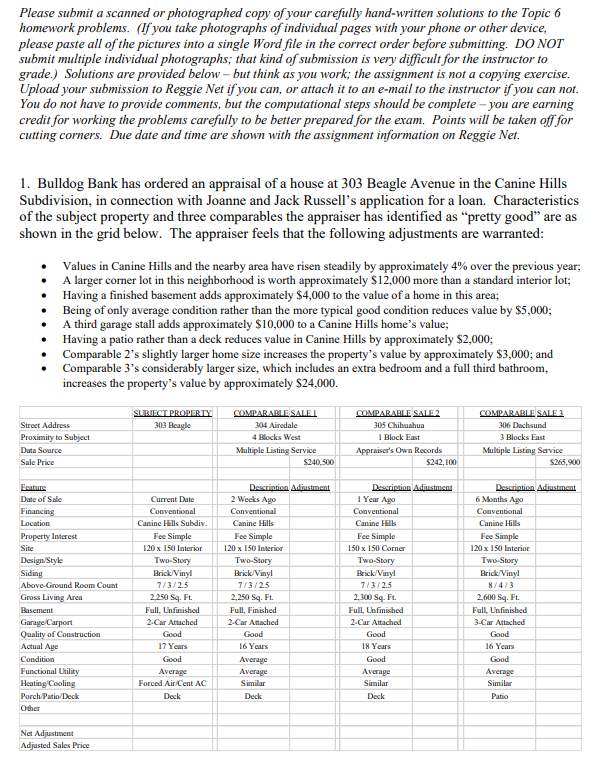

Please submit a scanned or photographed copy of your carefully hand-written solutions to the Topic 6 homework problems. (If you take photographs of individual pages with your phone or other device, please paste all of the pictures into a single Word file in the correct order before submitting. DO NOT submit multiple individual photographs; that kind of submission is very difficult for the instructor to grade.) Solutions are provided below - but think as you work; the assignment is not a copying exercise. Upload your submission to Reggie Net if you can, or attach it to an e-mail to the instructor if you can not. You do not have to provide comments, but the computational steps should be complete - you are earning credit for working the problems carefully to be better prepared for the exam. Points will be taken off for cutting corners. Due date and time are shown with the assignment information on Reggie Net. 1. Bulldog Bank has ordered an appraisal of a house at 303 Beagle Avenue in the Canine Hills Subdivision, in connection with Joanne and Jack Russell's application for a loan. Characteristics of the subject property and three comparables the appraiser has identified as "pretty good" are as shown in the grid below. The appraiser feels that the following adjustments are warranted: - Values in Canine Hills and the nearby area have risen steadily by approximately 4% over the previous year; - A larger corner lot in this neighborhood is worth approximately $12,000 more than a standard interior lot; - Having a finished basement adds approximately $4,000 to the value of a home in this area; - Being of only average condition rather than the more typical good condition reduces value by $5,000; - A third garage stall adds approximately $10,000 to a Canine Hills home's value; - Having a patio rather than a deck reduces value in Canine Hills by approximately $2,000; - Comparable 2's slightly larger home size increases the property's value by approximately $3,000; and - Comparable 3's considerably larger size, which includes an extra bedroom and a full third bathroom, increases the property's value by approximately $24,000. (No adjustment should be made for Comparable 1's sale date since it was so recent, and no adjustments for location or age are needed because the comparables all are in the same subdivision, within a few blocks of the subject, and all very close in age.) Use the Sales Comparison Approach, and the "squared adjustment weighting technique" explained in our Topic 6 outline, to estimate the subject property's indicated market value. 2. A large parcel of real estate near downtown Reggieville is zoned for commercial use. But at this time there is an older duplex (two-unit residential property) on the lot that people are paying rent to live in. A landlord looking to buy an older duplex of this quality in a similar location would be willing to pay as much as $122,000. If the land were vacant it could be sold to a commercial developer for $135,000. But the land is not vacant, and it would cost $9,500 to demolish the structure and make the land ready to build on. What is the property's highest and best use (HBU)? What would HBU be if a residential landlord would pay up to $129,000 ? 3. You are asked to estimate the market value of a vacant lot in Hook Slice Acres residential subdivision. This parcel is 110 feet wide and 130 feet deep, and is not located on the golf course that Hook Slice Acres surrounds. You find information on three reasonably similar lots in the same subdivision that have sold somewhat recently in arm's length transactions. Comparable 1 , which is 100 feet wide and 130 feet deep and also is not on the golf course, was sold just one week ago for $89,000. Comparable 2, also 100 feet wide and 130 feet deep, and also not on the golf course, was sold approximately a year ago for $82,000. Finally Comparable 3 , which is 90 feet wide and 130 feet deep and has direct frontage on the golf course, was sold six months ago for $95,000. Using the sales comparison approach with proper adjustments, estimate the subject lot's market value. 4. You are appraising a small apartment complex that is several years old. A local contractor estimates the cost today of constructing buildings that are similar in size and general amenities to be $1,150,000. You believe that the structures suffer from $57,000 in curable physical deterioration (cost to complete some needed roof repairs, painting, and caulking), and that general aging has left the buildings with incurable physical deterioration equal to 9% of the expected cost of new replacements. You also believe there is $45,000 in incurable functional obsolescence from the lack of a place to put laundry facilities on site. There is no locational obsolescence, as the surrounding neighborhood consists primarily of small apartment properties. If you estimate the land value to be $218,000, what is your estimate of the property's market value under the Cost Approach? 5. You are asked to appraise a 32,000 square foot warehouse in Redbird Heights, home to a number of small warehouses that are generally similar in age and size. This subject property generated \$295,500 in gross rental revenue for its owner in the most recent year. You choose three recent warehouse sales to use as comparables in computing a gross income multiplier. 