Question: Please summarize below. Global competitive conditions driving the manufacturing location decision Wendy L. Tate , Lisa M. Ellramb, Tobias Schoenherr, Kenneth J. Petersen a a

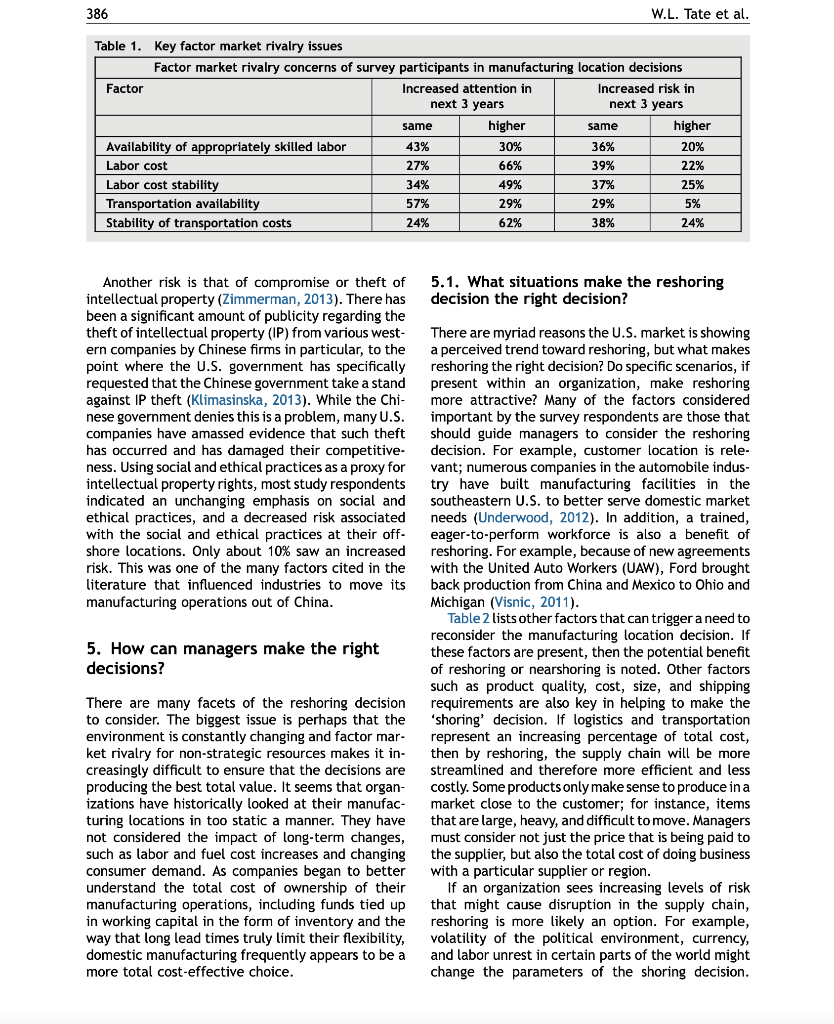

