Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please support to find answers for the figures marked in red. Avery Swan is 30 years old and single. She is employed as a middle-level

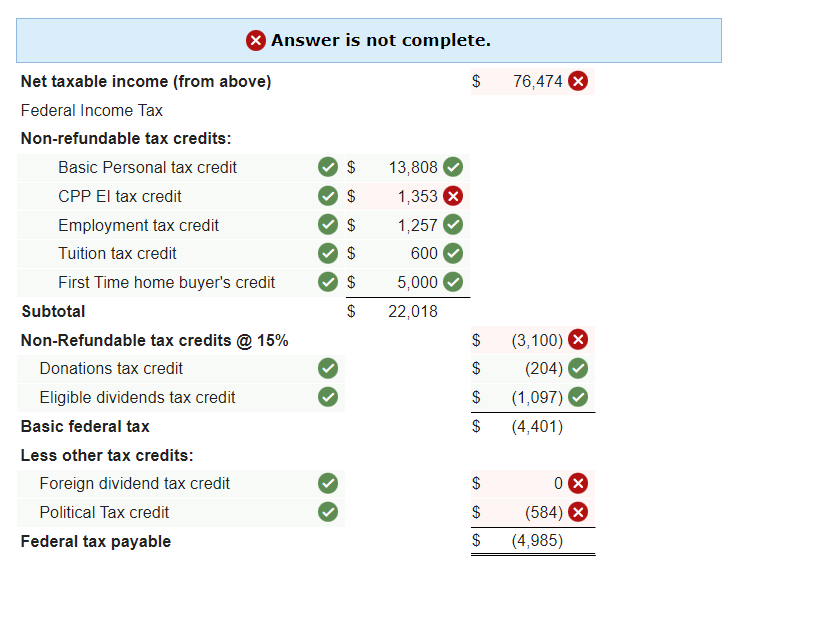

Please support to find answers for the figures marked in red.