28,000 square foot Warehouse A generated $257,000 in gross rental income in the most recent year, and it sold recently for $1,320,000. Warehouse B, with 34,250 square feet of area and gross income in the most recent year of $315,000, sold for $1,588,750; and Warehouse C,32,500 square feet in size and with $276,000 in recent annual gross income, sold for $1,375,000. What is the subject property's indicated market value, based on gross income multiplier analysis. 6. Now assume that the appraiser in the previous problem puts effort into determining operating expense information for the three recently sold comparable warehouses, because she fears that the subject property would be more expensive to operate than the three comparables would be. The resulting stabilized net operating income measures for the three are $148,750 for A; $177,500 for B; and $158,860 for C. The subject warehouse property's stabilized NOI should be $162,140. Compute the net income multiplier (and its reciprocal, the overall capitalization rate) indicated by these transactions and estimate the subject property's market value with direct Net Income Capitalization analysis. 7. Think of a house you know reasonably well. (It does not have to be your family's home, and all you need identify when you hand the assignment in is the town where the house is located.) Find the estimated value on three web sites that provide free estimates without requiring you to give e-mail or other contact information; at the time of this writing EZhouseprices, Fast Expert, HomeGain, and Trulia are among sites that require you to tell them things about yourself. Sites that give a value estimate (or at least value range) while asking only for the property address, at the time of this writing, include Bank of America Real Estate Center, Chase Mortgage Services, ForSaleByOwner, Penny Mac, Realtor.com, Redfin, Re/Max, Rocket Homes, Zillow (Eppraisal and Nerd Wallet just give the Zillow "Zestimate"), and Zip Realty. Some show pictures; neat but kind of scary from a privacy standpoint. There may be houses for which some sites lack information, so you may have to try a second or third choice of subject house. Then write a brief paragraph summarizing the following: - the value, or value range, each site provided (do not print out and hand in web pages), - whether the sites you used seem to do a good job of estimating what you perceive the true market value to be, - how the estimate was determined, if clearly explained on the site (if not then just say that it is not clear), and - whether you find these sites to be useful informational tools or more a form of entertainment. Please submit a scanned or photographed copy of your carefully hand-written solutions to the Topic 6 homework problems. (If you take photographs of individual pages with your phone or other device, please paste all of the pictures into a single Word file in the correct order before submitting. DO NOT submit multiple individual photographs; that kind of submission is very difficult for the instructor to grade.) Solutions are provided below - but think as you work; the assignment is not a copying exercise. Upload your submission to Reggie Net if you can, or attach it to an e-mail to the instructor if you can not. You do not have to provide comments, but the computational steps should be complete - you are earning credit for working the problems carefully to be better prepared for the exam. Points will be taken off for cutting corners. Due date and time are shown with the assignment information on Reggie Net. 1. Bulldog Bank has ordered an appraisal of a house at 303 Beagle Avenue in the Canine Hills Subdivision, in connection with Joanne and Jack Russell's application for a loan. Characteristics of the subject property and three comparables the appraiser has identified as "pretty good" are as shown in the grid below. The appraiser feels that the following adjustments are warranted: - Values in Canine Hills and the nearby area have risen steadily by approximately 4% over the previous year; - A larger corner lot in this neighborhood is worth approximately $12,000 more than a standard interior lot; - Having a finished basement adds approximately $4,000 to the value of a home in this area; - Being of only average condition rather than the more typical good condition reduces value by $5,000; - A third garage stall adds approximately $10,000 to a Canine Hills home's value; - Having a patio rather than a deck reduces value in Canine Hills by approximately $2,000; - Comparable 2's slightly larger home size increases the property's value by approximately $3,000; and - Comparable 3's considerably larger size, which includes an extra bedroom and a full third bathroom, increases the property's value by approximately $24,000. (No adjustment should be made for Comparable 1's sale date since it was so recent, and no adjustments for location or age are needed because the comparables all are in the same subdivision, within a few blocks of the subject, and all very close in age.) Use the Sales Comparison Approach, and the "squared adjustment weighting technique" explained in our Topic 6 outline, to estimate the subject property's indicated market value. 