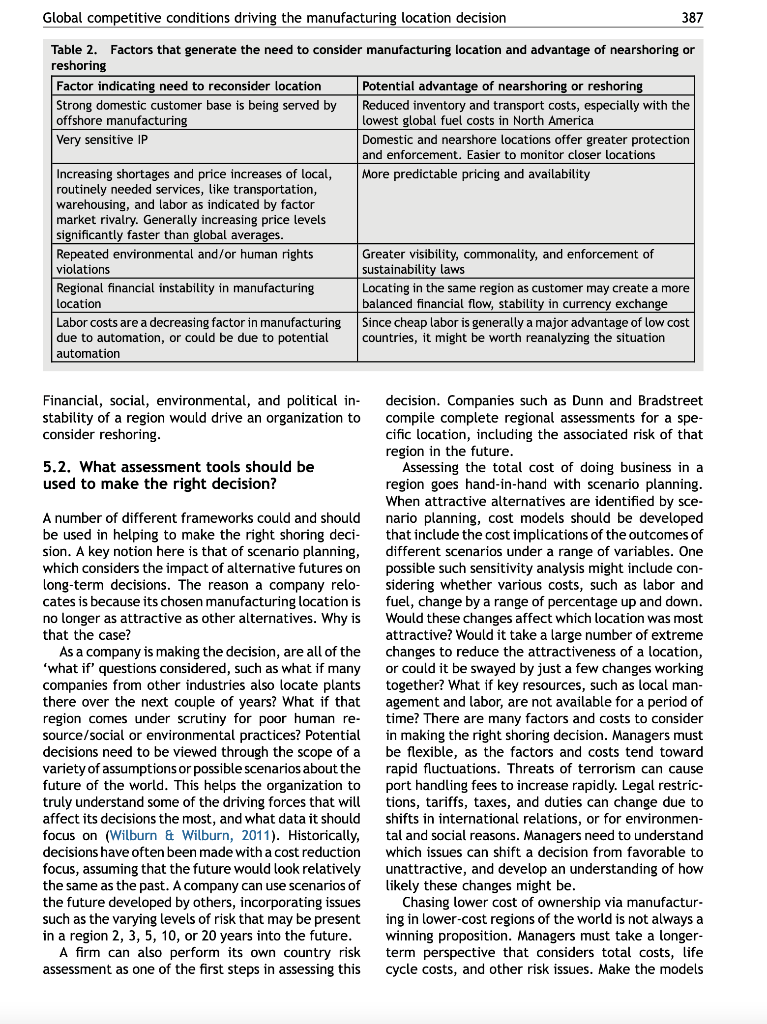

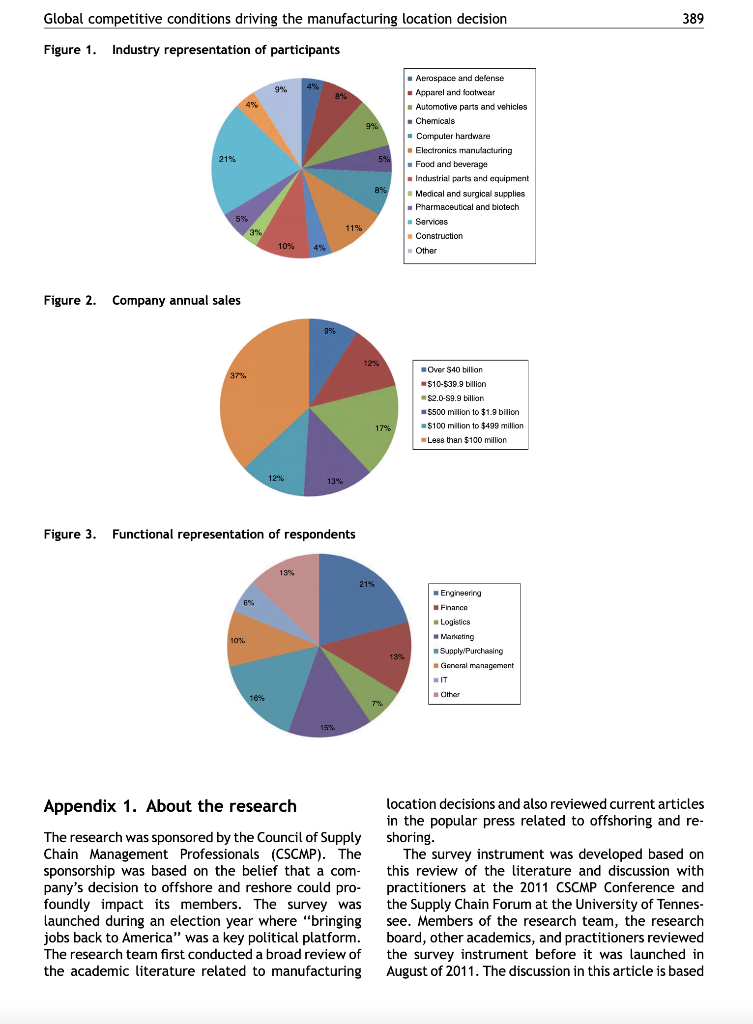

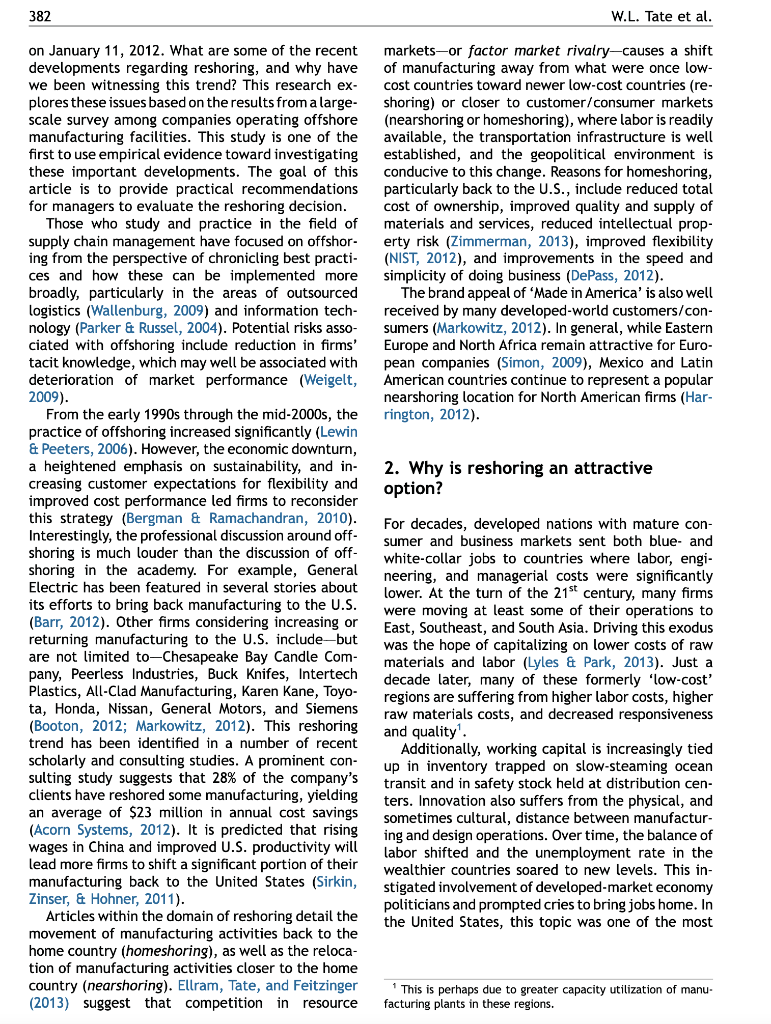

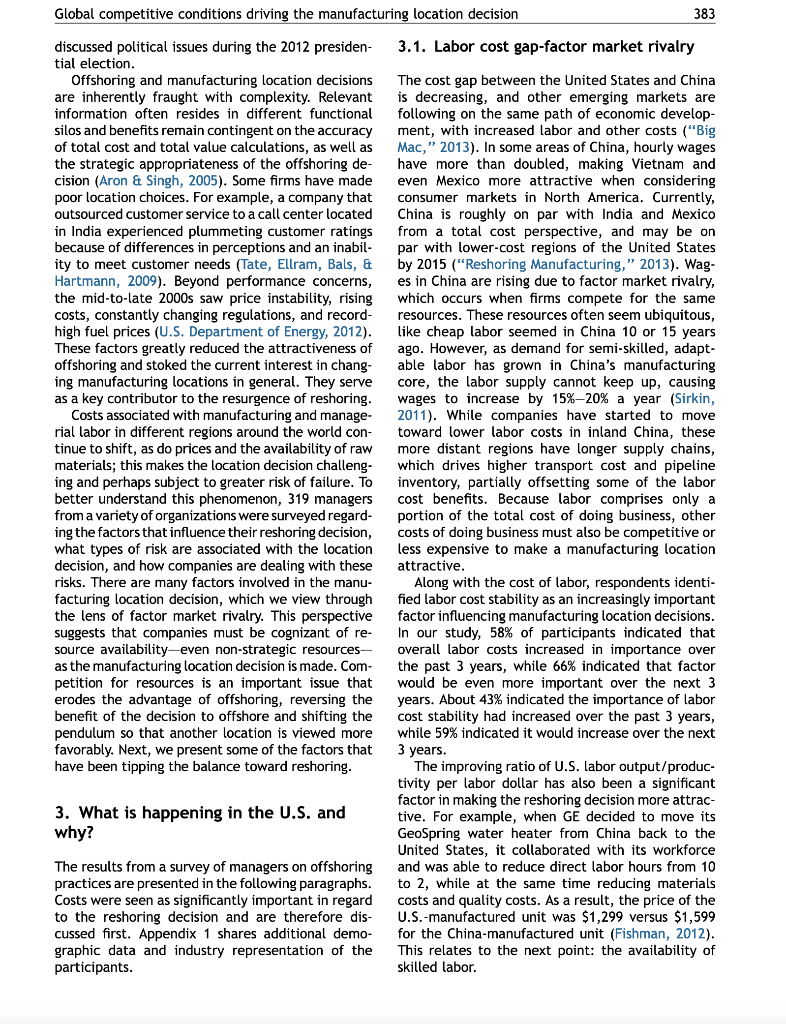

Please summarize below.

