Answered step by step

Verified Expert Solution

Question

1 Approved Answer

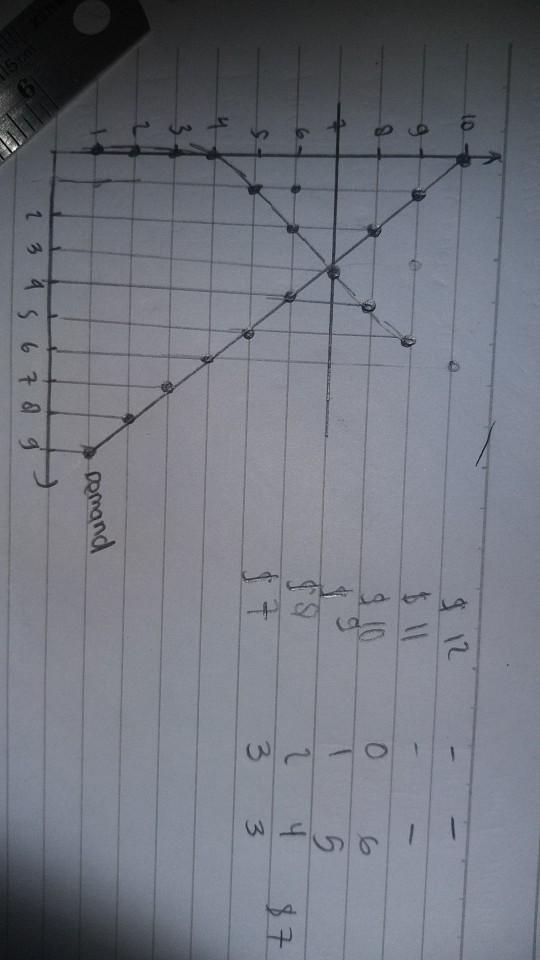

please teach how to draw the graph after the tax is imposed. is we need to draw a new table based on new price after

please teach how to draw the graph after the tax is imposed. is we need to draw a new table based on new price after the tax imposed ???

and how to ans the question above and please write in the detail so i can understand

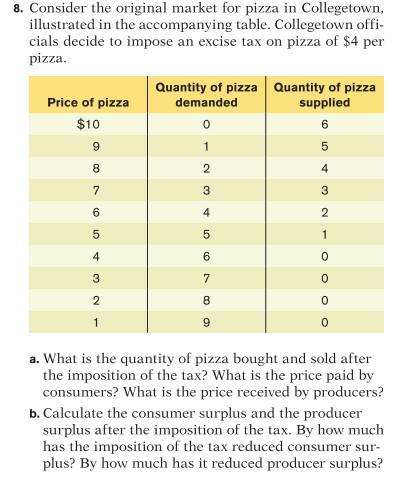

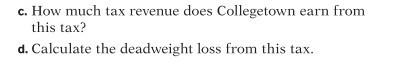

10 $12 9 . 3.10 2 3 5 4 3 $7 + s 4 Domand 2 3 a 5 6 7 8 9 8. Consider the original market for pizza in Collegetown, illustrated in the accompanying table. Collegetown offi- cials decide to impose an excise tax on pizza of $4 per pizza. Price of pizza $10 9 Quantity of pizza Quantity of pizza demanded supplied 0 6 1 5 2 4 8 3 3 7 6 4 2 01 5 1 4 0 ON 3 7 0 2 00 0 1 9 9 a. What is the quantity of pizza bought and sold after the imposition of the tax? What is the price paid by consumers? What is the price received by producers? b. Calculate the consumer surplus and the producer surplus after the imposition of the tax. By how much has the imposition of the tax reduced consumer sur- plus? By how much has it reduced producer surplus? c. How much tax revenue does Collegetown earn from this tax? d. Calculate the deadweight loss from this tax. 10 $12 9 . 3.10 2 3 5 4 3 $7 + s 4 Domand 2 3 a 5 6 7 8 9 8. Consider the original market for pizza in Collegetown, illustrated in the accompanying table. Collegetown offi- cials decide to impose an excise tax on pizza of $4 per pizza. Price of pizza $10 9 Quantity of pizza Quantity of pizza demanded supplied 0 6 1 5 2 4 8 3 3 7 6 4 2 01 5 1 4 0 ON 3 7 0 2 00 0 1 9 9 a. What is the quantity of pizza bought and sold after the imposition of the tax? What is the price paid by consumers? What is the price received by producers? b. Calculate the consumer surplus and the producer surplus after the imposition of the tax. By how much has the imposition of the tax reduced consumer sur- plus? By how much has it reduced producer surplus? c. How much tax revenue does Collegetown earn from this tax? d. Calculate the deadweight loss from this taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started