2. A large parcel of real estate near downtown Reggieville is zoned for commercial use. But at this time there is an older duplex (two-unit residential property) on the lot that people are paying rent to live in. A landlord looking to buy an older duplex of this quality in a similar location would be willing to pay as much as $122,000. If the land were vacant it could be sold to a commercial developer for $135,000. But the land is not vacant, and it would cost $9,500 to demolish the structure and make the land ready to build on. What is the property's highest and best use (HBU)? What would HBU be if a residential landlord would pay up to $129,000 ? 3. You are asked to estimate the market value of a vacant lot in Hook Slice Acres residential subdivision. This parcel is 110 feet wide and 130 feet deep, and is not located on the golf course that Hook Slice Acres surrounds. You find information on three reasonably similar lots in the same subdivision that have sold somewhat recently in arm's length transactions. Comparable 1 , which is 100 feet wide and 130 feet deep and also is not on the golf course, was sold just one week ago for $89,000. Comparable 2, also 100 feet wide and 130 feet deep, and also not on the golf course, was sold approximately a year ago for $82,000. Finally Comparable 3 , which is 90 feet wide and 130 feet deep and has direct frontage on the golf course, was sold six months ago for $95,000. Using the sales comparison approach with proper adjustments, estimate the subject lot's market value. 4. You are appraising a small apartment complex that is several years old. A local contractor estimates the cost today of constructing buildings that are similar in size and general amenities to be $1,150,000. You believe that the structures suffer from $57,000 in curable physical deterioration (cost to complete some needed roof repairs, painting, and caulking), and that general aging has left the buildings with incurable physical deterioration equal to 9% of the expected cost of new replacements. You also believe there is $45,000 in incurable functional obsolescence from the lack of a place to put laundry facilities on site. There is no locational obsolescence, as the surrounding neighborhood consists primarily of small apartment properties. If you estimate the land value to be $218,000, what is your estimate of the property's market value under the Cost Approach? 5. You are asked to appraise a 32,000 square foot warehouse in Redbird Heights, home to a number of small warehouses that are generally similar in age and size. This subject property generated \$295,500 in gross rental revenue for its owner in the most recent year. You choose three recent warehouse sales to use as comparables in computing a gross income multiplier. 28,000 square foot Warehouse A generated $257,000 in gross rental income in the most recent year, and it sold recently for $1,320,000. Warehouse B, with 34,250 square feet of area and gross income in the most recent year of $315,000, sold for $1,588,750; and Warehouse C,32,500 square feet in size and with $276,000 in recent annual gross income, sold for $1,375,000. What is the subject property's indicated market value, based on gross income multiplier analysis. 6. Now assume that the appraiser in the previous problem puts effort into determining operating expense information for the three recently sold comparable warehouses, because she fears that the subject property would be more expensive to operate than the three comparables would be. The resulting stabilized net operating income measures for the three are $148,750 for A; $177,500 for B; and $158,860 for C. The subject warehouse property's stabilized NOI should be $162,140. Compute the net income multiplier (and its reciprocal, the overall capitalization rate) indicated by these transactions and estimate the subject property's market value with direct Net Income Capitalization analysis. 7. Think of a house you know reasonably well. (It does not have to be your family's home, and all you need identify when you hand the assignment in is the town where the house is located.) Find the estimated value on three web sites that provide free estimates without requiring you to give e-mail or other contact information; at the time of this writing EZhouseprices, Fast Expert, HomeGain, and Trulia are among sites that require you to tell them things about yourself. Sites that give a value estimate (or at least value range) while asking only for the property address, at the time of this writing, include Bank of America Real Estate Center, Chase Mortgage Services, ForSaleByOwner, Penny Mac, Realtor.com, Redfin, Re/Max, Rocket Homes, Zillow (Eppraisal and Nerd Wallet just give the Zillow "Zestimate"), and Zip Realty. Some show pictures; neat but kind of scary from a privacy standpoint. There may be houses for which some sites lack information, so you may have to try a second or third choice of subject house. Then write a brief paragraph summarizing the following: - the value, or value range, each site provided (do not print out and hand in web pages), - whether the sites you used seem to do a good job of estimating what you perceive the true market value to be, - how the estimate was determined, if clearly explained on the site (if not then just say that it is not clear), and - whether you find these sites to be useful informational tools or more a form of entertainment