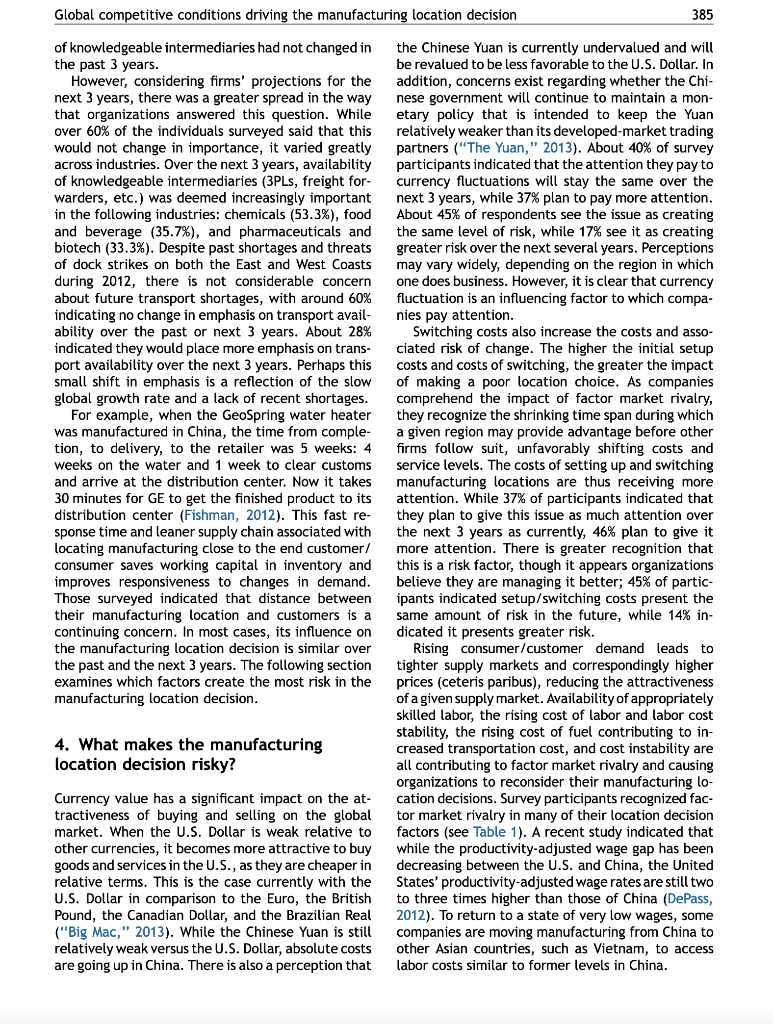

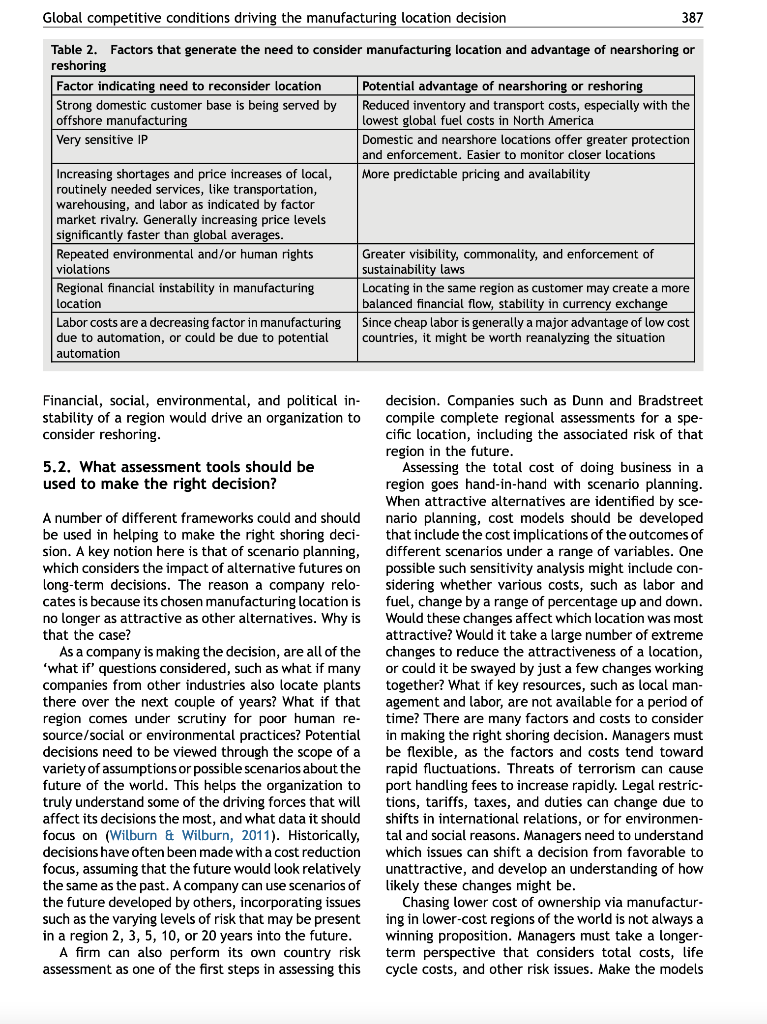

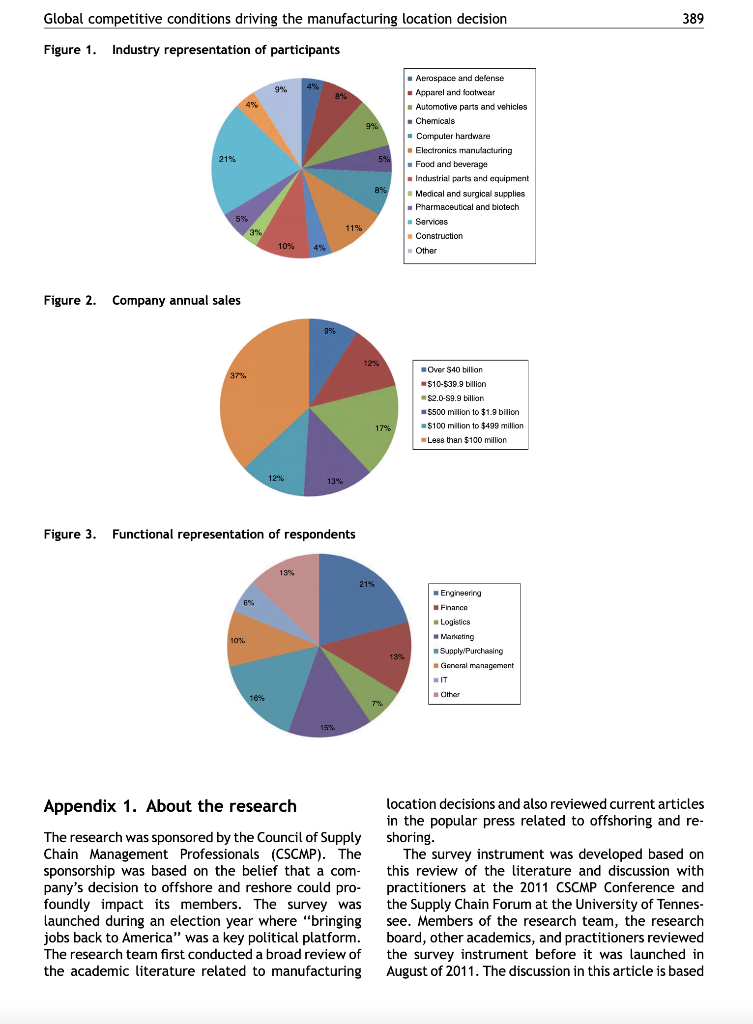

Global competitive conditions driving the manufacturing location decision Wendy L. Tate , Lisa M. Ellramb, Tobias Schoenherr, Kenneth J. Petersen a a College of Business Administration, University of Tennessee, Knoxville, TN 37996, U.S.A. Farmer School of Business, Miami University, Oxford, OH 45056, U.S.A. Broad College of Business, Michigan State University, East Lansing, MI 48824, U.S.A. KEYWORDS Offshoring; Reshoring; Manufacturing location decision; Factor market rivalry 1. Reshoring Shifting global competitive conditions have spurred many companies to consider changing their * Corresponding author E-mail addresses: wendy.tate@utk.edu (W.L. Tate), ellramlm@muohio.edu (L.M. Ellram), schoenherr@broad.msu.edu (T. Schoenherr), petersen@utk.edu (K.J. Petersen) Abstract Given today's rapidly shifting global competitive conditions including customer location, natural disasters, currency valuation, labor and transportation costs and availability-many U.S. companies are revisiting decisions about their pre- ferred manufacturing location(s). The purpose of this research is to understand some of the trends that affect whether U.S.-based companies bring their production back to the United States or relocate it to different geographical locations (reshore). The focus is on the key factors that affect companies' manufacturing location decisions, the impor- tance of these factors, and how the importance has changed over time. Because of the complexity involved in the manufacturing location decision, key risk factors inherent in the manufacturing decision are also assessed. Survey responses from 319 companies that currently manage offshore manufacturing plants are analyzed. Among other insights, this study found that 40% of these companies perceived a trend toward reshoring to the U.S. in their industries. The companies involved in this study also place an increasing importance on where their customers want them to locate, as well as how the location could help expand into new customer markets. These and further results and implications for U.S. manufacturing companies are presented herein. 2013 Kelley School of Business, Indiana University. Published by Elsevier Inc. All rights reserved. manufacturing footprint. The popular press has lauded the emergence of a reshoring trend: the relocation of manufacturing facilities from tradi- tional offshore locations to more attractive off- shore locations, or even home to the United States. This article focuses on the relocation of manufacturing capabilities back to the U.S., a phe- nomenon that has received wide attention, includ- ing a White House forum hosted by President Obama 382 on January 11, 2012. What are some of the recent developments regarding reshoring, and why have we been witnessing this trend? This research ex- plores these issues based on the results from a large- scale survey among companies operating offshore manufacturing facilities. This study is one of the first to use empirical evidence toward investigating these important developments. The goal of this article is to provide practical recommendations for managers to evaluate the reshoring decision. Those who study and practice in the field of supply chain management have focused on offshor- ing from the perspective of chronicling best practi- ces and how these can be implemented more broadly, particularly in the areas of outsourced logistics (Wallenburg, 2009) and information tech- nology (Parker & Russel, 2004). Potential risks asso- ciated with offshoring include reduction in firms' tacit knowledge, which may well be associated with deterioration of market performance (Weigelt, 2009). From the early 1990s through the mid-2000s, the practice of offshoring increased significantly (Lewin & Peeters, 2006). However, the economic downturn, a heightened emphasis on sustainability, and in- creasing customer expectations for flexibility and improved cost performance led firms to reconsider this strategy (Bergman & Ramachandran, 2010). Interestingly, the professional discussion around off- shoring is much louder than the discussion of off- shoring in the academy. For example, General Electric has been featured in several stories about its efforts to bring back manufacturing to the U.S. (Barr, 2012). Other firms considering increasing or returning manufacturing to the U.S. include-but are not limited to-Chesapeake Bay Candle Com- pany, Peerless Industries, Buck Knifes, Intertech Plastics, All-Clad Manufacturing, Karen Kane, Toyo- ta, Honda, Nissan, General Motors, and Siemens (Booton, 2012; Markowitz, 2012). This reshoring trend has been identified in a number of recent scholarly and consulting studies. prominent con- sulting study suggests that 28% of the company's clients have reshored some manufacturing, yielding an average of $23 million in annual cost savings (Acorn Systems, 2012). It is predicted that rising wages in China and improved U.S. productivity will lead more firms to shift a significant portion of their manufacturing back to the United States (Sirkin, Zinser, & Hohner, 2011). Articles within the domain of reshoring detail the movement of manufacturing activities back to the home country (homeshoring), as well as the reloca- tion of manufacturing activities closer to the home country (nearshoring). Ellram, Tate, and Feitzinger (2013) suggest that competition in resource W.L. Tate et al. markets-or factor market rivalry-causes a shift of manufacturing away from what were once low- cost countries toward newer low-cost countries (re- shoring) or closer to customer/consumer markets. (nearshoring or homeshoring), where labor is readily available, the transportation infrastructure is well established, and the geopolitical environment is conducive to this change. Reasons for homeshoring, particularly back to the U.S., include reduced total cost of ownership, improved quality and supply of materials and services, reduced intellectual prop- erty risk (Zimmerman, 2013), improved flexibility (NIST, 2012), and improvements in the speed and simplicity of doing business (DePass, 2012). The brand appeal of 'Made in America' is also well received by many developed-world customers/con- sumers (Markowitz, 2012). In general, while Eastern Europe and North Africa remain attractive for Euro- pean companies (Simon, 2009), Mexico and Latin American countries continue to represent a popular nearshoring location for North American firms (Har- rington, 2012). 