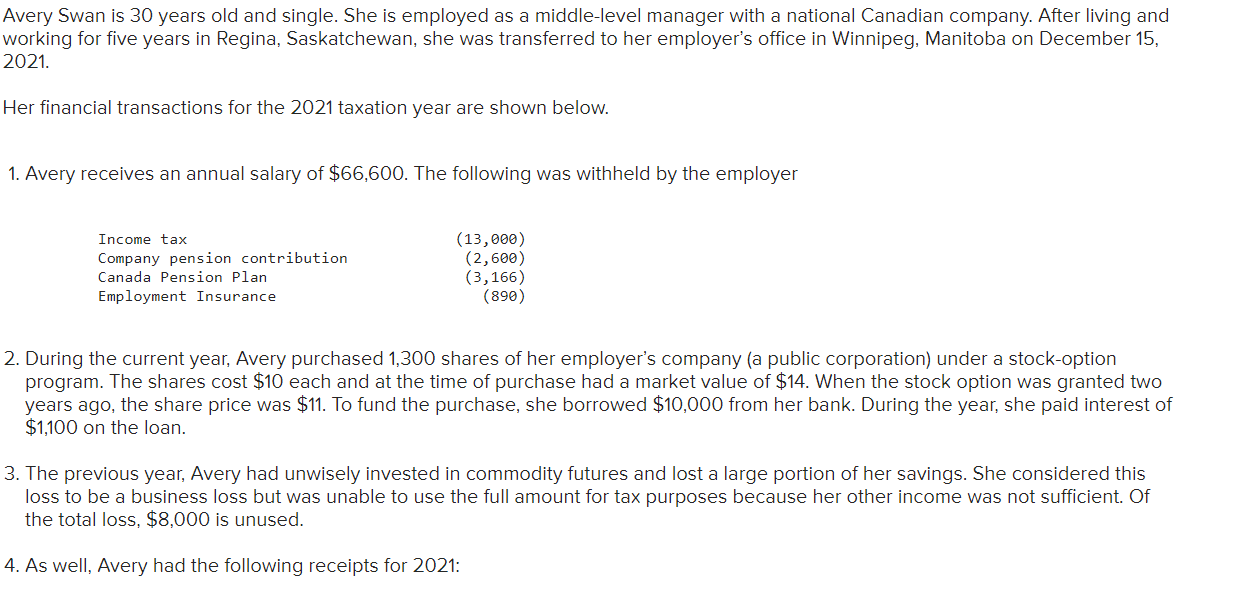

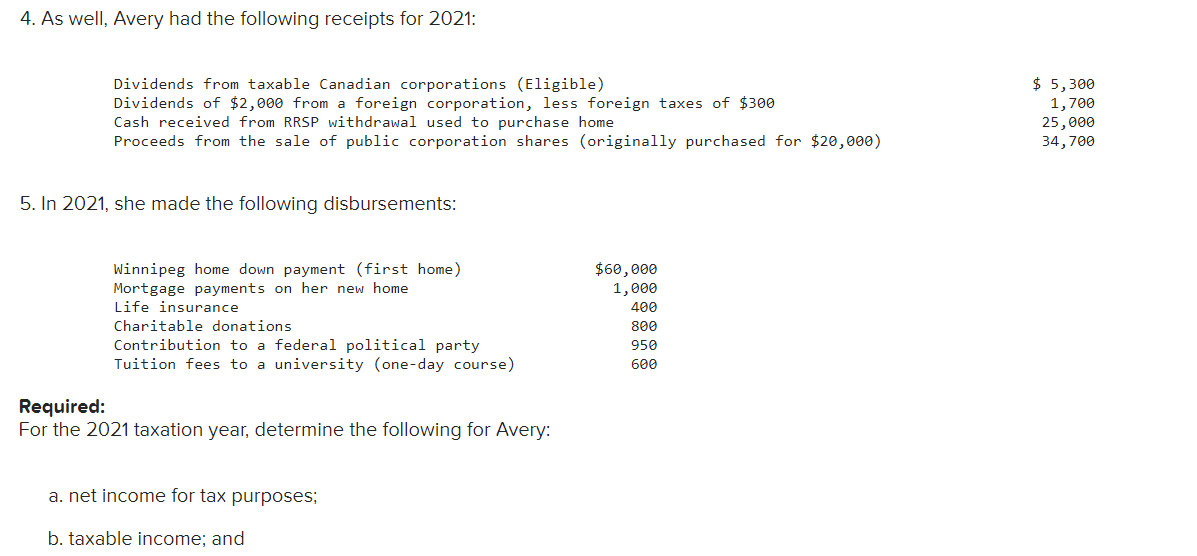

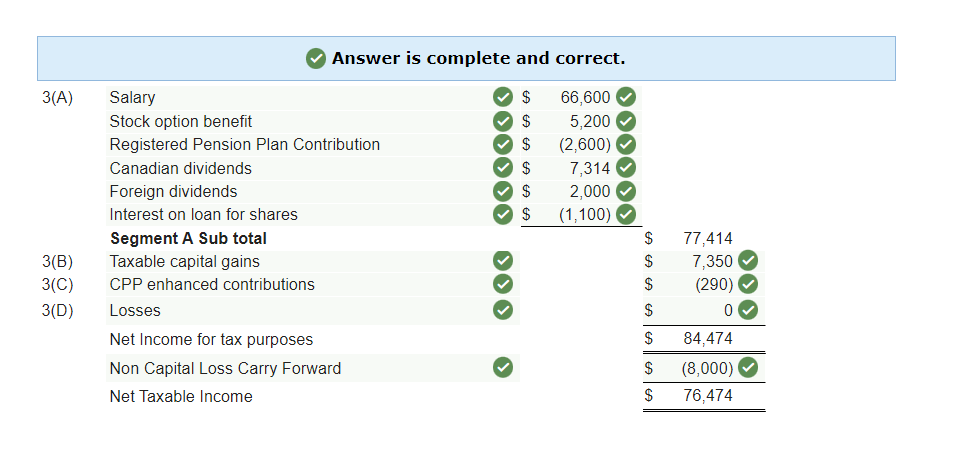

Avery Swan is 30 years old and single. She is employed as a middle-level manager with a national Canadian company. After living and working for five years in Regina, Saskatchewan, she was transferred to her employer's office in Winnipeg, Manitoba on December 15 , 2021. Her financial transactions for the 2021 taxation year are shown below. 1. Avery receives an annual salary of $66,600. The following was withheld by the employer 2. During the current year, Avery purchased 1,300 shares of her employer's company (a public corporation) under a stock-option program. The shares cost $10 each and at the time of purchase had a market value of $14. When the stock option was granted two years ago, the share price was $11. To fund the purchase, she borrowed $10,000 from her bank. During the year, she paid interest of $1,100 on the loan. 3. The previous year, Avery had unwisely invested in commodity futures and lost a large portion of her savings. She considered this loss to be a business loss but was unable to use the full amount for tax purposes because her other income was not sufficient. Of the total loss, $8,000 is unused. 4. As well, Avery had the following receipts for 2021: Dividends from taxable Canadian corporations (Eligible) Dividends of $2,000 from a foreign corporation, less foreign taxes of $300 Cash received from RRSP withdrawal used to purchase home Proceeds from the sale of public corporation shares (originally purchased for $20,000 ) 5. In 2021, she made the following disbursements: Required: For the 2021 taxation year, determine the following for Avery: a. net income for tax purposes; b. taxable income; and Avery Swan is 30 years old and single. She is employed as a middle-level manager with a national Canadian company. After living and working for five years in Regina, Saskatchewan, she was transferred to her employer's office in Winnipeg, Manitoba on December 15 , 2021. Her financial transactions for the 2021 taxation year are shown below. 1. Avery receives an annual salary of $66,600. The following was withheld by the employer 2. During the current year, Avery purchased 1,300 shares of her employer's company (a public corporation) under a stock-option program. The shares cost $10 each and at the time of purchase had a market value of $14. When the stock option was granted two years ago, the share price was $11. To fund the purchase, she borrowed $10,000 from her bank. During the year, she paid interest of $1,100 on the loan. 3. The previous year, Avery had unwisely invested in commodity futures and lost a large portion of her savings. She considered this loss to be a business loss but was unable to use the full amount for tax purposes because her other income was not sufficient. Of the total loss, $8,000 is unused. 4. As well, Avery had the following receipts for 2021: Dividends from taxable Canadian corporations (Eligible) Dividends of $2,000 from a foreign corporation, less foreign taxes of $300 Cash received from RRSP withdrawal used to purchase home Proceeds from the sale of public corporation shares (originally purchased for $20,000 ) 5. In 2021, she made the following disbursements: Required: For the 2021 taxation year, determine the following for Avery: a. net income for tax purposes; b. taxable income; andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started