Please submit a scanned or photographed copy of your carefully hand-written solutions to the Topic 6 homework problems. (If you take photographs of individual pages with your phone or other device, please paste all of the pictures into a single Word file in the correct order before submitting. DO NOT submit multiple individual photographs; that kind of submission is very difficult for the instructor to grade.) Solutions are provided below - but think as you work; the assignment is not a copying exercise. Upload your submission to Reggie Net if you can, or attach it to an e-mail to the instructor if you can not. You do not have to provide comments, but the computational steps should be complete - you are earning credit for working the problems carefully to be better prepared for the exam. Points will be taken off for cutting corners. Due date and time are shown with the assignment information on Reggie Net. 1. Bulldog Bank has ordered an appraisal of a house at 303 Beagle Avenue in the Canine Hills Subdivision, in connection with Joanne and Jack Russell's application for a loan. Characteristics of the subject property and three comparables the appraiser has identified as "pretty good" are as shown in the grid below. The appraiser feels that the following adjustments are warranted: - Values in Canine Hills and the nearby area have risen steadily by approximately 4% over the previous year; - A larger corner lot in this neighborhood is worth approximately $12,000 more than a standard interior lot; - Having a finished basement adds approximately $4,000 to the value of a home in this area; - Being of only average condition rather than the more typical good condition reduces value by $5,000; - A third garage stall adds approximately $10,000 to a Canine Hills home's value; - Having a patio rather than a deck reduces value in Canine Hills by approximately $2,000; - Comparable 2's slightly larger home size increases the property's value by approximately $3,000; and - Comparable 3's considerably larger size, which includes an extra bedroom and a full third bathroom, increases the property's value by approximately $24,000. (No adjustment should be made for Comparable 1's sale date since it was so recent, and no adjustments for location or age are needed because the comparables all are in the same subdivision, within a few blocks of the subject, and all very close in age.) Use the Sales Comparison Approach, and the "squared adjustment weighting technique" explained in our Topic 6 outline, to estimate the subject property's indicated market value. 2. A large parcel of real estate near downtown Reggieville is zoned for commercial use. But at this time there is an older duplex (two-unit residential property) on the lot that people are paying rent to live in. A landlord looking to buy an older duplex of this quality in a similar location would be willing to pay as much as $122,000. If the land were vacant it could be sold to a commercial developer for $135,000. But the land is not vacant, and it would cost $9,500 to demolish the structure and make the land ready to build on. What is the property's highest and best use (HBU)? What would HBU be if a residential landlord would pay up to $129,000 ? 3. You are asked to estimate the market value of a vacant lot in Hook Slice Acres residential subdivision. This parcel is 110 feet wide and 130 feet deep, and is not located on the golf course that Hook Slice Acres surrounds. You find information on three reasonably similar lots in the same subdivision that have sold somewhat recently in arm's length transactions. Comparable 1 , which is 100 feet wide and 130 feet deep and also is not on the golf course, was sold just one week ago for $89,000. Comparable 2, also 100 feet wide and 130 feet deep, and also not on the golf course, was sold approximately a year ago for $82,000. Finally Comparable 3 , which is 90 feet wide and 130 feet deep and has direct frontage on the golf course, was sold six months ago for $95,000. Using the sales comparison approach with proper adjustments, estimate the subject lot's market value. 4. You are appraising a small apartment complex that is several years old. A local contractor estimates the cost today of constructing buildings that are similar in size and general amenities to be $1,150,000. You believe that the structures suffer from $57,000 in curable physical deterioration (cost to complete some needed roof repairs, painting, and caulking), and that general aging has left the buildings with incurable physical deterioration equal to 9% of the expected cost of new replacements. You also believe there is $45,000 in incurable functional obsolescence from the lack of a place to put laundry facilities on site. There is no locational obsolescence, as the surrounding neighborhood consists primarily of small apartment properties. If you estimate the land value to be $218,000, what is your estimate of the property's market value under the Cost Approach? 5. You are asked to appraise a 32,000 square foot warehouse in Redbird Heights, home to a number of small warehouses that are generally similar in age and size. This subject property generated \$295,500 in gross rental revenue for its owner in the most recent year. You choose three recent warehouse sales to use as comparables in computing a gross income multiplier. 