2. Why is reshoring an attractive option? For decades, developed nations with mature con- sumer and business markets sent both blue- and white-collar jobs to countries where labor, engi- neering, and managerial costs were significantly lower. At the turn of the 21st century, many firms were moving at least some of their operations to East, Southeast, and South Asia. Driving this exodus was the hope of capitalizing lower costs of raw materials and labor (Lyles & Park, 2013). Just a decade later, many of these formerly 'low-cost' regions are suffering from higher labor costs, higher raw materials costs, and decreased responsiveness and quality. Additionally, working capital is increasingly tied up in inventory trapped on slow-steaming ocean transit and in safety stock held at distribution cen- ters. Innovation also suffers from the physical, and sometimes cultural, distance between manufactur- ing and design operations. Over time, the balance of labor shifted and the unemployment rate in the wealthier countries soared to new levels. This in- stigated involvement of developed-market economy politicians and prompted cries to bring jobs home. In the United States, this topic was one of the most This is perhaps due to greater capacity utilization of manu- facturing plants in these regions. Global competitive conditions driving the manufacturing location decision 383 discussed political issues during the 2012 presiden- 3.1. Labor cost gap-factor market rivalry tial election. Offshoring and manufacturing location decisions are inherently fraught with complexity. Relevant information often resides in different functional silos and benefits remain contingent on the accuracy of total cost and total value calculations, as well as the strategic appropriateness of the offshoring de- cision (Aron & Singh, 2005). Some firms have made poor location choices. For example, a company that outsourced customer service to a call center located in India experienced plummeting customer ratings because of differences in perceptions and an inabil- ity to meet customer needs (Tate, Ellram, Bals, & Hartmann, 2009). Beyond performance concerns, the mid-to-late 2000s saw price instability, rising costs, constantly changing regulations, and record- high fuel prices (U.S. Department of Energy, 2012). These factors greatly reduced the attractiveness of offshoring and stoked the current interest in chang- ing manufacturing locations in general. They serve as a key contributor to the resurgence of reshoring. The cost gap between the United States and China is decreasing, and other emerging markets are following on the same path of economic develop- ment, with increased labor and other costs ("Big Mac," 2013). In some areas of China, hourly wages have more than doubled, making Vietnam and even Mexico more attractive when considering consumer markets in North America. Currently, China is roughly on par with India and Mexico from a total cost perspective, and may be on par with lower-cost regions of the United States by 2015 ("Reshoring Manufacturing," 2013). Wag- es in China are rising due to factor market rivalry, which occurs when firms compete for the same resources. These resources often seem ubiquitous, like cheap labor seemed in China 10 or 15 years ago. However, as demand for semi-skilled, adapt- able labor has grown in China's manufacturing core, the labor supply cannot keep up, causing wages to increase by 15%-20% a year (Sirkin, 2011). While companies have started to move toward lower labor costs in inland China, these more distant regions have longer supply chains, which drives higher transport cost and pipeline inventory, partially offsetting some of the labor cost benefits. Because labor comprises only a portion of the total cost of doing business, other costs of doing business must also be competitive or less expensive to make a manufacturing location attractive. Costs associated with manufacturing and manage- rial labor in different regions around the world con- tinue to shift, as do prices and the availability of raw materials; this makes the location decision challeng- ing and perhaps subject to greater risk of failure. To better understand this phenomenon, 319 managers from a variety of organizations were surveyed regard- ing the factors that influence their reshoring decision, what types of risk are associated with the location decision, and how companies are dealing with these risks. There are many factors involved in the manu- facturing location decision, which we view through the lens of factor market rivalry. This perspective suggests that companies must be cognizant of re- source availability-even non-strategic resources- as the manufacturing location decision is made. Com- petition for resources is an important issue that erodes the advantage of offshoring, reversing the benefit the decision to offshore and shifting the pendulum so that another location is viewed more favorably. Next, we present some of the factors that have been tipping the balance toward reshoring. Along with the cost of labor, respondents identi- fied labor cost stability as an increasingly important factor influencing manufacturing location decisions. In our study, 58% of participants indicated that overall labor costs increased in importance over the past 3 years, while 66% indicated that factor would be even more important over the next 3 years. About 43% indicated the importance of labor cost stability had increased over the past 3 years, while 59% indicated it would increase over the next 3 years. 3. What is happening in the U.S. and why? The results from a survey of managers on offshoring practices are presented in the following paragraphs. Costs were seen as significantly important in regard to the reshoring decision and are therefore dis- cussed first. Appendix 1 shares additional demo- graphic data and industry representation of the participants. The improving ratio of U.S. labor output/produc- tivity per labor dollar has also been a significant factor in making the reshoring decision more attrac- tive. For example, when GE decided to move its GeoSpring water heater from China back to the United States, it collaborated with its workforce and was able to reduce direct labor hours from 10 to 2, while at the same time reducing materials costs and quality costs. As a result, the price of the U.S.-manufactured unit was $1,299 versus $1,599 for the China-manufactured unit (Fishman, 2012). This relates to the next point: the availability of skilled labor. 