Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please tell me how to calculate the duration and Modified duration (with detailed formula and financial calculator's step) Consider the following bonds, each with a

Please tell me how to calculate the duration and Modified duration (with detailed formula and financial calculator's step)

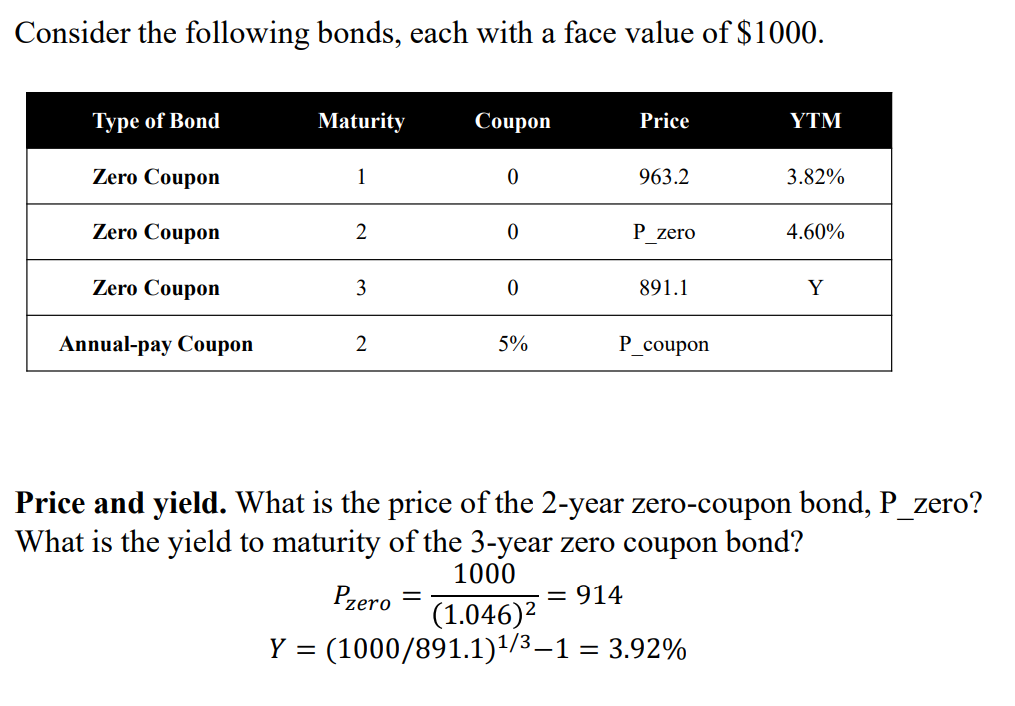

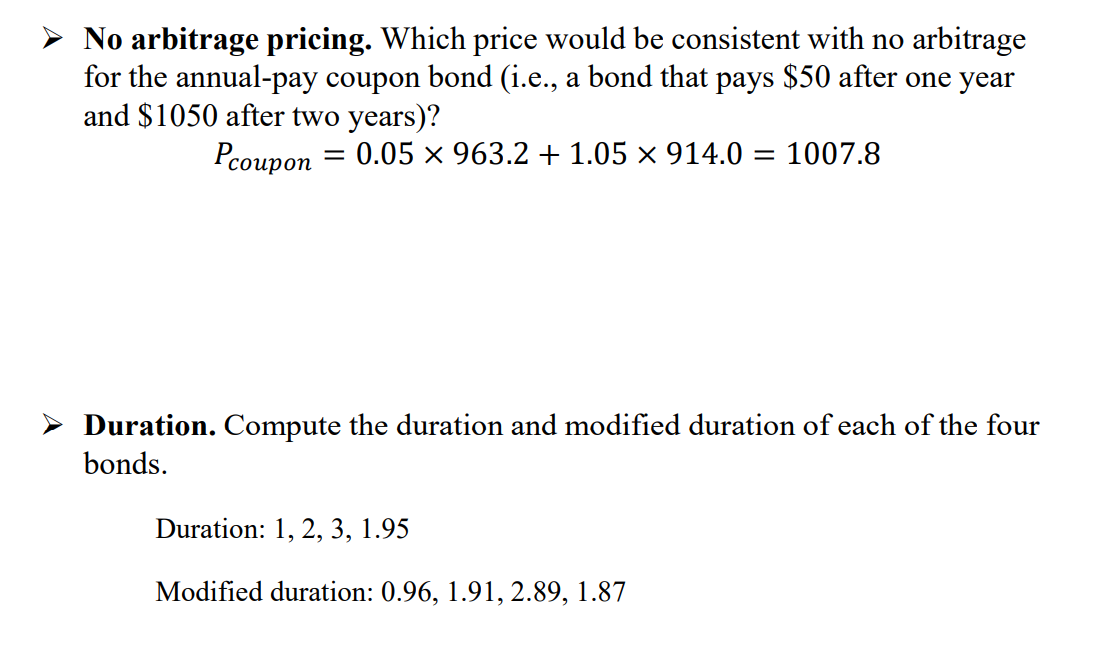

Consider the following bonds, each with a face value of $1000. Price and yield. What is the price of the 2-year zero-coupon bond, Pzero? What is the yield to maturity of the 3-year zero coupon bond? Pzero=(1.046)21000=914Y=(1000/891.1)1/31=3.92% No arbitrage pricing. Which price would be consistent with no arbitrage for the annual-pay coupon bond (i.e., a bond that pays $50 after one year and $1050 after two years)? Pcoupon=0.05963.2+1.05914.0=1007.8 Duration. Compute the duration and modified duration of each of the four bonds. Duration: 1,2,3,1.95 Modified duration: 0.96,1.91,2.89,1.87 Consider the following bonds, each with a face value of $1000. Price and yield. What is the price of the 2-year zero-coupon bond, Pzero? What is the yield to maturity of the 3-year zero coupon bond? Pzero=(1.046)21000=914Y=(1000/891.1)1/31=3.92% No arbitrage pricing. Which price would be consistent with no arbitrage for the annual-pay coupon bond (i.e., a bond that pays $50 after one year and $1050 after two years)? Pcoupon=0.05963.2+1.05914.0=1007.8 Duration. Compute the duration and modified duration of each of the four bonds. Duration: 1,2,3,1.95 Modified duration: 0.96,1.91,2.89,1.87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started