28,000 square foot Warehouse A generated $257,000 in gross rental income in the most recent year, and it sold recently for $1,320,000. Warehouse B, with 34,250 square feet of area and gross income in the most recent year of $315,000, sold for $1,588,750; and Warehouse C,32,500 square feet in size and with $276,000 in recent annual gross income, sold for $1,375,000. What is the subject property's indicated market value, based on gross income multiplier analysis. 6. Now assume that the appraiser in the previous problem puts effort into determining operating expense information for the three recently sold comparable warehouses, because she fears that the subject property would be more expensive to operate than the three comparables would be. The resulting stabilized net operating income measures for the three are $148,750 for A; $177,500 for B; and $158,860 for C. The subject warehouse property's stabilized NOI should be $162,140. Compute the net income multiplier (and its reciprocal, the overall capitalization rate) indicated by these transactions and estimate the subject property's market value with direct Net Income Capitalization analysis. 7. Think of a house you know reasonably well. (It does not have to be your family's home, and all you need identify when you hand the assignment in is the town where the house is located.) Find the estimated value on three web sites that provide free estimates without requiring you to give e-mail or other contact information; at the time of this writing EZhouseprices, Fast Expert, HomeGain, and Trulia are among sites that require you to tell them things about yourself. Sites that give a value estimate (or at least value range) while asking only for the property address, at the time of this writing, include Bank of America Real Estate Center, Chase Mortgage Services, ForSaleByOwner, Penny Mac, Realtor.com, Redfin, Re/Max, Rocket Homes, Zillow (Eppraisal and Nerd Wallet just give the Zillow "Zestimate"), and Zip Realty. Some show pictures; neat but kind of scary from a privacy standpoint. There may be houses for which some sites lack information, so you may have to try a second or third choice of subject house. Then write a brief paragraph summarizing the following: - the value, or value range, each site provided (do not print out and hand in web pages), - whether the sites you used seem to do a good job of estimating what you perceive the true market value to be, - how the estimate was determined, if clearly explained on the site (if not then just say that it is not clear), and - whether you find these sites to be useful informational tools or more a form of entertainment. Please submit a scanned or photographed copy of your carefully hand-written solutions to the Topic 6 homework problems. (If you take photographs of individual pages with your phone or other device, please paste all of the pictures into a single Word file in the correct order before submitting. DO NOT submit multiple individual photographs; that kind of submission is very difficult for the instructor to grade.) Solutions are provided below - but think as you work; the assignment is not a copying exercise. Upload your submission to Reggie Net if you can, or attach it to an e-mail to the instructor if you can not. You do not have to provide comments, but the computational steps should be complete - you are earning credit for working the problems carefully to be better prepared for the exam. Points will be taken off for cutting corners. Due date and time are shown with the assignment information on Reggie Net. 1. Bulldog Bank has ordered an appraisal of a house at 303 Beagle Avenue in the Canine Hills Subdivision, in connection with Joanne and Jack Russell's application for a loan. Characteristics of the subject property and three comparables the appraiser has identified as "pretty good" are as shown in the grid below. The appraiser feels that the following adjustments are warranted: - Values in Canine Hills and the nearby area have risen steadily by approximately 4% over the previous year; - A larger corner lot in this neighborhood is worth approximately $12,000 more than a standard interior lot; - Having a finished basement adds approximately $4,000 to the value of a home in this area; - Being of only average condition rather than the more typical good condition reduces value by $5,000; - A third garage stall adds approximately $10,000 to a Canine Hills home's value; - Having a patio rather than a deck reduces value in Canine Hills by approximately $2,000; - Comparable 2's slightly larger home size increases the property's value by approximately $3,000; and - Comparable 3's considerably larger size, which includes an extra bedroom and a full third bathroom, increases the property's value by approximately $24,000. (No adjustment should be made for Comparable 1's sale date since it was so recent, and no adjustments for location or age are needed because the comparables all are in the same subdivision, within a few blocks of the subject, and all very close in age.) Use the Sales Comparison Approach, and the "squared adjustment weighting technique" explained in our Topic 6 outline, to estimate the subject property's indicated market value. 