384 3.2. Skilled labor As indicated in the preceding example involving GE, the U.S. is known for skilled labor and innovation. There is a growing shortage of skilled and semi- skilled labor in China as more factories automate and replace manual labor with higher-technology equipment and manufacturing processes (Huang & Lynch, 2013). The Economist recently reported that China's labor market is overstretched and all high- quality labor has been exhausted ("Reshoring Man- ufacturing," 2013). Availability of skilled labor also became a problem in India when many companies offshored their call center services (Tate et al., 2009). In situations like this, companies had to hire people with lesser qualifications; consequently, quality became a problem. As increased wealth enters into these low-labor cost countries, the needs of employees change. Jobs and industries that were once aspired to become less desirable, and the total cost gap-for example, in China is slowly eroding. Among the survey partici- pants, around 45% indicated no change in the impor- tance of properly skilled labor as influential regarding the manufacturing location decision, while 30% said it would be of increased importance over the next 3 years. Over 60% of respondents indicated no change in the importance of availability of local management in the current or next 3 years, while 31% placed in- creased emphasis on this factor over the next 3 years. 3.3. Energy cost Energy represents an important manufacturing cost. Currently, the United States has the lowest cost per megawatt of any country reporting to the Interna- tional Energy Agency, is second-lowest (to Canada) on the cost of industrial natural gas, and is second- lowest (to Mexico) on the cost of diesel fuel. Clearly, the attractiveness of U.S. energy costs contributes to it being a very favorable location when serving markets in the Western Hemisphere (International Energy Agency, 2012). China's energy costs have continued to rise due to shortages energy supplies and significant dependence on imports. To the ex- tent that energy costs influence transport costs, study participants were very concerned about the stability of transportation cost, with over 60% as- signing this factor increased emphasis over both the past 3 and the next 3 years in regard to manufactur- ing location decision. 3.4. Currency exchange Real and anticipated volatility in currency valuation increases the risk of doing business outside of one's W.L. Tate et al. own currency. From June 2003 to June 2013, the Chinese Yuan strengthened by 35% against the U.S. Dollar, which makes the price of Chinese goods much less attractive in the United States ("Reshor- ing Manufacturing," 2013). In considering whether currency stability was a more or less important factor in the manufacturing location decision, 27% of respondents indicated the factor had in- creased in importance over the past 3 years, and 36% indicated it would increase in importance over the next 3 years. However, 23% indicated currency stability would decrease in emphasis as part of the manufacturing location decision over the next 3 years. 3.5. Tax structure Global tax structures have been paid much media attention, with some countries-such as Ireland, India, and China-standing accused of being tax havens to lure in rich companies. Other countries, like the United States, scare companies away with their high tax rates ("Yuan," 2013). In general, taxation is a factor that does not favor the U.S. as a manufacturing location. Yet within the U.S., individual states vie to lure business from other states and municipalities by offering a range of incentives. Over 50% of the companies we surveyed indicated that they gave the same weight to tax advantages in the manufacturing location decision over the past 3 years and next 3 years. Perhaps this is a reflection that things have not changed, especially since about 60% believe tax risks have actually decreased. Only about 24% of those surveyed indi- cated that they will give more weight to tax ad- vantage in the location decision over the next 3 years. 3.6. Shipping time/customer proximity Slowing of the global supply chain due to shipping industry adoption of slow-steaming ocean freight has increased the length of global supply chains in real time. Yet, companies want to reduce the length to better manage inventory levels and working cap- ital, and to be more responsive. Slow-steaming reduces the ships' speeds, CO emissions, and fuel usage. New ships are being built to optimize per- formance at slow-steaming speeds. Transit time from Shanghai to the West Coast of the United States has gone from 15 to 17 days, while it has increased from 29 to 35-36 days to the East Coast (Solomon, 2012). Despite the intermittent shortages of trans- portation due to factor market rivalry and growing demand, 50% or more of respondents in every in- dustry indicated that their focus on the availability 385 the Chinese Yuan is currently undervalued and will be revalued to be less favorable to the U.S. Dollar. In addition, concerns exist regarding whether the Chi- nese government will continue to maintain a mon- etary policy that is intended to keep the Yuan relatively weaker than its developed-market trading partners ("The Yuan," 2013). About 40% of survey participants indicated that the attention they pay to currency fluctuations will stay the same over the next 3 years, while 37% plan to pay more attention. About 45% of respondents see the issue as creating the same level of risk, while 17% see it as creating greater risk over the next several years. Perceptions may vary widely, depending on the region in which one does business. However, it is clear that currency fluctuation is an influencing factor to which compa- nies pay attention. Switching costs also increase the costs and asso- ciated risk of change. The higher the initial setup costs and costs of switching, the greater the impact of making a poor location choice. As companies comprehend the impact of factor market rivalry, they recognize the shrinking time span during which a given region may provide advantage before other firms follow suit, unfavorably shifting costs and service levels. The costs of setting up and switching manufacturing locations are thus receiving more attention. While 37% of participants indicated that they plan to give this issue as much attention over the next 3 years as currently, 46% plan to give it more attention. There is greater recognition that this is a risk factor, though it appears organizations believe they are managing it better; 45% of partic- ipants indicated setup/switching costs present the same amount of risk in the future, while 14% in- dicated it presents greater risk. Rising consumer/customer demand leads to tighter supply markets and correspondingly higher prices (ceteris paribus), reducing the attractiveness of a given supply market. Availability of appropriately skilled labor, the rising cost of labor and labor cost stability, the rising cost of fuel contributing to in- creased transportation cost, and cost instability are all contributing to factor market rivalry and causing organizations to reconsider their manufacturing lo- cation decisions. Survey participants recognized fac- tor market rivalry in many of their location decision factors (see Table 1). A recent study indicated that while the productivity-adjusted wage gap has been decreasing between the U.S. and China, the United States' productivity-adjusted wage rates are still two to three times higher than those of China (DePass, 2012). To return to a state of very low wages, some companies are moving manufacturing from China to other Asian countries, such as Vietnam, to access labor costs similar to former levels in China. Global competitive conditions driving the manufacturing location decision of knowledgeable intermediaries had not changed in the past 3 years. However, considering firms' projections for the next 3 years, there was a greater spread in the way that organizations answered this question. While over 60% of the individuals surveyed said that this would not change importance, it varied greatly across industries. Over the next 3 years, availability of knowledgeable intermediaries (3PLs, freight for- warders, etc.) was deemed increasingly important in the following industries: chemicals (53.3%), food and beverage (35.7%) , and pharmaceuticals and biotech (33.3%). Despite past shortages and threats of dock strikes on both the East and West Coasts during 2012, there is not considerable concern about future transport shortages, with around 60% indicating no change in emphasis on transport avail- ability over the past or next 3 years. About 28% indicated they would place more emphasis on trans- port availability over the next 3 years. Perhaps this small shift in emphasis is a reflection of the slow global growth rate and a lack of recent shortages. For example, when the GeoSpring water heater was manufactured in China, the time from comple- tion, to delivery, to the retailer was 5 weeks: 4 weeks on the water and 1 week to clear customs and arrive at the distribution center. Now it takes 30 minutes for GE to get the finished product to its distribution center (Fishman, 2012). This fast re- sponse time and leaner supply chain associated with locating manufacturing close to the end customer/ consumer saves working capital in inventory and improves responsiveness to changes in demand. Those surveyed indicated that distance between their manufacturing location and customers is a continuing concern. In most cases, its influence on the manufacturing location decision is similar over the past and the next 3 years. The following section examines which factors create the most risk in the manufacturing location decision. 4. What makes the manufacturing location decision risky? Currency value has a significant impact on the at- tractiveness of buying and selling on the global market. When the U.S. Dollar is weak relative to other currencies, it becomes more attractive to buy goods and services in the U.S., as they are cheaper in relative terms. This is the case currently with the U.S. Dollar in comparison to the Euro, the British Pound, the Canadian Dollar, and the Brazilian Real ("Big Mac," 2013). While the Chinese Yuan is still relatively weak versus the U.S. Dollar, absolute costs are going up in China. There is also a perception that W.L. Tate et al. 386 Table 1. Key factor market rivalry issues Factor market rivalry concerns of survey participants in manufacturing location decisions Factor Increased attention in Increased risk in next 3 years next 3 years same higher same higher Availability of appropriately skilled labor 43% 30% 36% 20% Labor cost 27% 66% 39% 22% Labor cost stability 34% 49% 37% 25% Transportation availability 57% 29% 29% 5% 24% 62% Stability of transportation costs 38% 24% 5.1. What situations make the reshoring decision the right decision? Another risk is that of compromise or theft of intellectual property (Zimmerman, 2013). There has been a significant amount of publicity regarding the theft of intellectual property (IP) from various west- ern companies by Chinese firms in particular, to the point where the U.S. government has specifically requested that the Chinese government take a stand against IP theft (Klimasinska, 2013). While the Chi- nese government denies this is a problem, many U.S. companies have amassed evidence that such theft has occurred and has damaged their competitive- ness. Using social and ethical practices as a proxy for intellectual property rights, most study respondents indicated an unchanging emphasis on social and ethical practices, and a decreased risk associated with the social and ethical practices at their off- shore locations. Only about 10% saw an increased risk. This was one of the many factors cited in the literature that influenced industries to move its manufacturing operations out of China. There are myriad reasons the U.S. market is showing a perceived trend toward reshoring, but what makes reshoring the right decision? Do specific scenarios, if present within an organization, make reshoring more attractive? Many of the factors considered important by the survey respondents are those that should guide managers to consider the reshoring decision. For example, customer location is rele- vant; numerous companies in the automobile indus- try have built manufacturing facilities the southeastern U.S. to better serve domestic market needs (Underwood, 2012). In addition, a trained, eager-to-perform workforce is also a benefit of reshoring. For example, because of new agreements with the United Auto Workers (UAW), Ford brought back production from China and Mexico to Ohio and Michigan (Visnic, 2011). 