2. A large parcel of real estate near downtown Reggieville is zoned for commercial use. But at this time there is an older duplex (two-unit residential property) on the lot that people are paying rent to live in. A landlord looking to buy an older duplex of this quality in a similar location would be willing to pay as much as $122,000. If the land were vacant it could be sold to a commercial developer for $135,000. But the land is not vacant, and it would cost $9,500 to demolish the structure and make the land ready to build on. What is the property's highest and best use (HBU)? What would HBU be if a residential landlord would pay up to $129,000 ? 3. You are asked to estimate the market value of a vacant lot in Hook Slice Acres residential subdivision. This parcel is 110 feet wide and 130 feet deep, and is not located on the golf course that Hook Slice Acres surrounds. You find information on three reasonably similar lots in the same subdivision that have sold somewhat recently in arm's length transactions. Comparable 1 , which is 100 feet wide and 130 feet deep and also is not on the golf course, was sold just one week ago for $89,000. Comparable 2, also 100 feet wide and 130 feet deep, and also not on the golf course, was sold approximately a year ago for $82,000. Finally Comparable 3 , which is 90 feet wide and 130 feet deep and has direct frontage on the golf course, was sold six months ago for $95,000. Using the sales comparison approach with proper adjustments, estimate the subject lot's market value. 4. You are appraising a small apartment complex that is several years old. A local contractor estimates the cost today of constructing buildings that are similar in size and general amenities to be $1,150,000. You believe that the structures suffer from $57,000 in curable physical deterioration (cost to complete some needed roof repairs, painting, and caulking), and that general aging has left the buildings with incurable physical deterioration equal to 9% of the expected cost of new replacements. You also believe there is $45,000 in incurable functional obsolescence from the lack of a place to put laundry facilities on site. There is no locational obsolescence, as the surrounding neighborhood consists primarily of small apartment properties. If you estimate the land value to be $218,000, what is your estimate of the property's market value under the Cost Approach? 5. You are asked to appraise a 32,000 square foot warehouse in Redbird Heights, home to a number of small warehouses that are generally similar in age and size. This subject property generated \$295,500 in gross rental revenue for its owner in the most recent year. You choose three recent warehouse sales to use as comparables in computing a gross income multiplier. 28,000 square foot Warehouse A generated $257,000 in gross rental income in the most recent year, and it sold recently for $1,320,000. Warehouse B, with 34,250 square feet of area and gross income in the most recent year of $315,000, sold for $1,588,750; and Warehouse C,32,500 square feet in size and with $276,000 in recent annual gross income, sold for $1,375,000. What is the subject property's indicated market value, based on gross income multiplier analysis. 6. Now assume that the appraiser in the previous problem puts effort into determining operating expense information for the three recently sold comparable warehouses, because she fears that the subject property would be more expensive to operate than the three comparables would be. The resulting stabilized net operating income measures for the three are $148,750 for A; $177,500 for B; and $158,860 for C. The subject warehouse property's stabilized NOI should be $162,140. Compute the net income multiplier (and its reciprocal, the overall capitalization rate) indicated by these transactions and estimate the subject property's market value with direct Net Income Capitalization analysis. 7. Think of a house you know reasonably well. (It does not have to be your family's home, and all you need identify when you hand the assignment in is the town where the house is located.) Find the estimated value on three web sites that provide free estimates without requiring you to give e-mail or other contact information; at the time of this writing EZhouseprices, Fast Expert, HomeGain, and Trulia are among sites that require you to tell them things about yourself. Sites that give a value estimate (or at least value range) while asking only for the property address, at the time of this writing, include Bank of America Real Estate Center, Chase Mortgage Services, ForSaleByOwner, Penny Mac, Realtor.com, Redfin, Re/Max, Rocket Homes, Zillow (Eppraisal and Nerd Wallet just give the Zillow "Zestimate"), and Zip Realty. Some show pictures; neat but kind of scary from a privacy standpoint. There may be houses for which some sites lack information, so you may have to try a second or third choice of subject house. Then write a brief paragraph summarizing the following: - the value, or value range, each site provided (do not print out and hand in web pages), - whether the sites you used seem to do a good job of estimating what you perceive the true market value to be, - how the estimate was determined, if clearly explained on the site (if not then just say that it is not clear), and - whether you find these sites to be useful informational tools or more a form of entertainment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started