5. How can managers make the right decisions? There are many facets of the reshoring decision to consider. The biggest issue is perhaps that the environment is constantly changing and factor mar- ket rivalry for non-strategic resources makes it in- creasingly difficult to ensure that the decisions are producing the best total value. It seems that organ- izations have historically looked at their manufac- turing locations too static a manner. They have not considered the impact of long-term changes, such as labor and fuel cost increases and changing consumer demand. As companies began to better understand the total cost of ownership of their manufacturing operations, including funds tied up in working capital in the form of inventory and the way that long lead times truly limit their flexibility, domestic manufacturing frequently appears to be a more total cost-effective choice. Table 2 lists other factors that can trigger a need to reconsider the manufacturing location decision. If these factors are present, then the potential benefit of reshoring or nearshoring is noted. Other factors. such as product quality, cost, size, and shipping requirements are also key in helping to make the 'shoring' decision. If logistics and transportation represent an increasing percentage of total cost, then by reshoring, the supply chain will be more streamlined and therefore more efficient and less costly. Some products only make sense to produce in a market close to the customer; for instance, items that are large, heavy, and difficult to move. Managers must consider not just the price that is being paid to the supplier, but also the total cost of doing business with a particular supplier or region. If an organization sees increasing levels of risk that might cause disruption in the supply chain, reshoring is more likely an option. For example, volatility of the political environment, currency, and labor unrest in certain parts of the world might change the parameters of the shoring decision. Global competitive conditions driving the manufacturing location decision 387 Table 2. Factors that generate the need to consider manufacturing location and advantage of nearshoring or reshoring Factor indicating need to reconsider location Strong domestic customer base is being served by offshore manufacturing Very sensitive IP Potential advantage of nearshoring or reshoring Reduced inventory and transport costs, especially with the lowest global fuel costs in North America Domestic and nearshore locations offer greater protection and enforcement. Easier to monitor closer locations More predictable pricing and availability Increasing shortages and price increases of local, routinely needed services, like transportation, warehousing, and labor as indicated by factor market rivalry. Generally increasing price levels significantly faster than global averages. Repeated environmental and/or human rights violations Greater visibility, commonality, and enforcement of sustainability laws Regional financial instability in manufacturing location Locating in the same region as customer may create a more balanced financial flow, stability in currency exchange Since cheap labor is generally a major advantage of low cost countries, it might be worth reanalyzing the situation Labor costs are a decreasing factor in manufacturing due to automation, or could be due to potential automation Financial, social, environmental, and political in- stability of a region would drive an organization to consider reshoring. decision. Companies such as Dunn and Bradstreet compile complete regional assessments for a spe- cific location, including the associated risk of that region in the future. 5.2. What assessment tools should be used to make the right decision? A number of different frameworks could and should be used in helping to make the right shoring deci- sion. A key notion here is that of scenario planning, which considers the impact of alternative futures on long-term decisions. The reason a company relo- cates is because its chosen manufacturing location is no longer as attractive as other alternatives. Why is that the case? As a company is making the decision, are all of the 'what if' questions considered, such as what if many companies from other industries also locate plants there over the next couple of years? What if that region comes under scrutiny for poor human re- source/social or environmental practices? Potential decisions need to be viewed through the scope of a variety of assumptions or possible scenarios about the future of the world. This helps the organization to truly understand some of the driving forces that will affect its decisions the most, and what data it should focus on (Wilburn & Wilburn, 2011). Historically, decisions have often been made with a cost reduction focus, assuming that the future would look relatively the same as the past. A company can use scenarios of the future developed by others, incorporating issues such as the varying levels of risk that may be present in a region 2, 3, 5, 10, or 20 years into the future. Assessing the total cost of doing business in a region goes hand-in-hand with scenario planning. When attractive alternatives are identified by sce- nario planning, cost models should be developed that include the cost implications of the outcomes sof different scenarios under a range of variables. One possible such sensitivity analysis might include con- sidering whether various costs, such as labor and fuel, change by a range of percentage up and down. Would these changes affect which location was most attractive? Would it take a large number of extreme changes to reduce the attractiveness of a location, or could it be swayed by just a few changes working together? What if key resources, such as local man- agement and labor, are not available for a period of time? There are many factors and costs to consider in making the right shoring decision. Managers must be flexible, as the factors and costs tend toward rapid fluctuations. Threats of terrorism can cause port handling fees to increase rapidly. Legal restric- tions, tariffs, taxes, and duties can change due to shifts in international relations, or for environmen- tal and social reasons. Managers need to understand which issues can shift a decision from favorable to unattractive, and develop an understanding of how likely these changes might be. Chasing lower cost of ownership via manufactur- ing in lower-cost regions of the world is not always a winning proposition. Managers must take a longer- term perspective that considers total costs, life cycle costs, and other risk issues. Make the models A firm can also perform its own country risk assessment as one of the first steps in assessing this 388 as flexible as possible, and thoroughly and routinely scan the changing landscape to better understand the rapid changes. 5.3. How can we communicate, negotiate, and repatriate after the right decision is made? Over the past decade, firms have developed signifi- cant insights regarding the opportunities and risks associated with offshoring, nearshoring, and home- shoring decisions. Manufacturing locations have been shifting from one low-cost region to another as conditions change and competition for relatively ubiquitous, substitutable resources grows in a given area, making that area less attractive. Increasingly, organizations are developing models or approaches to their manufacturing locations that allow them to analyze these decisions more frequently, and tweak or adjust them over time. It is important for those involved in and affected by the decision to under- stand that the organization is committed to long- term survival, and that requires change. It is also important to remember that the jobs being reshored are not the same jobs that left the U.S., since advancements in technology have played a significant role in helping to automate manufac- turing and reduce the labor portion of manufactur- ing (Fishman, 2012). Thus, fewer jobs may return, and those that do may require different and some- times greater-skills. The old-style union versus management mentality is no longer acceptable. Companies, cities, and even entire states have seen that this approach does not work if both parties are to survive and thrive. Thus, there must be a culture of continuous improvement where perhaps there was not one in the past. In exchange, the workforce may want more input into the organization's oper- ations, improvements, and decisions. The manufacturing location decision is central to business strategy and of crucial concern to most manufacturing firms, regardless of the location of their customer and consumer markets. One of the consistent themes is that much of the tacit knowl- edge necessary to make the best total value decision is both cross-functional and cross-organizational. Therefore, firms must have a supply chain and busi- ness intelligence strategy designed to capture and make available this important information to ana- lyze the current and projected attractiveness of a given location, and to make that location work after the plant is up and running. As an example, one equipment manufacturer that participated in this research experienced poor quality and attempts to steal IP when it set up manufacturing in China; hence, it decided to move W.L. Tate et al. back to the United States. However, a consultant advised it to move instead to Mexico, which was projected to save the company $100 million per year. But the president of this equipment manufac- turer considered Mexico unsafe, and was unwilling to put employees at risk. Manufacturing was thus moved to the U.S., with the understanding that $100 million in costs would have to be reduced to keep operations there. Responding to the challenge, the company exceeded its goal savings via waste reduc- tion and then moved additional, more complex and quality-essential manufacturing back to the U.S. This equipment manufacturer wants to sell in the U.S. what is made in the U.S. Because change is constant, however, annual total cost evaluations are conducted to ensure that its location decisions con- tinue to be the most effective. The company under- stands that this process must be continuously reviewed and updated as necessary so the firm can stay on top of the ever-changing global land- scape. 6. Conclusion The phenomenon of offshoring to low-cost regions will continue. The opportunity is to select the best locations, given the firm's current competitive busi- ness strategy, while considering the flexibility to adapt this decision effectively to future scenarios. For instance, the level of capital investment in a low-cost region may be very different if the business strategy is based solely around capitalizing on the shorter-term lower cost of manufacturing to serve developed-world markets when compared with at- tempting to develop these lower manufacturing cost markets into future consumer markets. In the latter case, firms may well need a multi-stage strategy that begins to lay the groundwork for a second phase of low-cost manufacturing that will be implemented to serve these once-developingow- developed marketplaces. Considering the reshoring opportunity beyond its immediate benefits and in- corporating a medium- and long-term strategy that can be effective in a number of possible future environments is essential to long-term success in this area. Acknowledgment The authors would like to thank the Council for Supply Chain Management Professionals (CSCMP) for a grant that supported this research. Global competitive conditions driving the manufacturing location decision Figure 1. Industry representation of participants 9% Aerospace and defense Apparel and footwear Automotive parts and vehicles Chemicals Computer hardware 21% Electronics manufacturing Food and beverage Industrial parts and equipment Medical and surgical supplies Pharmaceutical and biotech Services Construction Other Figure 2. Company annual sales Over $40 billion 37% $10-$39.9 billion $2.0-S9.9 billion $500 million to $1.9 bilion $100 million to $499 million Less than $100 million 12% 13% Figure 3. Functional representation of respondents 13% 21% Engineering 6% Finance Logistics Marketing Supply/Purchasing General management Other 16% 7% Appendix 1. About the research location decisions and also reviewed current articles in the popular press related to offshoring and re- shoring. The research was sponsored by the Council of Supply Chain Management Professionals (CSCMP). The sponsorship was based on the belief that a com- pany's decision to offshore and reshore could pro- foundly impact its members. The survey was launched during an election year where "bringing jobs back to America" was a key political platform. The research team first conducted a broad review of the academic literature related to manufacturing The survey instrument was developed based on this review of the literature and discussion with practitioners at the 2011 CSCMP Conference and the Supply Chain Forum at the University of Tennes- see. Members of the research team, the research board, other academics, and practitioners reviewed the survey instrument before it was launched in August of 2011. The discussion in this article is based 5% 3% 10% 10% 4% 8% 15% 11% 9% 5% 8% 12% 17% 13% WIT 389